Vital Statistics:

| Last | Change | |

| S&P futures | 3043 | 5.1 |

| Oil (WTI) | 32.94 | -0.69 |

| 10 year government bond yield | 0.7% | |

| 30 year fixed rate mortgage | 3.28% |

Stocks are flat this morning on no real news. Bonds and MBS are flat as well.

Initial Jobless Claims came in at 2.1 million, about in line with expectations. At a minimum we need to see this number fall back to the six digit area to have any prayer of a recovery.

Luxury homebuilder Toll Brothers beat on the top line and the bottom line. This quarter ended on April 30, so half of the quarter was pre-COVID and half was post-COVID. Revenues fell 11% YOY, while signed contracts were down 22%. Backlog was flat YOY. CEO Doug Yearley noted that deposit activity rebounded in May and was up YOY. This is a leading indicator of housing demand.

“While net signed contracts in the first four weeks of May were down 37% year-over-year, we are very encouraged by recent deposit activity. Our deposits, which typically precede a binding sales contract by about three weeks and represent a leading indicator of current market demand, were up 13% over the past three weeks versus the same three-week period last year. Importantly, our recent deposit-to-contract conversion ratio has remained consistent with pre-Covid-19 levels. Web traffic has also steadily improved from the lows we experienced in mid-March and has returned to the same strong activity we enjoyed pre-Covid-19 in February. These early trends suggest the housing market may be more resilient than anticipated just two months ago.”

Homebuilding is an early-cycle play, so you should expect to see a turnaround in that sector first. Overall, it sounds like the builders have been pleasantly surprised at how the sector has held up during the crisis.

First quarter GDP was revised downward to -5% from -4.8% in the second estimate. Inflation continues to be tame, with the headline number up 1.3%. Ex-food and energy it rose 1.8%. In other economic news, Durable Good Orders fell 17% in April. Most of this data is pretty much irrelevant to stock prices right now. The stock market is looking over the valley.

Ex-Obama staffer Jason Furman predicts that we are about to see the best economic numbers the country has ever seen. FWIW, I agree with his sentiment. The COVID Crisis is about 3 months old. There was nothing wrong with the economy going into the crisis, and the shock to the economy should feel more like a natural disaster than a traditional bubble-driven recession. If we have passed the bottom (admittedly a big “if”) then the economy could be on fire by late summer / early fall. And speaking of “fire,” the government poured a few trillion gallons of fiscal gasoline on it.

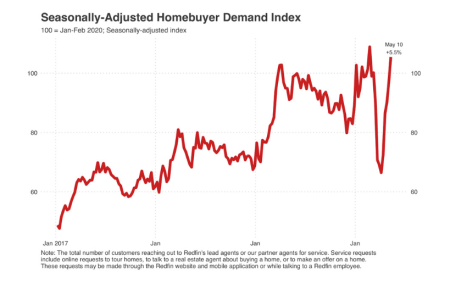

Pending Home Sales fell 22% in April, according to NAR. “While coronavirus mitigation efforts have disrupted contract signings, the real estate industry is ‘hot’ in affordable price points with the wide prevalence of bidding wars for the limited inventory,” NAR Chief Economist Lawrence Yun said. “In the coming months, buying activity will rise as states reopen and more consumers feel comfortable about homebuying in the midst of the social distancing measures. Given the surprising resiliency of the housing market in the midst of the pandemic, the outlook for the remainder of the year has been upgraded for both home sales and prices, with home sales to decline by only 11% in 2020 with the median home price projected to increase by 4%,” Yun said. “In the prior forecast, sales were expected to fall by 15% and there was no increase in home price.”

Those hoping to snap up recession-driven bargains in the real estate market may be disappointed. That said, the bargains (if any) would be in the higher priced area, not the more affordable price points. “The mix of homes that are on the market now is a little bit different,” says Ratiu. “What’s really selling at a premium are lower-priced homes. The higher-priced homes are sitting on the market longer.”

Filed under: Economy, Morning Report | 15 Comments »