Vital Statistics:

| Last | Change | |

| S&P Futures | 2462.3 | 6.5 |

| Eurostoxx Index | 374.1 | 3.1 |

| Oil (WTI) | 46.3 | 0.3 |

| US dollar index | 86.1 | 0.2 |

| 10 Year Govt Bond Yield | 2.14% | |

| Current Coupon Fannie Mae TBA | 103.33 | |

| Current Coupon Ginnie Mae TBA | 104.21 | |

| 30 Year Fixed Rate Mortgage | 3.86 |

Stocks are up this morning on end-of-month window dressing. Bonds and MBS are flat.

Personal incomes rose 0.4% in July, while personal spending rose 0.3%. The PCE index (the Fed’s preferred measure for inflation) rose 0.1% MOM and 1.4% YOY. Good report for stock bulls in that incomes and spending are rising smartly while low inflation keeps the Fed at bay. The December Fed Funds futures are currently predicting a 36% chance of a rate hike at the December meeting and virtually no chance of a hike at the September meeting.

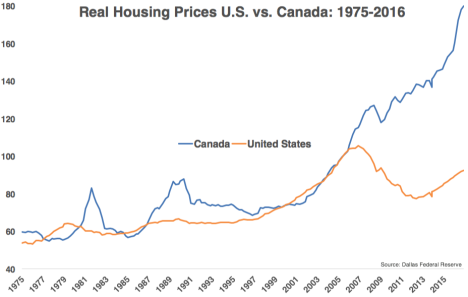

Pending Home sales fell again in July, for the fourth time in five months as tight inventory reduced contract activity. Since bottoming 5 years ago, home prices are up 38% while incomes are only up about a third of that. While that would imply home affordability is getting worse, we are still quite affordable (as far as mortgage payment to income ratios) than we have been historically. It turns out that interest rates matter more than prices when it comes to affordability.

Job cuts rose to 33,825 in August according to the Challenger and Gray Job Cuts report. This is an uptick from July, and a slight uptick on a YOY basis. Retail and construction (surprisingly) were the areas hit. A number in the low 30ks is generally a pretty strong number historically. Don’t forget, these are job cut announcements based on press releases. They may never actually happen.

Initial Jobless Claims were flat at 236,000 last week, which is still an exceptionally strong number.

The Chicago PMI was unchanged at a strong 58.9 last month. New orders and production rose, while employment contracted. Another possible sign of a slowdown in the labor market?

Congress may tie Harvey funding to a debt ceiling increase to make it palatable for all parties to vote for it. If there is going to be a fight over spending increases, the wall, and the debt ceiling, it will happen at the end of the year, not now. Note that Harvey’s costs will also complicate tax reform.

Fannie, Fred, and FHA have announced they will offer forbearance for at least 90 days for homeowners in Houston who were affected by Harvey.

The CFPB has released its planned changes to TRID. These changes go into the Federal Register on October 10, however they are not mandatory until 10/1/18.

The hits keep coming for Wells. An expanded review of fake accounts increased the estimate to 3.5 million. They are also being sued for charging improper lock extension fees. This will certainly be an obstacle for Republicans who want to argue for loosened financial regulation. For the most part, it seems that any regulatory relief will be directed towards the smaller community banks who have been hit the hardest with increased compliance costs. There is still very little sympathy in Washington for the big money center banks.

Filed under: Economy, Morning Report | 25 Comments »