Vital Statistics:

| Last | Change | |||

| S&P futures | 2679 | 7.6 | ||

| Eurostoxx index | 385.1 | 0.46 | ||

| Oil (WTI) | 67.48 | -0.62 | ||

| 10 Year Government Bond Yield | 2.96% | |||

| 30 Year fixed rate mortgage | 4.56% | |||

Stocks are higher after a slew of new mergers were announced. Bonds and MBS are up small.

We have a big week ahead with the FOMC meeting starting tomorrow and the jobs report on Friday. The Street isn’t looking for any changes in interest rates at the May meeting, but will focus as usual on the language of the statement. For the jobs report, the expectation is 190k new payrolls and 2.7% annual wage inflation.

Pending Home Sales were up marginally from February, but were still down on an annual basis, according to NAR’s Pending Home Sales Index. Bad weather in the Northeast pushed down pending sales, however all parts of the country were down. Again, blame low inventory and falling affordability.

Personal Incomes rose 0.3% in March, while personal spending rose 0.4%, in line with expectations. The PCE index was up 2% YOY and the core PCE index was up 1.9%. This is the Fed’s preferred measure of inflation and it is right where they are targeting. Income growth was the weakest since last Fall, however.

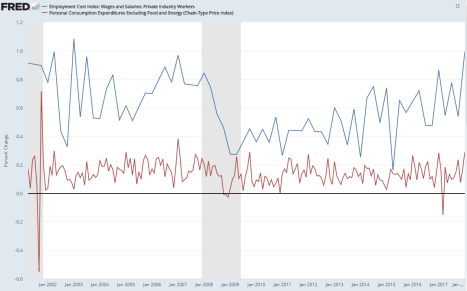

The big debate right now is whether there is any slack in the labor market. Anecdotal evidence abounds that companies are struggling to find qualified workers. However, Econ 101 says that we should be seeing higher wage inflation as a result and that isn’t happening (at least not yet). Some theories are claiming this is a market failure and that employers are artificially holding down wages (which is then used as an argument for more government intervention in the labor market). I suspect the issue is that there are three big forces holding back wage growth. First, inflation is low – if companies cannot pass along price increases to their customers, they aren’t going to be raising wages. Second, lower wage jobs are competing with technology which is only getting better and cheaper. And finally, the long-term unemployed represent a reservoir of slack that companies know they can tap if needed. FWIW, I think the first and third explanations explain it, and find the idea that employers are somehow colluding to keep wages low to be wholly unconvincing. Take a look at the chart below, which shows wage increases versus inflation. You are seeing actual wage growth.

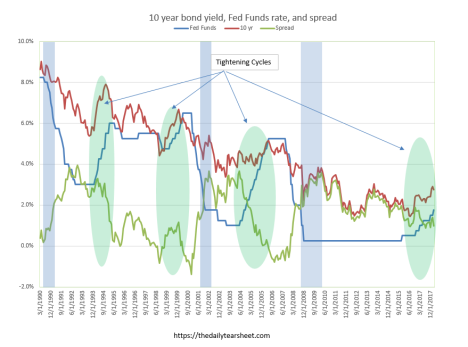

For now it looks like the 3% level in the 10 year has held. What drove the sell-off – it wasn’t like there was anything data-wise to support it. JP Morgan blames CTAs using momentum strategies to short the 10-year. Chinese selling has also been rumored to be a factor. We won’t be able to confirm or deny that theory for a couple of months. CTA funds have been net short Treasuries since September, however a momentum signal in mid-April caused people to pile into the trade and that apparently drove the late month sell-off.

Steve Mnuchin is “cautiously optimistic” on trade talks with China. The subject will include intellectual property and joint ventures.

Defect risk decreased on a MOM basis but was up on a YOY basis, according to the First American Loan Defect Index. The biggest risk was in the sand states, while the lowest risk was in the Rust Belt.

Filed under: Economy, Morning Report | 5 Comments »