Vital Statistics:

| Last | Change | |

| S&P futures | 2811.75 | 1.25 |

| Eurostoxx index | 375.78 | -1.45 |

| Oil (WTI) | 59.49 | -0.45 |

| 10 year government bond yield | 2.38% | |

| 30 year fixed rate mortgage | 4.08% |

Stocks are flattish this morning on no real news. Bonds and MBS are flat.

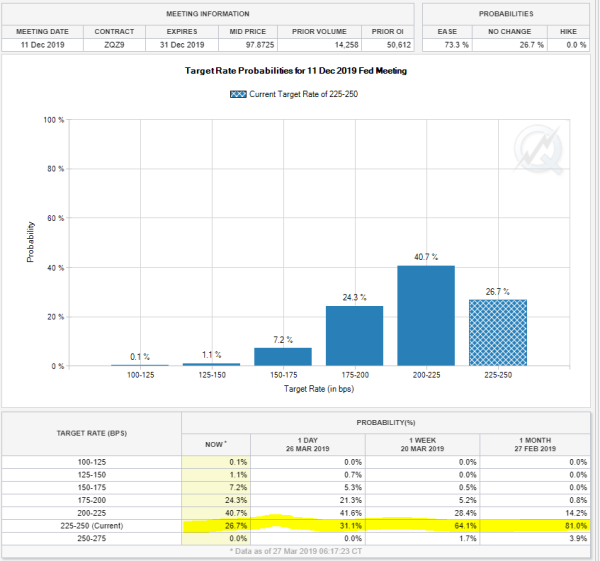

Fourth quarter GDP was revised downward to 2.2% in the third and final estimate. Inflation came in at 1.5%. This is more ammo for the Fed to possibly cut rates this year.

Initial Jobless Claims came in at 211k last week. Despite the slowdown in economic activity, employers are hanging on to their workers. Speaking of labor, McDonalds will no longer lobby against minimum wage hikes. It probably is safe for McDonalds – their franchisees bear the brunt of labor costs not corporate. At any rate, I’m not sure that Republicans really need a lobbyist to tell them to oppose minimum wage hikes, but companies seem more interested in placating the social justice mob these days than delivering shareholder returns.

Facebook has been charged with housing discrimination based on algorithms that target housing-related ads. “Facebook is discriminating against people based upon who they are and where they live,” HUD Secretary Ben Carson said in a statement announcing the charges of violating the Fair Housing Act. “Using a computer to limit a person’s housing choices can be just as discriminatory as slamming a door in someone’s face.”

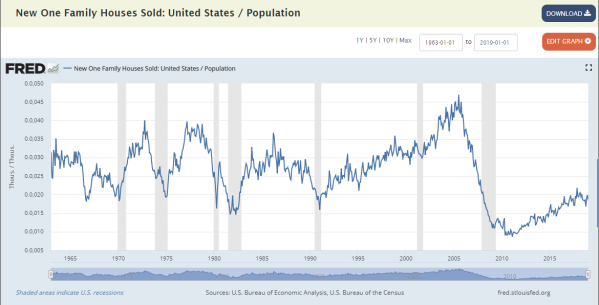

The White House has released a memorandum on housing reform. There were no discernible policy changes in it – the government would like to decrease the GSE’s footprint in the mortgage market while maintain the 30 year fixed rate mortgage and affordable housing goals. They did mention the goal of getting more banks doing FHA loans, although the capital treatment of servicing rights probably makes that tough. Fannie Mae stock liked the release, rallying 9%.

The Washington Post has run something like 4 anti Steven Moore editorials in the past few days. The economics establishment really doesn’t like the nomination. Don’t forget one thing, though. While it is generally not a good thing when politicians criticize monetary policy (and Trump / Moore were pretty outspoken about it), the action in the Fed Funds futures and the change in the dot plot shows they were right.

Filed under: Economy, Morning Report | 58 Comments »