Vital Statistics:

| Last | Change | |

| S&P Futures | 2473.3 | 3.0 |

| Eurostoxx Index | 379.6 | 1.3 |

| Oil (WTI) | 49.7 | 0.0 |

| US dollar index | 86.2 | -0.3 |

| 10 Year Govt Bond Yield | 2.29% | |

| Current Coupon Fannie Mae TBA | 102.93 | |

| Current Coupon Ginnie Mae TBA | 103.81 | |

| 30 Year Fixed Rate Mortgage | 3.95 |

Stocks are flat this morning on no real news. Bonds and MBS are unchanged.

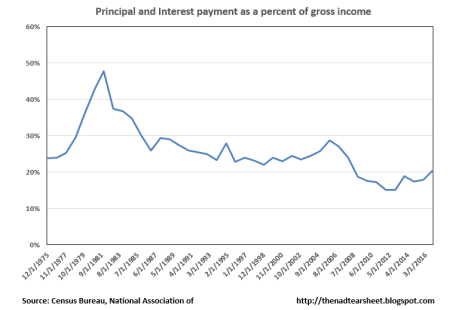

Pending Home Sales rose 1.5% in June, according to NAR. On a YOY basis, the index is up half a percent. Housing inventory is down 7% YOY.

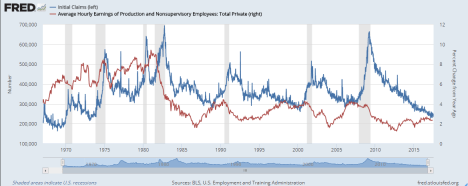

Freddie Mac explores the issue of tight inventory and asks why builders aren’t adding much supply. The issue largely concerns labor, especially skilled labor. The bust laid off about 1.5 million construction employees, who ended up finding new jobs in different sectors of the economy (especially the energy sector). These people are probably not coming back to the construction sector without some sort of catalyst. Second, young people don’t seem all that interested in working construction, and the ones that are cannot pass a drug test. Tighter immigration enforcement and the economy in general have led to a drop in immigrants, who have historically been about 25% of the construction industry. Land costs as a percent of new home costs have been rising as well, which is creating pressure on margins. Land use regulations are also stretching out the time it takes to work through the permitting process.

Speaking of drug tests, a factory owner in Ohio says they have plenty of jobs, but can’t find people who can pass the drug test. 40% of their applicants cannot pass a drug test.

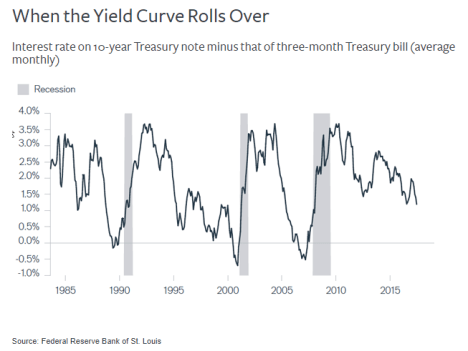

The Fed plans to unveil soon its recommendation to replace LIBOR. LIBOR had been the benchmark interest rate for all sorts of variable rate products for decades, but had one fatal flaw: it was set based on self-reports from a consortium of investment banks. The problem is that the bank could say it was pricing LIBOR at a rate that it wasn’t prepared to actually honor. Since banks have all sorts of products that are pegged to LIBOR, they have an incentive to manipulate the measure in order to get the most favorable mark for their own positions. The group is recommending a broad treasury financing rate based on Treasury repos. This rate will be based on what people are actually paying for financing in the markets, not a survey. There are something lie, $330 trillion of derivatives and loans (everything from mortgages to student loans) that are pegged to LIBOR.

New documents bolster the case for Fannie Mae shareholders that the government lied when began to sweep all of Fannie’s profits. The cover story was that Fannie was in a “death spiral” and this was necessary to hasten the wind-down of their business. The documents show Tim Geithner saying that Fannie will be earning strong revenues and can support the 10% dividend for years into the future. Does that mean shareholders will get anything? They probably shouldn’t, as the government maintained a 20% public minority stake only so it didn’t have to consolidate Fannie’s debt on its own balance sheet. Under any sort of bankruptcy scenario shareholders would have been wiped out. The stock is a litigation lottery ticket.

Filed under: Economy, Morning Report | 30 Comments »