Vital Statistics:

| Last | Change | |

| S&P futures | 4,327 | -54.2 |

| Oil (WTI) | 95.24 | 3.63 |

| 10 year government bond yield | 1.89% | |

| 30 year fixed rate mortgage | 4.19% |

Stocks are lower as markets take stock of the Ukraine situation. Bonds and MBS are up.

The reality of sanctions is begging to be evident in some of the financial markets. The Russian Ruble is in free-fall, trading as low as 110 to the dollar this morning. It entered the year at 75 to the dollar. The US Treasury has banned transactions with the Russian Central Bank, which means that Russia has no tools to manage currency rates, and this will trigger an inflationary wave in the country. Russian sovereign credit default swaps are pricing in a 50% chance of default

Russia introduced capital controls to prevent capital from fleeing the country and hiked its interbank interest rate to 20%. . Russia’s economy is about to collapse and will probably be too small to be included in the G-20 much longer.

Supposedly 3 Russian banks will be banned from SWIFT, which allows banks to transact. This will allow companies who are re-thinking their business dealings in Russia some time to get their capital out. Supposedly the sanctions include a pretty hefty fine, so pretty much every company with exposure there has their lawyers poring over the language and I guess they will choose to err on the side of caution and reduce their exposure.

What does all this mean in the short term? First of all, bonds and stocks will be driven by headlines and not by economic data. Friday’s jobs report will matter, as will Jerome Powell’s Humphrey-Hawkins testimony this week. Things like the ISM, productivity etc becomes less relevant.

Second, oil is going up. The US is going to release some reserves from the Strategic Petroleum Reserve in order to reduce prices. That said, most of the US oil comes from North America, so Russia’s output doesn’t really matter all that much.

Third, whenever you have this sort of financial contagion, you should expect credit to tighten. Hedge funds with big positions are going to get slammed with margin calls. I heard on Bloomberg that a big institution was trying to move a big block of Rosneft stock and there was no bid. The stock has gotten cut in half over the past few days.

Here is a good place for finance geeks to get the latest and greatest of what is going on. Adam Tooze’s substack is on it.

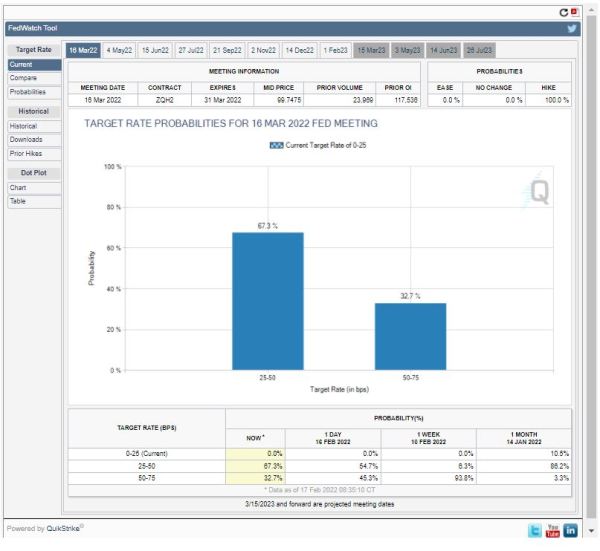

If we start to see credit tighten in the US, then the Fed is put into a bind: It needs to tighten to control inflation, but if credit markets seize up, the playbook is to do the exact opposite. The Fed Funds futures are beginning to reflect this reality. Two weeks ago, the March Fed Funds futures saw a 50% chance of a 50 basis point hike. Today, it is 10%. The December futures are now looking at 125 – 175 basis points in hikes this year. Not too long ago, we were looking at 150 – 200.

Mortgage rates will probably move down only grudgingly as the 10 year falls. MBS investors are going to be more worried about the Fed unloading its book so they are reluctant to stick their necks out too much. I see MBS spreads stable to wider as the market sorts everything out.

Rocket reported fourth quarter earnings last week. Volumes fell 29% and gain on sale fell from 4.41% to 2.8%. Earnings per share fell 71%. Rocket sees margins staying stable or increasing in the second quarter.

Filed under: Economy | 17 Comments »