Vital Statistics:

| Last | Change | |

| S&P futures | 4,011 | 22.00 |

| Oil (WTI) | 90.21 | -1.38 |

| 10 year government bond yield | 3.13% | |

| 30 year fixed rate mortgage | 5.81% |

Stocks are up this morning on no real news. Bonds and MBS are flat.

The Fed Funds futures continue to get more hawkish. The futures now see a 72% chance of a 75 basis point hike in September and a 65% chance of a total of 150 basis points in rate hikes by the end of the year. A month ago the market was circling a fed funds rate of 3.25%, and almost no chance of 3.75%. Today, the market sees a 65% chance of 3.75% and a negligible chance of a 3.25% rate.

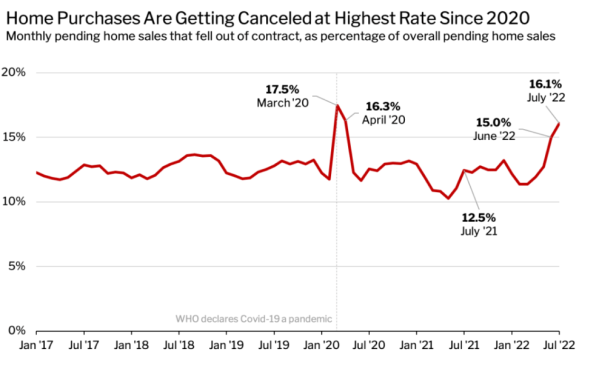

Mortgage applications fell to the lowest level in 22 years, according to the MBA. “Application volume dropped and remained at a multi-decade low last week, led by an 8 percent decline in refinance applications, which now make up only 30 percent of all applications,” Kan added. “Purchase applications have declined in eight of the last nine weeks, as demand continues to shrink due to higher rates and a weaker economic outlook. However, rising inventories and slower home-price growth could potentially bring some buyers back into the market later this year.”

The chart for the index looks dismal indeed

FWIW, I think Joel Kan is probably correct, although purchase activity will probably rebound early in 2023 as the spring selling season starts. I don’t see a decline in overall home prices, although appreciation could slow back to normal levels.

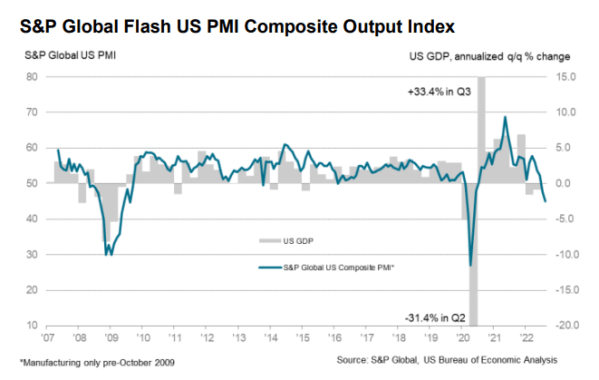

I also think that the economy is weakening already and the impact of the Fed’s tightening have yet to be felt. With GDP growth already negative, and many of the supply issues having been solved the Fed Funds futures might be erring on the hawkishness side.

What the US desperately needs is a homebuilding boom, and hopefully we get one in early 2023 to help lead the economy out of recession as they have typically done in the past (2008 notwithstanding, as the recession was due to the bursting of the housing bubble).

FWIW, Goldman Sachs does not see a homebuilding boom in 2023. “Past housing downturns have typically been accompanied by economy wide recessions, which led to an influx of housing supply as unemployment rose and individuals were forced to sell their homes (this was especially the case in the financial crisis). However, an influx of supply from this channel seems unlikely this cycle: the labor market remains robust (and likely will, even in a mild recession) and, as we wrote last week, household balance sheets are extremely strong and loan delinquency rates are likely to remain historically low,” writes Goldman Sachs researchers. “Thereafter, we expect home prices to be flat in 2023.”

I agree with their statement that we won’t see a lot of forced selling – the economy is too strong for that. But I think hanging your hat on a labor market restricting supply as construction wages continue to rise is an awfully thin reed to hang on to. A lack of consumer pain could affect existing home sales, perhaps. But the simple fact is that there is an abject shortage of housing in the US, and homebuilders will take advantage of it at some point. Note that gross margins are sky-high for the builders. I will admit there have been a lot of false dawns for homebuilding, so perhaps the trend will continue.

Filed under: Economy | 10 Comments »