Vital Statistics:

|

Last |

Change |

| S&P Futures |

2177.5 |

-2.0 |

| Eurostoxx Index |

342.0 |

1.5 |

| Oil (WTI) |

47.0 |

0.2 |

| US dollar index |

85.5 |

-0.1 |

| 10 Year Govt Bond Yield |

1.55% |

|

| Current Coupon Fannie Mae TBA |

103.3 |

|

| Current Coupon Ginnie Mae TBA |

104.2 |

|

| 30 Year Fixed Rate Mortgage |

3.5 |

|

Stocks are flattish after the FOMC minutes came in less hawkish than feared. Bonds and MBS are up.

Initial Jobless Claims came in at 262k last week.

The Philly Fed Business Outlook Survey came in slightly positive, about in line with expectations.

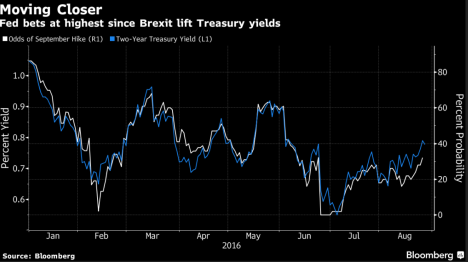

The FOMC minutes were not quite as hawkish as markets feared. The Fed noted that the two biggest fears at the June meeting (Brexit, which had just happened, and the terrible May jobs report) turned out to be non-events. That said, there is still some debate at the Fed over how much more work they have to do on the employment side of their dual mandate. Some at the Fed point to the unemployment rate and infer their job is largely done, while others point to the low labor force participation rate and say they have more work to do. The lack of language about the risks of the economy being more tilted toward the upside than the downside has been taken as a signal that the Fed isn’t planning to move in September. Bonds rallied somewhat on the minutes, with the 10 year falling to 1.54% and the Fed Funds futures reducing the implied probability of a 2016 hike to a coin toss.

The minutes did discuss housing a bit as well. In terms of housing construction, they noted that housing activity growth had slowed in recent months, which is a fair observation however housing starts have been in a 1.1 million to 1.2 million range for about a year. Not much improvement going on there at all, just steady state. Much of the growth is going to multi-fam construction, not single, however.

In terms of credit, the Fed noted that mortgage credit became somewhat more easy between the June and July meetings. Apparently, a number of large banks said they had eased standards somewhat for GSE loans. Purchase and refi activity picked up as well.

Speaking of GSE loans, everyone in DC realizes that the current state of affairs (with the GSEs as wards of the state) is unsustainable, however no one really knows what to do with them. The US taxpayer bears the credit risk of 90% of all new origination. Republicans would like the government less involved with the mortgage market, while Democrats would like to see them officially nationalized and made a government owned corporation. The point is moot, however in that there is nothing in the private sector capable of replacing them.

Note that Fan and Fred used to be 100% owned by the government (Fannie Mae was a New Deal phenomenon), and LBJ made them a nominally private institution. The reason? Fannie Mae’s debt was becoming a problem for the national balance sheet and was making it difficult to finance the Vietnam war. LBJ wanted Fannie Mae’s debt off the official books of the US Government, so he spun off a piece to private investor. So, yes Virginia, the first user of off-balance sheet financing was Uncle Sam.

Former Minneapolis Fed Head Narayana Kochlerakota compares the US recovery to that of Europe and Japan. People trumpeting the great performance of the US versus their peers (largely a partisan affair) are ignoring the fact that the US population has been increasing much faster than Europe, so comparing simple GDP growth isn’t really all that meaningful. If you look at employment, the US looks worse. This has big implications for monetary policy. Perhaps QE hasn’t been quite the elixir it has been held up to be. In Japan, banks are running out of JGBs to sell the Central Bank. To me, the glaring observation is that the 10 year bond yield where it was pre taper tantrum (Spring of 2013). It implies they could have achieved the same result doing nothing! As Art Cashin said, the Fed is beginning to resemble Casey Stengal’s 1962 Mets.

That said, it looks like fiscal policy might be ready to run with the ball. Hillary Clinton and Donald Trump both want to spend more money. Assuming Hillary wins and the GOP keeps the House, we will have to see if she can cut a deal with Republicans to allow for more spending.

Filed under: Economy, Federal Reserve, Morning Report | 13 Comments »