Vital Statistics:

|

Last |

Change |

| S&P futures |

2692.5 |

6 |

| Eurostoxx index |

358.13 |

0.76 |

| Oil (WTI) |

51.75 |

0.19 |

| 10 year government bond yield |

|

3.06% |

| 30 year fixed rate mortgage |

|

4.89% |

Stocks are higher this morning on as we await a speech from Jerome Powell. Bonds and MBS are flat.

Same store sales increased 7.7% last week according to Redbook. This would indicate that Black Friday was strong.

Consumer confidence from its multi-decade peak in October, driven by fears of of an economic slowdown. It is funny – the index asks people about their current state and then asks about their expectations for the future. The current state is at almost record highs while the future state is lower. This was the opposite for most of the Obama administration – the current state numbers were lousy, but people were optimistic for the future. Historically, consumer confidence was kind of an inverse gasoline price index, but the media is so heavily invested in talking down the “Orange Man Bad” economy that CNN damn near has an “impending recession” countdown monitor ticking in the lower right hand corner of the screen.

House prices rose 6.3% in the third quarter, according to the FHFA index. Prices were strongest in the Pacific Northwest / Mountain states. Prices were weakest in the Dakotas, Alaska, Louisiana, and Connecticut.

The Case-Shiller Home Price Index was flat MOM, and up 5.1% YOY. “Home prices plus data on house sales and construction confirm the slowdown in housing,” says David

M. Blitzer, Managing Director and Chairman of the Index Committee at S&P Dow Jones Indices. “Sales of both new and existing single family homes peaked one year ago in November 2017. Sales of existing homes are down 9.3% from that peak. Housing starts are down 8.7% from November of last year. The National Association of Home Builders sentiment index dropped seven points to 60, its lowest level in two years. One factor contributing to the weaker housing market is the recent increase in mortgage rates. Currently the national average for a 30-year fixed rate loan is 4.9%, a full percentage

point higher than a year ago.”

Freddie Mac is out with their housing forecast for the next couple of years. Their view is that the market will adjust to the big slowdown we saw in 2018 and resume modest growth. That said, they see originations down slightly in 2019 and 2020, largely driven by a continued uptick in interest rates, but the worst of the decline is behind us. Purchases activity will increase, however the refi business will continue to decline. Interestingly, they see housing starts continue to lag historical levels despite the pent-up demand.

The new 2019 conforming limits are out, and the new limit for SFR is 484,350, a 6.9% increase from 2018. Hi bal limits for SFR is 726,525. The multi-unit limits also increased by the same percentage.

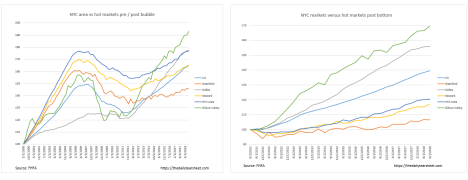

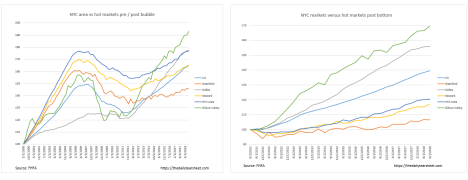

Yesterday, I mentioned an article in the Wall Street Journal about the Dallas home market and how it is the “canary in the coal mine” for the US real estate market. Builders are beginning to have to offer discounts / amenities in order to attract buyers, who are becoming more cautious following a rise in real estate markets. The Dallas market is interesting because Texas is more restrictive in terms of cash-out refinances. Take a look at the charts below. Dallas is the grey line. You can see they largely missed out a lot of the torrid growth during the bust years, but prices held up during the bust (they barely fell). However, take a look at the chart on the right, which shows the relative performance of several MSAs following the quarter when the US in general bottomed (late 2011). Dallas has well outperformed the US, and their appreciation is comparable to Silicon Valley. The Dallas market does indeed look toppy, and probably has more in common with the high flyers than the rest of the US. The median house price to income ratio is Dallas is 6, versus 4.4 for the rest of the US. Note as well how poorly the NYC metro area is doing. Fairfield County, CT (Stamford / Bridgeport), North Jersey (Newark) and Westchester (NYC area) are all just barely off the bottom. They have barely participated in the rebound seen in the rest of the country.

Filed under: Economy, Morning Report | 36 Comments »