Vital Statistics:

| Last | Change | |

| S&P Futures | 2246.5 | 1.5 |

| Eurostoxx Index | 360.7 | -0.8 |

| Oil (WTI) | 53.9 | -0.2 |

| US dollar index | 93.2 | -0.3 |

| 10 Year Govt Bond Yield | 2.49% | |

| Current Coupon Fannie Mae TBA | 103 | |

| Current Coupon Ginnie Mae TBA | 104 | |

| 30 Year Fixed Rate Mortgage | 4.29 |

Stocks are flat as we head into the end of the year and volume dries up. Bonds and MBS are up again.

Initial Jobless Claims ticked up slightly to 365k last week.

Wholesale inventories increased 0.9% last month as autos and retailers had unsold items. This follows a decline in October. Chances are this inventory will be moved in December, however if it is not, it will have the effect of “borrowing” economic growth from Q1.

PHH has announced they are selling their entire MSR portfolio. New Residential was the buyer. This sale excludes the Ginnie Mae MSR, which were sold separately. The sale price is about 84 basis points of unpaid principal balance. MSR valuations were hurt during 2016 due to higher-than-expected prepayment speeds and lower interest rates. MSR valuations should firm going forward due to higher interest rates as well as new rules regarding the securitization of VA IRRLs. Higher MSR values should generally translate into better rates for the borrower.

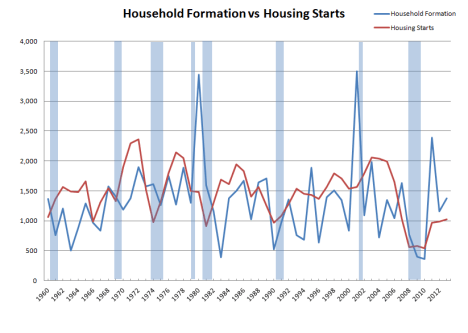

Higher mortgage rates will probably force buyers to purchase lower-priced homes, according to a survey of realtors by Redfin. Almost half think that homebuyers will be forced to lower their price range, while another 15% think it will cause buyers to walk away. The rest either see no effect or think that sellers will decide to sit tight. Homebuilders will probably shift their production to lower price points, and builders like D.R. Horton and Pulte could be situated best. We are also seeing a migration of younger families from the coasts to the heartland, where real estate and the cost of living is much lower.

One other tidbit from the survey: more and more realtors are offering discounts.

Investor optimism hit a 9 year high, according to Gallup. There was a definite partisan birfurcation, as Republicans became more optimistic while Democrats became more pessimistic.

21% of home buyers regret their choice of mortgage lender, according to a study by J.D. Power. 27% of first time home buyers regretted their choice. The complaints basically fell into two categories: The first type included a customer experience that was harmed by lack of communication, unforseen problems, and broken promises. The second type felt pressured to choose a specific type of mortgage product. They ended up being happy with their rate, but felt like they weren’t exposed to other options. Of course for the first time homebuyer, some of this is to be expected. If your only experience with getting credit is a “sign and drive” event at a car dealership, then the mortgage process will be a new experience. TRID and everything that goes with it could explain some of disappointment as well. For the second type, the borrower typically already had a relationship with the lender, but felt like the menu was limited. Note that technology is becoming more important, with 28% completing their application online last year versus 18% 2 years ago.

Filed under: Economy, Morning Report | 54 Comments »