Vital Statistics:

|

Last |

Change |

| S&P Futures |

2167.0 |

5.0 |

| Eurostoxx Index |

336.3 |

1.0 |

| Oil (WTI) |

45.4 |

0.2 |

| US dollar index |

87.4 |

0.1 |

| 10 Year Govt Bond Yield |

1.56% |

|

| Current Coupon Fannie Mae TBA |

103.3 |

|

| Current Coupon Ginnie Mae TBA |

104.2 |

|

| 30 Year Fixed Rate Mortgage |

3.52 |

|

Stocks are higher this morning on no real news. Bonds and MBS are up small.

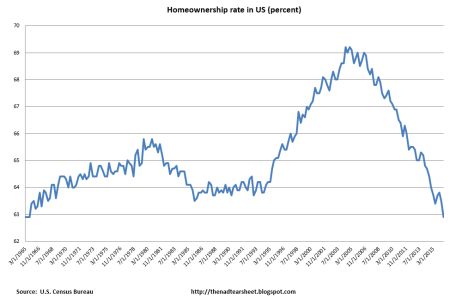

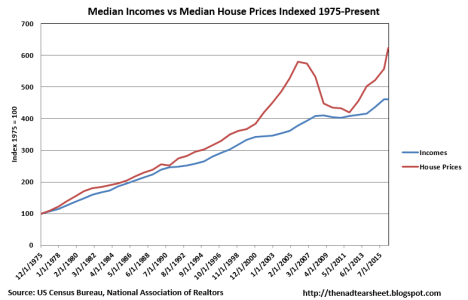

Housing starts came in at 1.19 million units, the highest since February. May was revised lower. Building Permits rose to 1.15 million units. Starts seem to have found a level here at 1.2 million per year, which is still depressed. Housing starts have historically averaged closer to 1.5 million units (even before the real estate bubble) and inventory remains tight. This is helping push up prices, but the side effect is that the first time homebuyer remains on the sidelines due to affordability issues. Given the tight inventory out there, starts should be closer to 2 million per year, and that makes a huge difference in economic growth.

Now that Brexit hasn’t caused the world to end, the Fed is back to thinking about hiking rates again. The Fed Funds futures are now pricing in a 45% chance of a rate hike this year versus a 20% chance last week. Next week’s FOMC meeting just went from being a sleeper to potentially big. It might also mean that people who are waiting for a 1.37% 10-year bond yield to refinance might be waiting a while. The big driver will be overseas rates, and if European bonds head back into negative territory, US yields will follow. Absent the overseas influence, rates would be a lot higher in the US than they are.

Note that Morgan Stanley is calling for a 1% 10-year yield by the end of the year.

The Republican platform now includes reinstating Glass-Steagall which would break up the big banks. I guess the idea is that JP Morgan would split back into JP Morgan and Chase, Citi would spin off Smith Barney, and Bank of America would spin off Merrill. FWIW, Glass-Steagall is a solution in search of a problem, and it really had nothing to do with the financial crisis.

For a quick history lesson, Glass-Steagall was instituted during the Great Depression, but the reason for it is largely forgotten. At the beginning of the Depression, investment banks were choking on failed underwritings. In an underwriting, Company XYZ comes to an investment bank and says “I want to borrow $100 million by issuing bonds.” The investment bank gives Company XYZ $100 million and takes the bonds. The investment bank now has to sell these bonds to the public in order to get their money back. In the early 30s, there were no buyers for bonds, so the investment banks were stuck with a lot of stock and bond issues they couldn’t sell. Since these investment banks also owned commercial banks and insurance companies, they basically “sold” the failed underwritings to their subsidiaries who bought them at their inflated full value, not market value. When these banks and insurance companies failed, the regulators saw that much of their assets were worthless bonds bought from the parent investment bank. Thus Glass-Steagall was born – it prohibited investment banks from using their captive commercial banks and insurance companies as a buyer of last resort for failed underwritings. All transactions had to be arm’s length after that.

Fast forward to the late 1990s. Plain vanilla derivatives like currency and interest rate swaps were a huge business as Corporate America was doing more and more business overseas. The arena for these derivatives was highly competitive, and big foreign banks like Credit Suisse, Deutsche Bank, Barclay’s and Nomura were able to offer much better rates to Corporate America than Goldman or Merrill because they had access to cheap capital: deposits. Banks like Nomura could borrow for free, while Morgan Stanley had to borrow at LIBOR. Washington saw that “Wall Street” was beginning to mean foreign banks and not US banks. The rest of the world doesn’t separate investment banking and commercial banking. Indeed, the rest of the world doesn’t even recognize a difference. Washington decided that Glass Steagall was handicapping US banks versus the international competition (and it was). And thus Glass Steagall was repealed.

It is important to realize that the financial crisis was not the result of JP Morgan selling CDO squareds to Chase. Nor was Citi selling crap paper to Travelers. The financial crisis was the result of a residential real estate bubble, which are the Hurricane Katrinas of banking. Banking systems almost never survive a nationwide real estate bust, derivatives or no derivatives. See the busts in Japan and Sweden in the early 90s, and watch what happens in other places with massive bubbles. I guess the hope is G-S can address too big to fail, however if a hedge fund nearly brought down the system (LTCM), then an investment bank failure will as well. I am sure plenty in Washington are licking their chops at further regulating the banks and using them as a policy tool for social engineering. This is the model for many European banks.

If GS gets re-instated and the big banks break up, you could see a similar effect to when the government busted up AT&T in the 80s and investors cleaned up on all the baby bells.

Anyway, re-installing Glass Steagall might be politically popular, but it is a solution in search of a problem.

Filed under: Economy, Morning Report, politics | 20 Comments »