Vital Statistics:

| Last | Change | Percent | |

| S&P Futures | 1587.3 | -0.9 | -0.06% |

| Eurostoxx Index | 2720.1 | 2.7 | 0.10% |

| Oil (WTI) | 93.73 | -0.8 | -0.81% |

| LIBOR | 0.273 | -0.001 | -0.36% |

| US Dollar Index (DXY) | 82.16 | 0.015 | 0.02% |

| 10 Year Govt Bond Yield | 1.65% | -0.02% | |

| Current Coupon Ginnie Mae TBA | 106.4 | 0.0 | |

| Current Coupon Fannie Mae TBA | 104.7 | 0.1 | |

| RPX Composite Real Estate Index | 192.1 | 1.1 | |

| BankRate 30 Year Fixed Rate Mortgage | 3.43 |

Markets are lower this morning on no real news. The Employment Cost Index increased .3% in the first quarter and Q412 was revised down. Wages and salaries increased .5% while benefit costs dropped .1%. No inflationary pressures in the labor market. Today starts the two day FOMC meeting. Bonds and MBS are up slightly.

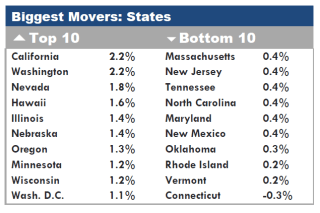

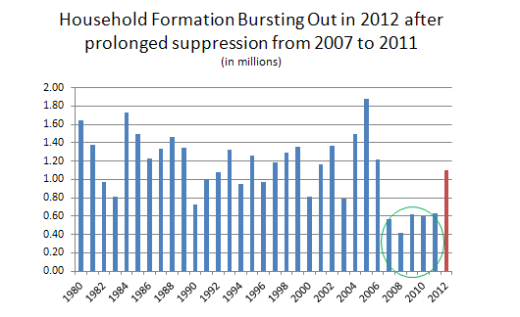

The S&P / Corelogic / Case-Schiller index of home values came in at + 9.32% year over year and + 1.24% month-over-month. This was the biggest increase since May 2006. Of course the real estate market is pretty bifurcated, with annual growth in the high teens out West and mid-to-high single digit growth elsewhere. They note that housing is now becoming a driver of GDP growth, although the mix still is skewed towards apartments and not single family residences.

Chart: Case-Schiller indices

Apple is doing a massive bond issue – 6 different issues, including a 30 year bond. The proceeds will be used to fund dividends and buybacks and will help Apple avoid repatriation taxes on the over $100 billion in funds it holds overseas. The 30 year bond is supposedly going to be priced at a 115 basis point spread to Treasuries. That would be around 4%. The 5 year paper will be issued at 1.2%. Those are positively Japanese yields. Grandpa, tell me again about the days when companies would issue debt with yields lower than their dividend yield.

PIMCO’s Mohammed El-Arian thinks that the tone of the FOMC meeting will shift from “when do we end QE?” to maintaining it and possibly increasing stimulus. That would certainly be MBS bullish, which could start another refi wave, although prepay burnout has got to be pretty big at this point. He does note the risks of the record amount of stimulus: “The benefits of the Fed come with costs and risks. What I worry about is when you run a system at artificial price levels, you start creating damage, resources are misallocated, too much risk is taken.” Exhibit (A): Apple is borrowing money for 30 years at 4% to fund a stock buyback.

Filed under: Morning Report | 16 Comments »