Vital Statistics:

| Last | Change | |

| S&P Futures | 2365.8 | -2.5 |

| Eurostoxx Index | 369.7 | 0.2 |

| Oil (WTI) | 53.7 | -0.4 |

| US dollar index | 90.9 | |

| 10 Year Govt Bond Yield | 2.36% | |

| Current Coupon Fannie Mae TBA | 102.59 | |

| Current Coupon Ginnie Mae TBA | 104.063 | |

| 30 Year Fixed Rate Mortgage | 4.09 |

Stocks are flattish on no real news. Bonds and MBS are down small.

There were no changes to the headline estimate for fourth quarter GDP in the second revision. It came in at 1.9%, while the price index was revised down to 1.9% from 2.2%.

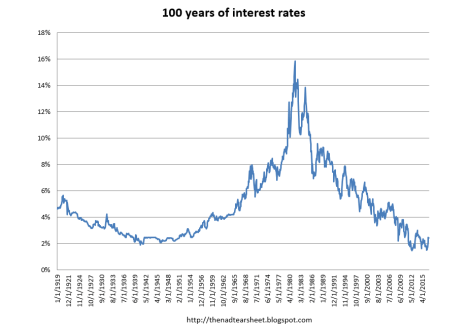

Despite the subdued growth and inflation, the Fed Funds futures are bumping up their probability of a March hike to about 50% now. There is the perception that Yellen’s Fed is worried most about surprising the markets, so in some ways, this becomes a self-fulfilling prophecy. The more the Fed Funds futures price in a hike, the more likely the Fed is to vote for one.

Home prices rose 5.8% in December, according to the Case-Shiller Home Price index. This is the fastest pace of acceleration in the past 2.5 years. Interestingly, we are starting to see correlations between the top tier and bottom tiers break down as the luxury market slows while the demand for starter homes increases. Much of that is inventory-driven, where starter homes are snapped up within a month of listing, while McMansions languish. Certainly in the Western MSAs, Chinese demand is a big factor, and that has been slowed by capital controls.

Housing demand increased 6.5% in January, according to Redfin. “Soaring stock markets, still low mortgage rates and a steady economy bolstered homebuyers at the start of 2017,” said Redfin chief economist Nela Richardson. “Homebuyers were not just window shopping, they were serious about making offers and getting to the closing table. However, this uptick in homebuyer enthusiasm won’t guarantee strong sales in the coming months. With pending home sales down across the country in January despite strong demand, the lack of supply is a formidable foe for buyers this year.”

The trade deficit widened to $69.2 billion in January from $64.4 billion in December. Exports fell 0.2% while imports rose 2.3%. The US dollar is playing a big part here, but I suspect this number will begin to take on more importance going forward, especially with respect to threats of protectionism, which will flow through to growth and ultimately interest rates.

In other economic news, business activity strengthened in February, according to the Chicago PMI Index. Consumer confidence rose in February and stands at a 15 year high, according to the Conference Board. Finally, the Richmond Fed Manufacturing Index improved.

Donald Trump will address Congress tonight, and lay out his vision for his administration going forward. Expect to see a call for increased defense spending, while cuts in discretionary spending to offset it, along with stepped up growth assumptions. Administration officials are signaling that the speech will be a Reaganesque “Morning in America” speech of optimism and economic growth. Those looking for details on his plans should probably not expect much in the way of clarity. The speech will probably not be market-moving unless it goes really badly, in which case you should expect a flight to safety, with lower stock prices and lower interest rates. Here are the sectors to watch: financials, retailers, healthcare.

Freddie Mac has put out its Outlook for the housing market and origination. They forecast a 27% drop in originations as the refi business goes away, with the 30 year fixed rate mortgage to average 4.4%. Their baseline prediction anticipates some fiscal stimulus out of DC, which should send inflationary expectations somewhat higher, but not cause a major increase. The second most likely scenario would be heavier fiscal stimulus, which would cause higher inflation, with higher interest rates, higher home price inflation, and lower origination numbers. The least likely scenario is a retrenchment of inflation (basically the Japan scenario).

Filed under: Economy, Morning Report | 17 Comments »