Vital Statistics:

| Last | Change | |

| S&P Futures | 2387.0 | 1.0 |

| Eurostoxx Index | 386.8 | -1.0 |

| Oil (WTI) | 49.5 | 0.6 |

| US dollar index | 89.7 | |

| 10 Year Govt Bond Yield | 2.32% | |

| Current Coupon Fannie Mae TBA | 102.63 | |

| Current Coupon Ginnie Mae TBA | 103.68 | |

| 30 Year Fixed Rate Mortgage | 3.98 |

Stocks are flattish after first quarter GDP misses expectations. Bonds and MBS are down.

First quarter GDP came in at 0.7%, which was lower than the 1.1% consensus forecast. A decline in spending on motor vehicles was a drag on Q1, which has been weak the past several years for some reason. The personal consumption expenditure (the inflation measure most preferred by the Fed rose 2.4%, which is higher than their target rate. This was the highest reading in several years, which means the Fed might be forced to move even though growth is weak. The savings rate jumped from 5.5% to 5.7%, which means consumers are still using increases in income to pay down debt. Inventory depletion and a drop in government spending, along with weak consumption were the main drivers. Note that this is just the advance estimate, and will be revised twice in the next month.

Employment costs rose 2.8% annualized in the first quarter, according the BLS. Wages and salaries rose 2.5% while benefit costs increased 2.2%. We have been seeing a gradual tick up in this index, however wages are still well off their pre-crisis historical trend.

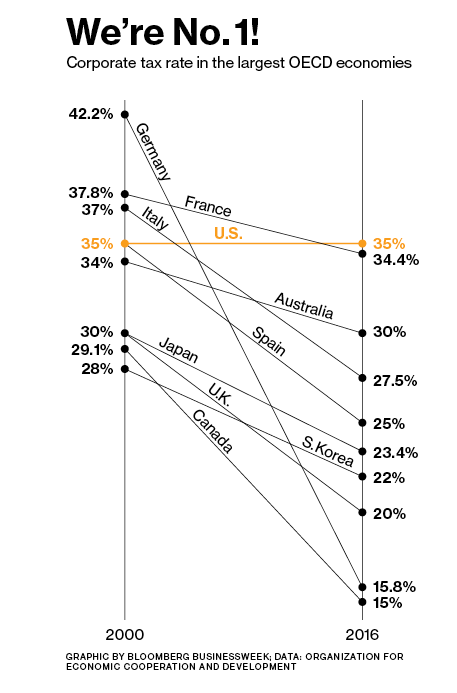

Trump’s tax plan was short on specifics, but it certainly looks like wealthier residents in high tax states will feel it the most. Killing the state and local tax deduction has been fraught with risk, but given that it will largely affect the blue states it might have a chance. Eliminating the mortgage interest deduction will be a poison pill, IMO. Will tax reform hit the residential real estate market? Probably not, as tight inventories are the dominant factor driving pricing right now.

The homeownership rate ticked down slightly in the first quarter to 63.6% from 63.7% in the fourth quarter. It looks like it is on the rebound, however the first time homebuyer really needs incomes to rise in order to catch an asset that is increasing 7% a year. More starter home construction would help too, but multi-fam seems to be the interest of builders. Vacancy rates are largely flat MOM and YOY.

The Chicago Purchasing Manager Index rose last month, while consumer sentiment slipped.

Housing Wire’s home price forecast for the rest of the year. Overall, looking at 3.5% growth, with a range of anywhere from 1% to 10%.

Filed under: Economy, Morning Report | 46 Comments »