Vital Statistics:

| Last | Change | |

| S&P futures | 2761 | -29 |

| Oil (WTI) | 55.56 | -0.6 |

| 10 year government bond yield | 2.16% | |

| 30 year fixed rate mortgage | 4.25% |

Stocks are lower this morning after Trump threatened Mexico with 5% tariffs over illegal immigration. Bonds and MBS are up.

The 10 year bond is trading at 2.16 this morning, the lowest level in almost 2 years. We are seeing some action in the TBAs as the 3% FN coupons are all trading above par. We should see more pain in the servicing space as marks have to come in. If you were hoping for a good MSR mark to paper over an aggressive cut in margins, you are about to get a double-whammy.

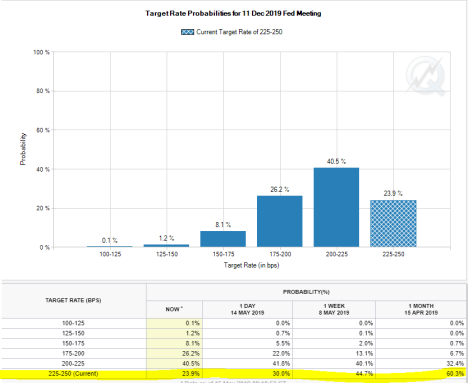

Personal Incomes rose 0.5% in April versus Street expectations of a 0.3% increase. Personal Consumption rose 0.3%, again topping estimates. March’s consumption numbers were revised upward as well. The core PCE price index (the Fed’s preferred measure of inflation) rose 1.6% YOY, which is well below their target. For those keeping score at home, the market is now pricing in a 90% probability of a rate cut this year. with a better-than 50% chance of 2 or more!

Regardless of the strength in the economy, pending home sales dropped 1.5% in April. YOY contract signings fell 2%, making this the 16 consecutive month of YOY declines. Lawrence Yun highlighted the problem: a glut of expensive homes and a shortgage of low priced homes: “Home price appreciation has been the strongest on the lower-end as inventory conditions have been consistently tight on homes priced under $250,000. Price conditions are soft on the upper-end, especially in high tax states like Connecticut, New York and Illinois.” The supply of inventory for homes priced under $250,000 stood at 3.3 months in April, and homes priced $1 million and above recorded an inventory of 8.9 months in April.” Given that a balanced market is usually around six and a half months, you can see the extremes of 3.3 months at the low end and 8.9 months at the high end.

Fed Vice Chair Richard Clarida gave some support to the bond market yesterday in a speech at the Economic Club of New York. “If the incoming data were to show a persistent shortfall in inflation below our 2 percent objective or were it to indicate that global economic and financial developments present a material downside risk to our baseline outlook, then these are developments that the [Federal Open Market Committee] would take into account in assessing the appropriate stance for monetary policy…..Midway through the second quarter of 2019, the U.S. economy is in a good place…By most estimates, fiscal policy played an important role in boosting growth in 2018, and I expect that fiscal policies will continue to support growth in 2019.”

Filed under: Economy, Morning Report | 11 Comments »