I have several bloggers on the left that I regularly follow. Sometimes they’re a little over the partisan top but I am generally able to separate the nuggets of truth from the red meat. Here’s David Atkins discussing the difference between an asset economy and a wage economy. He’s not placing blame only on Republicans but policy makers in general since before Reagan. Both Atkins and David Dayen over at FDL work hard, I think, to understand what’s going on without blinders to their own side’s shortcomings and both do a good job of analyzing policy and the repercussions. Of course in the interest of moderation I’ll say they don’t always get it right but I think they do a lot of research and thought before throwing up any “ole thang”.

It would be comforting in a way to think that most every public official in Washington were eating luxurious dinners while rubbing their hands in glee at how best to destroy American families to benefit corporate contributors, so that those same public officials could buy houses in the Hamptons and eat filet mignon every night. Then it would just be a question of rooting them all out and putting “good” people into office. But that’s not really how most people, including elected officials, operate. Some are overtly corrupt to be sure, but a large number of them think they’re doing what they do for the right reasons.

I think this is true in the same way I believe my opponents on the right, you know who you are, believe in both their support of our heavily subsidized capitalist system and their prescription to bring us back from the economic precipice we’ve been on for three years now. Sure there are men and women in government and private markets who are only interested in their own bottom line but I’m hoping that most Americans would want to see a prospering economy and citizenry.

The real bipartisan agenda can be neatly summed up in this much overlooked but central Ronald Reagan quote from 1975:

“Roughly 94 percent of the people in capitalist America make their living from wage or salary. Only 6 percent are true capitalists in the sense of deriving income from ownership of the means of production…We can win the argument once and for all by simply making more of our people Capitalists.”

Understanding this idea is the key to understanding what is happening in America today, without resorting to Snidely Whiplash caricatures of elected officials.

Obviously policy makers thought by expanding home ownership, access to easy credit and inexpensive imported goods, and investing retirement funds in the market would lift us all. Unfortunately, it didn’t work out all that well for most of the middle class, regardless of how many refrigerators or tech gadgets they own.

The bipartisan idea from a public policy standpoint was not simply to enrich the wealthy at the expense of the middle class. The idea was to make the American middle class dependent on assets rather than wages.

On its face, the idea is insane. In a capitalist system, assets do often rise in value. But they also decline, and often sharply. Without significant wage growth and redundancies in the economy that provide stability at the expense of efficiency for asset growth, the popping of economic bubbles produces Great-Depression-style economic pain. The only way an asset-based economy can work is if assets grow reliably forever into the future. Not even the most “pro-growth” policies can promise that. In fact, those policies usually inflate bubbles that ensure just the opposite.

When policymakers attempt to privatize Social Security and Medicare, they aren’t necessarily supervillains hoping to turn America into a nation of nobles and peasants. Some are, but not all. The objective is to convert what they see as “useless” money sitting in the financial equivalent of a freezer, and put it to “productive” use in asset investments.

I think this is an important point and when I or others say that asset captitalists such as Pete Peterson are anxiously waiting to invest SS taxes paid by Americans into private investment opportunities this is what we mean. Many of us don’t believe this will work out very well for the little guy.

The recklessness and stupidity of this sort of approach to public policy should have been proven by the 2008 financial crisis that saw the rapid destruction of asset values in stocks, bonds, and housing. Predicating economic health on asset growth is a pipe dream: most people will never have enough assets to make it work, and asset growth is far too unstable to serve as the basis for a functional economy.

I think his conclusion is something to think about but I don’t see any real change in direction on the horizon so in the meantime, I’ll just try to protect our assets and push for a change in policy makers.

America will only return to real economic health when the asset-crazed insanity of the last 30 years is brought to heel, and America returns to a public policy that is far more interested in wage growth and economic stability than it is in asset inflation. Until then, we can expect continued political and economic shocks from an angry electorate and an economy that has run off the rails due to 30 years of deeply misguided anti-inflation, pro-asset-growth ideology.

Filed under: Uncategorized | Tagged: asset bubbles, Reaganomics |

Lms, Here is an NYT article describing the pension crisis in Rhode Island. It's tangentially related to your posting. I do want to weigh in with my opinion, but it won't be until later. Sorry.

LikeLike

"Obviously policy makers thought by expanding home ownership, access to easy credit and inexpensive imported goods, and investing retirement funds in the market would lift us all. Unfortunately, it didn't work out all that well for most of the middle class, regardless of how many refrigerators or tech gadgets they own."My argument isn't that the policy makers chose wrongly, it's that they acted as if it were in their authority to act at all. That we're shocked that government intrusion in the market creates unintended consequences, often worse than the original problem it was designed to address, is what should be shocking to the electorate."I think this is an important point and when I or others say that asset capitalists such as Pete Peterson are anxiously waiting to invest SS taxes paid by Americans into private investment opportunities this is what we mean. Many of us don't believe this will work out very well for the little guy."For me, thinking the government would be responsible in their collecting of and stewardship of these things is what's alarming. These programs are not set up for the indignant, but for the middle class. As a result, they are huge. The bigger the program size, the greater the amount of corruption. Could the vast electorate have done a worse job with its own money? I don't think so.

LikeLike

David Stockman had a nice turn of phrase regarding the current state of the American Economy:"On the other side, Representative Ryan fails to recognize that we are not in an era of old-time enterprise capitalism in which the gospel of low tax rates and incentives to create wealth might have had relevance. A quasi-bankrupt nation saddled with rampant casino capitalism on Wall Street and a disemboweled, offshored economy on Main Street requires practical and equitable ways to pay its bills."The Bipartisan March to Fiscal Madness

LikeLike

Until this year, Rhode Island calculated its pension numbers by assuming that its various funds would post an average annual return on their investments of 8.25 percent; the real number for the last decade is about 2.4 percent.I believe a lot of cities and states have faced this reality (from the NYTimes piece). I also believe the public sector unions have gotten a better deal than their counterparts in the private sector especially at the same pay level. It doesn't mean though that I don't support workers unions. I think the pensions are mismanaged across the board but when interest rates are so low it's difficult to know where to stash the money. And one of the problems with public pensions is that the public sector has been downsized dramatically.I don't see SS as any sort of a corrupt or unnecessary program. As a matter of fact, big surprise I know, I think it needs to be saved for another 75 years and there are various ways to do that. If it means I get a little less over the next 20 years (hopefully I have that many years left) that's fine with me.Medicare is an important program for seniors especially now considering the rising cost of health care and insurance premiums. Once people are retired it's difficult to change the cost sharing as they're limited in what they can earn, if anything. There is a lot of fraud in Medicare, but I don't believe it's on the government side as much as the industry side.We had a hospital group out here just get nailed for defrauding the program in the millions. They were claiming very unusual medical conditions for seniors more than 75% higher than normal. Conditions such as bleeding eyes (high blood pressure?) and some brain inflammation or something.I don't blame government for our woes although it sure could be run a lot more efficiently but I do blame the collusion of government (policy makers) and industry that works better for the benefit of a few than the general prospects of the middle class. And I'm not talking about the support the middle class ostensibly gets from some government programs, I'm talking about jobs and wages and over subsidized industry and influential mega corporations.

LikeLike

"These programs are not set up for the indignant, but for the middle class."Can't I be middle-class and indignant, McWing? "waiting to invest SS taxes paid by Americans into private investment opportunities this is what we mean."If we're talking about the government doing it (as Clinton proposed) then, yes, that's a very bad idea. If it's a curated selection of top-15 and top-25 index funds picked by the individual, then it's not so bad an idea. What about taking that same small percentage 9re: the Bush proposal) of current SS taxes already paid and putting those in treasury bills, but that itty-bitty portion that makes of the individual account belongs to the person, and can be passed on?

LikeLike

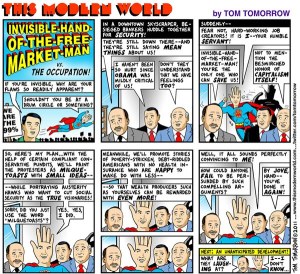

BTW, I think Tom Tomorrow may be over-extending the Invisible Hand metaphor:http://en.wikipedia.org/wiki/Invisible_hand

LikeLike

Kevin, I thought he was making a mockery of the Invisible Hand metaphor.The rich…are led by an invisible hand to make nearly the same distribution of the necessaries of life, which would have been made, had the earth been divided into equal portions among all its inhabitants, and thus without intending it, without knowing it, advance the interest of the society…

LikeLike

lm: over-extending, making a mockery . . . you say tomato, I say tomaht-o. No, really, I do. From the article: "When policymakers attempt to privatize Social Security and Medicare, they aren't necessarily supervillains hoping to turn America into a nation of nobles and peasants. Some are, but not all. "Some policymakers are actually supervillains? Cool.

LikeLike

"They were claiming very unusual medical conditions for seniors more than 75% higher than normal. Conditions such as bleeding eyes (high blood pressure?) and some brain inflammation or something."This is yet another reason electronic health records (EHR) are helpful, although not without a downside. In addition to allowing physicians to share data, avoid multiplication of testing and all the other positivies of EHRs, they also allow the government and private payers to identify these outliers more quickly. On the downside, this means a more intrusive government with access to all of our health data (exaggerating some there, but the point remains). Physicians (and their lawyers) point out there is and always will be one doctor who diagnosis a given condition the most or who performs a certain procedure the most. That doesn't mean he/she is committing fraud.

LikeLike

Kevin, at least he's being a little more diplomatic than some people on either the left or the right, who shall remain unnamed, and depict the entire opposition as less than intelligent, completely immoral or incapable of a self-reflective thought.

LikeLike

ashotHave you heard about this new book, "Deadly Monopolies"? It details among other things that the $800m cost of developing and marketing a new drug is highly inflated.

LikeLike

I had not, lmsinca. So thanks. I'm actually going to start paying more attention to some of these big pharma issues. I have had some experience recently with negotiating clinical trial agreements and have a burgeoning interest in the field.QB and Mark- Any suggestions on places to learn some more about this area of the law?

LikeLike

Two other things:1) limsinca, thanks for carrying the fight for liberals here at the blog. 2) I'm going to invite a liberal friend of mine to join the blog. He's not the divisive, name-calling sort at all, so I think he'll fit in well.

LikeLike

Ashot: Invite away!

LikeLike

limsinca, thanks for carrying the fight for liberals here at the blog.It's a dirty job but someone's got to do it, lol. And I do have some help.One of my most endearing qualities is my stubbornness.

LikeLike

Kevin:I think Tom Tomorrow may be over-extending the Invisible Hand metaphorI think the concept is lost on him entirely. Even the picture is wrong…the hand is, er, clearly visible.

LikeLike