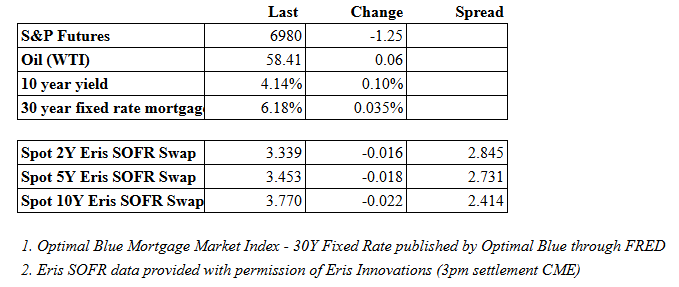

Stocks are lower this morning as bank earnings come in. Bonds and MBS are up.

The bond market seems to be taking the Powell / Trump situation as symbolic and not a true threat to Fed independence.

The issue of credit card interest caps came up on the JP Morgan earnings call yesterday:

John McDonald

Truist Securities, Inc., Research DivisionOkay. And then maybe you or Jamie could provide some thoughts on the idea of regulators putting caps on credit card APRs, just potential impacts on the industry and how you would think through strategic reactions as a big issuer.

Jeremy Barnum

Executive VP & CFOYes. Thanks, John. And I appreciate the way you framed the question because the thing that I’m sort of trying to avoid doing is spend a lot of energy or time speculating on the probability that this does or doesn’t happen in whatever form it does or doesn’t happen. So I think for the purposes of this call and, obviously, you can assume that institutionally, we’ll be doing all the relevant contingency planning. But for the purposes of this call, given how little we know at this point, the way I would prefer to talk about it is, just assume for the sake of argument that something in the general mode of price controls on credit card interest rates goes through, what would be the consequences of that.

And I think the first thing to say, which you obviously know very well, is that the card ecosystem is an exceptionally competitive ecosystem. It’s among the most competitive businesses that we operate in. And that’s true for all levels of borrower credit score, from high FICO to low FICO. And so in that context, when you — just basic economics, when you start with that as your starting point, the right assumption about what the response of the system is going to be to the imposition of price controls is not that you will simply compress the profit margins, which are already at their sort of competitively optimal level, and thereby pass on benefits to consumers. What’s actually simply going to happen is that the provision of the service will change dramatically.

Specifically, people will lose access to credit, like on a very, very extensive and broad basis, especially the people who need it the most, honestly. And so that’s a pretty severely negative consequence for consumers and frankly, probably also a negative consequence for the economy as a whole right now.

I don’t want to let this pass without saying that I think it should be obvious that, that would also be bad for us. I’m not going to get into quantifying but in a narrow sense, this is a big business for us. It’s a very competitive business, but we wouldn’t be in it if it weren’t a good business for us. And in a world where price controls make it no longer a good business, that would present a significant challenge clearly. Beyond that, the way we actually respond would have a lot to do with the details and I just don’t think we have enough information at this point.

Two things to note: First JP Morgan doesn’t sound like they plan to cap interest rates in 6 days (the Jan 20 deadline Trump imposed). My guess is that they probably talked to someone in the Administration who said nothing is really imminent. Second, interest caps are price controls, and price controls create shortages, which should be obvious.

Wholesale inflation rose 0.2% MOM in November, according to the Producer Price Index. On a YOY basis they rose 3.0%. The monthly number was below consensus while the annual number was higher. The PPI for goods rose 0.9% while the PPI for services was flat. More than half the increase in goods was attributable to gasoline, and fuel prices were up across the board.

Final demand ex-food and energy rose 3.5% YOY, which was the highest since March. The 2026 new models for cars and trucks entered the index and it looks like it caused a bump as well.

Overall, the PPI came in a touch higher than expected, but this is old data.

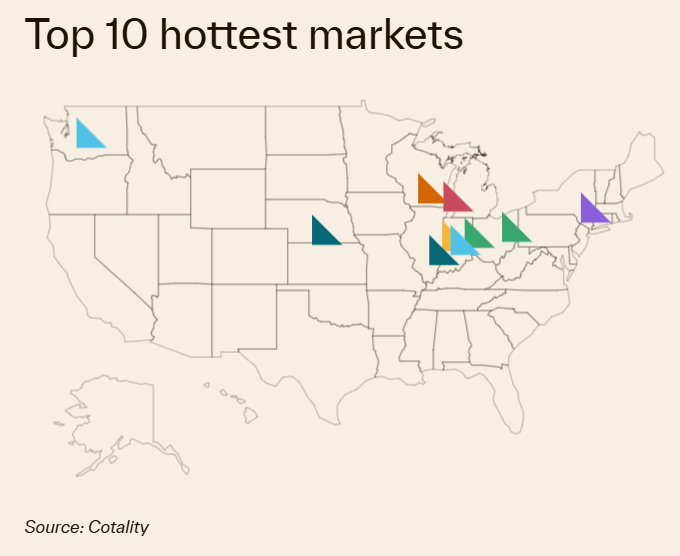

New home sales rose 18.7% annually to 737,000 units. Note this is October data, so it is quite old. Builders are sitting on 7.9 month’s worth of inventory so the market is a touch oversupplied.

Notably the median home price fell 8% YOY to $392,300. This indicates a shift away from luxury and towards starter homes. This is below the median home price for existing homes.

Mortgage applications increased 29% last week as purchases rose 18% and refis rose 40%. “Mortgage rates dropped lower last week following the announcement of increased MBS purchases by the GSEs. Lower rates, including the 30-year fixed rate declining to 6.18%, sparked an increase in refinance applications,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “Compared to a holiday-adjusted week, refinance applications surged 40 percent to the strongest weekly pace since October 2025.The average loan size for refinance applications was also higher, as borrowers with larger loan sizes are typically more sensitive to changes in rates.”

Retail sales moved up smartly in November, according to the Census Bureau (we don’t have December data yet). Sales rose 0.6% MOM and 3.5% YOY. It looks like we might be getting December retail sales tomorrow.

Small business optimism improved in December, according to the NFIB. Much of this was driven by a decline in the uncertainty index which it the lowest levels in over a year. Optimism about the overall economy improved despite a more negative outlook on sales.

The number of firms raising prices decreased as well, although we are still above historical averages.

2025 ended with a second consecutive monthly uptick in small business optimism. Small business owners anticipate economic conditions remaining generally favorable going into 2026 and all signs from questions outside the index appear to support their sentiment. Costs pressures moderated, employment challenges eased (for most), and capital investments picked up. Consumer sentiment might be at historic lows, but consumer spending continues to support economic growth.

The December data also delivered good news on a major 2025 pain point, with a welcome improvement in uncertainty. Specifically, the Uncertainty Index dropped 7 points to 84, the lowest level since June 2024. The mid-term election coverage will soon enter the main stage, taking oxygen from the stock market rallies and AI investments that currently dominate the airwaves. As the news cycle shifts, small business owners will be front and center voicing their concerns on issues related to running their business.

Filed under: Economy | Leave a comment »