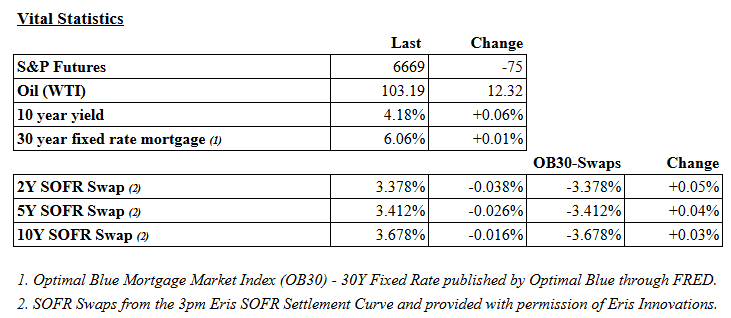

Markets are getting clobbered as oil skyrockets. Bonds and MBS are down. In the overnight session, oil spiked to $118 before coming back down, and the stock index futures were down a couple of percent.

Traffic through the Strait of Hormuz has basically ground to a halt, which is sending oil prices through the roof. While US gets most of its oil domestically – US consumers use West Texas Intermediate – it still correlates price-wise with North Sea Brent. Shortages are a definite risk for Europe and China, but are not on the table in the US. California does import a lot of its oil, however it mainly comes from the Americas.

There are a slew of wells that were drilled when oil prices were much higher, and they all have oil price points where they become economic to operate. So supply is available domestically and will come on line the longer oil prices stay here. This won’t be a repeat of the Arab Oil Embargo of 1973 where the US had gas lines which kicked off the 1970s inflation. This is not a structural supply issue.

The US has said it will begin shepherding tankers through the Strait with the US Navy, which should help increase global supply. The longer this goes on, the worse it will be for markets and commodity prices in general. It certainly won’t help for the summer driving season, nor will it help for consumer confidence.

Iran has named Mojtaba Khamenei, the son of Ayatollah Ali Khamenei as the Supreme Leader. Trump said last week that “Khamenei’s son is unacceptable to me.”

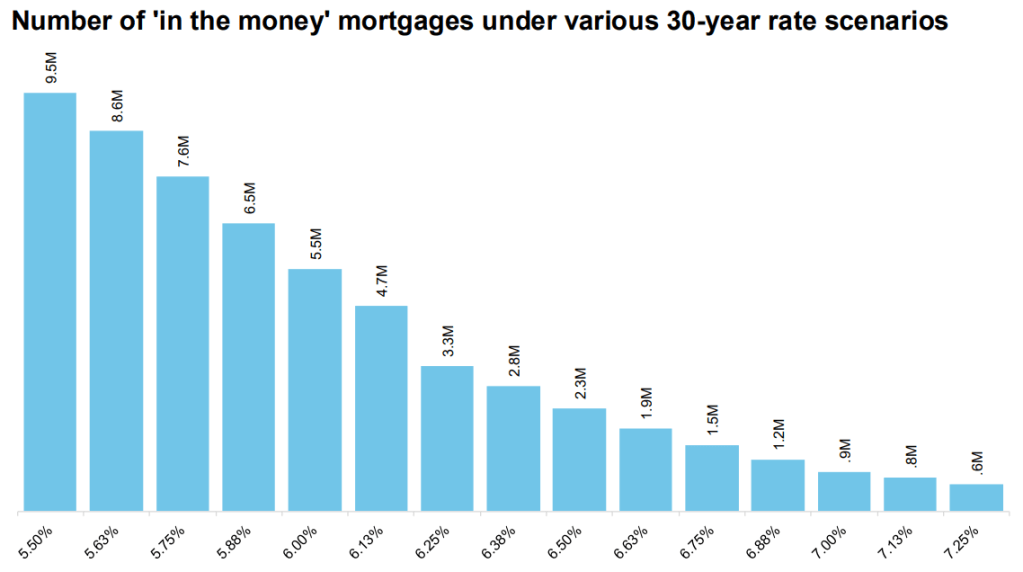

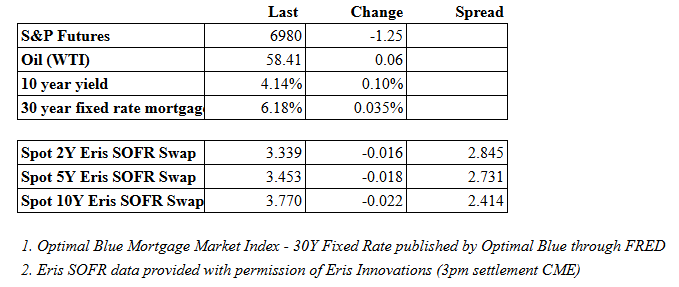

The 10 year bond yield continues to rise, however mortgage rates are not up as dramatically. As a general rule MBS will lag movements in Treasuries, so this may not last. So far, we are seeing non-QM rates hold steady. Still none of this is good news for the Spring Selling Season.

The week ahead will be dominated by inflation data with the consumer price index on Wednesday and the personal incomes / outlays report on Friday. We will also get housing starts, the first revision of Q4 GDP and existing home sales. Given the situation in Iran, a rate cut at the March meeting is off the table, so the inflation data probably won’t have much of an impact on the markets.

Boston Fed President Susan Collins is in no hurry to make any changes to monetary policy. From her prepared remarks: “I do not see an urgency for additional policy adjustments, and I will be looking for clear evidence that inflation is moving durably toward the 2 percent target – something that might occur only over the second half of the year. Of course, it remains very important to continue assessing the incoming data in their entirety – and policy is well positioned to adjust as needed, depending on how conditions and the outlook evolve.”

Separately, San Francisco Fed President Mary Daly noted the weak jobs report on Friday: “This jobs market report has got my attention,” she said during a “Squawk Box” interview. “I don’t think you can look through this report, but I also don’t think you should make more of it than one month of data.”

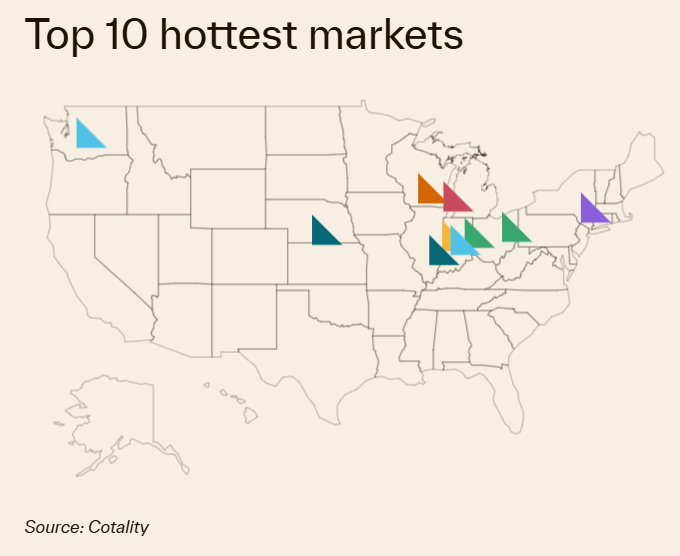

The Senate has added a provision to its housing affordability legislation to require institutional investors who build for rent to sell their properties within 7 years. The White House had sent a proposal which excluded build-to-rent funds. “It’s about making sure people like the single mom who raised me in North Charleston, South Carolina, have even greater access to economic opportunity and the American dream of homeownership,” Sen. Tim Scott (R., S.C.), who is co-sponsoring the bill with Massachusetts Democratic Sen. Elizabeth Warren, said last week.

The bigger question is how this will affect the supply of homes for sale. Theoretically this could make it tougher for builders to finance these properties, although that seems like a stretch given that these funds raise capital independent of the properties that secure them. They aren’t taking out DSCR loans for each property – they are raising $200 million in the bond market at a clip.

What happens with tenants who are living in the homes when the forced sale date arrives? Do they get evicted? If the government wants investors to sell the home to a first-time homebuyer, presumably they would have to.

Ultimately, if the government wants to increase housing supply, this doesn’t look like a helpful step in that direction. The ban on institutional investor home ownership is a specious solution to the affordability problem.

Filed under: Economy | Leave a comment »