Vital Statistics:

| Last | Change | |

| S&P Futures | 2423.5 | 3.8 |

| Eurostoxx Index | 382.0 | 1.3 |

| Oil (WTI) | 45.2 | 0.2 |

| US dollar index | 87.8 | 0.1 |

| 10 Year Govt Bond Yield | 2.28% | |

| Current Coupon Fannie Mae TBA | 102.88 | |

| Current Coupon Ginnie Mae TBA | 103.75 | |

| 30 Year Fixed Rate Mortgage | 4 |

Stocks are higher this morning after yesterday’s bloodbath. Bonds and MBS are down as well.

Should be a relatively quiet day ahead of the July 4 weekend. Expect liquidity to dry up in the bond market as most of the Street will be on the LIE by noon.

Consumer sentiment increased in June, according to the University of Michigan survey, while the Chicago PMI also jumped.

Personal incomes rose 0.4% in May, while spending rose 0.1%. Inflation remained muted as the core PCE index (the preferred inflation measurement for the Fed) rose 0.1% MOM and 1.4% YOY. The increased spending was driven primarily by utility spending, so it isn’t that great of an indicator for the economy going forward. The savings rate increased to 5.5%, and has rebounded from the lows of the bubble years. The increase in the savings rate represents the de-leveraging of the American consumer, which does depress GDP in the near term.

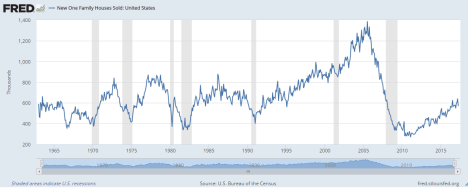

Regulatory issues are restricting mortgage credit, according to Treasury. This is causing people at the lower end of the credit spectrum to be shut out of the mortgage market. The recommendations largely involve clarifying QM and TRID rules to make them less uncertain, which drives risk-averse behavior out of lenders. They also propose a moratorium on new servicing rules. They also recommend revising or repealing the residential mortgage risk retention requirement, which has more or less shut down the private label MBS market. The goal of this is to (a) increase credit, and (b) draw private capital into the market. As of now, the US taxpayer bears pretty much all of the credit risk of new origination.

Unicredito Bank’s Chief Economists sees the US unemployment rate falling to 3%. If you believe the Phillips Curve, that level should trigger inflation, however we have so much slack in the labor market with the long-term unemployed we still might not see much wage inflation. Janet Yellen has already said the Fed is willing to let the employment market “run hot.” At any rate, the Fed is just moving from “ultra-accommodative” to simply “accommodative.”

Blue Apron priced its IPO at the lower end of its reduced range and broke price (i.e traded lower than the IPO price) in the aftermarket. Old-timers might remember the days when something like that was a huge embarrassment for the issuing bank. For the most part, getting in on a IPO typically meant at least a 20% pop on the first day of trading. The behavior of APRN represents the change in the landscape in investment banking over the past 20 years. 20 years ago, IPOs were priced that way in order to reward the buy side for their trading business. Since issuers used investment banking services only sporadically, and the investment banks dealt with the big mutual funds every day, the banks were more concerned with making sure that the buy side was happy and therefore under-priced IPOs (which means the issuer was leaving money on the table). Fast forward 20 years, and trading commissions are now 5% – 10% of what they used to be. Nowadays the banks are more worried about keeping the issuers happy, which means IPOs are no longer underpriced. Which is why IPOs are no longer the free money trade they used to be.

Filed under: Economy, Morning Report | 26 Comments »