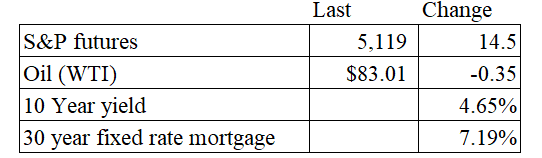

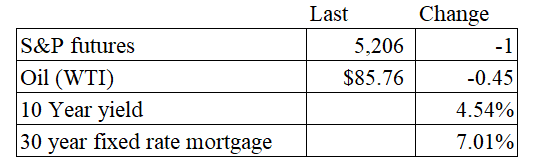

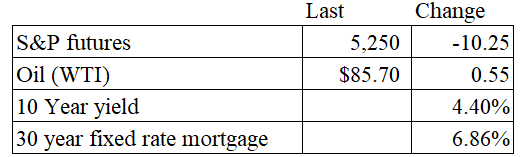

Vital Statistics:

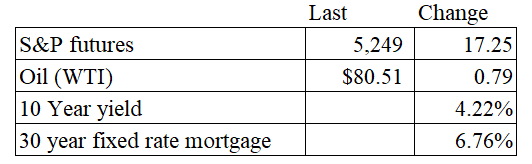

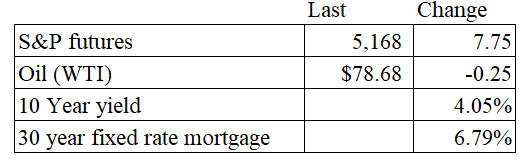

Stocks are lower this morning on no real news. Bonds and MBS are down.

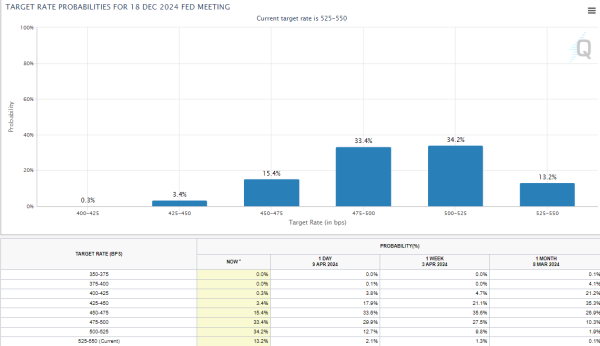

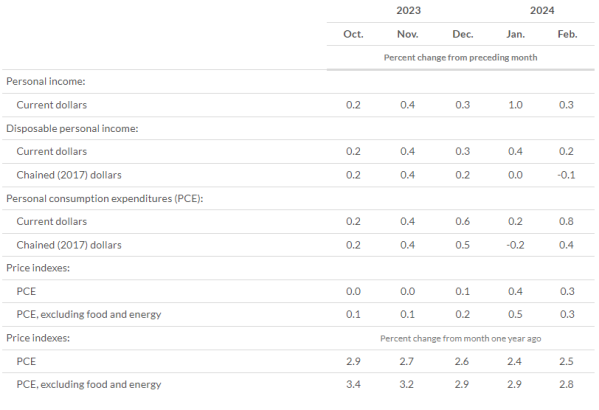

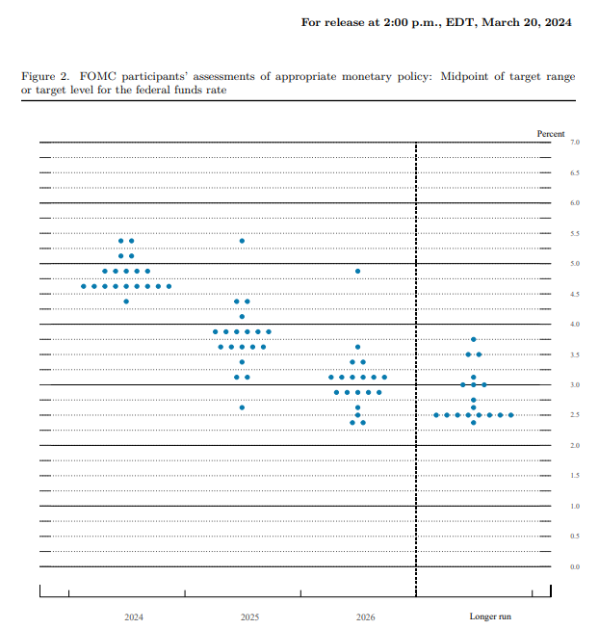

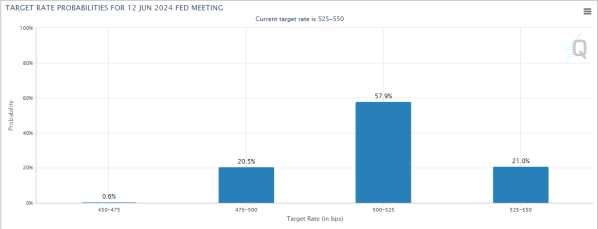

Minneapolis Fed President Neel Kashkari thinks the current rate regime will last a while. He didn’t rule out further rate hikes, although he doesn’t consider that a base case. “The FOMC targets 12-month headline inflation of 2 percent. While we saw rapid disinflation in the second half of 2023, that progress appears to have stalled in the most recent quarter (see Figure 1). The question we now face is whether the disinflationary process is in fact still underway, merely taking longer than expected, or if inflation is instead settling to around a 3 percent level, suggesting that the FOMC has more work to do to achieve our dual mandate goals.”

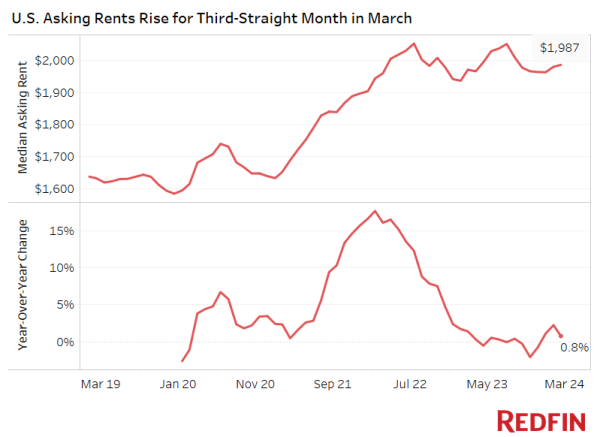

He also suggested that policy might not be super-restrictive given the strength of the housing market. He does mention some exogenous factors such as underbuilding post-2008, along with heavy immigration has increased demand for housing. “Policy actions by the FOMC have driven 30-year mortgage rates from around 4.0 percent prior to the pandemic to around 7.5 percent today. Perhaps that level of mortgage rates is not as contractionary for residential investment as it would have been absent these unique factors which are driving housing demand higher. In other words, perhaps a neutral rate for the housing market is higher than before the pandemic.” Since housing is the main driver of inflation these days, inflation (and therefore tight monetary policy) might stick around a while longer.

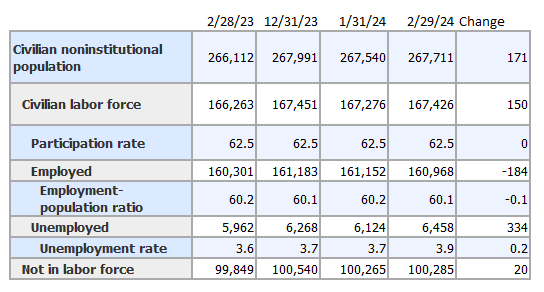

In an interview, he did say the bar is high to consider additional rate hikes, and also said we may be at current levels a while: “My colleagues and I are of course very happy that the labor market has proven resilient, but, with inflation in the most recent quarter moving sideways, it raises questions about how restrictive policy really is.”

Bottom line: if housing is the driver of inflation, and the neutral rate may be higher, then additional rate hikes might be needed to cool the housing market. Unfortunately, it is a catch-22: The problem for housing is limited supply, and higher rates don’t encourage building. But if they cut rates to stimulate building, they might stimulate speculation instead.

FWIW, I think a lot of the hottest markets (especially in FL) were driven by Air BnB speculators, and the Air BnBust is in full bloom. We are seeing price cutting in a lot of the hottest markets.

If these properties were financed with non-QM mortgages using DSCR programs, we could start seeing DQs pile up there.

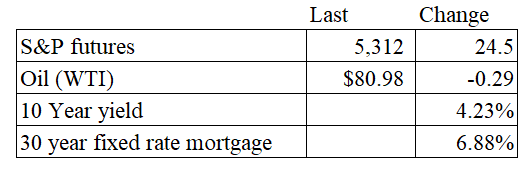

Mortgage applications rose 2.5% last week as purchases rose 2% and refis rose 5%. “Treasury rates and mortgage rates fell last week on the news of a slowing job market, with wage growth at the slowest pace since 2021, and the Federal Reserve’s announced plans to ease quantitative tightening in June and to maintain its view that another rate hike is unlikely. The conventional 30-year rate dropped 11 basis points, and the FHA rate fell 17 basis points to 6.92 percent, back below 7% for the first time in three weeks,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “Mortgage applications increased for the first time in three weeks, with refinances up 5 percent. Even with the increase, which included a 29 percent jump in VA refinances, refinance volume remains about 6 percent below last year’s already low levels.”

Filed under: Economy | 13 Comments »