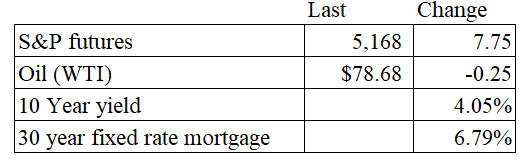

Vital Statistics:

Stocks are higher this morning after the jobs report. Bonds and MBS are up small.

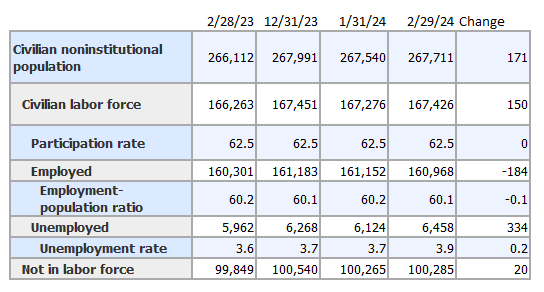

The economy added 275,000 jobs in February, which was way more than expected. The unemployment rate ticked up from 3.7% to 3.9%, while average hourly earnings rose 0.1%. The headline numbers are indicative of a strong labor market.

January’s payroll number was revised downward substantially, from a gain of 353,000 to a gain of 229,000. The February payroll number was another case of statistical adjustments accounting for the increase, as the number of people with jobs actually fell by 184,000. The number of unemployed people rose by 334k.

The Fed will be happy with the decline in wage growth, and the overall message that the labor market is coming more into balance.

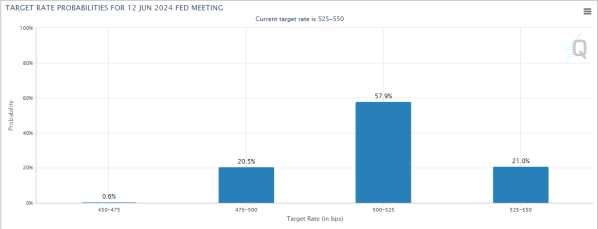

Jerome Powell said yesterday that the Fed is close to cutting rates. “I think we are in the right place,” Powell said of the current stance of monetary policy in a hearing before the Senate Banking Committee. “We are waiting to become more confident that inflation is moving sustainably down to 2%. When we do get that confidence, and we’re not far from it, it will be appropriate to begin to dial back the level of restriction so that we don’t drive the economy into recession.”

When asked about concerns over workers losing their jobs, Powell said: “We’re well aware of that risk, of course, and very conscious of avoiding it,” Powell said. “If what we expect and what we’re seeing – continued strong growth, strong labor market and continuing progress in bringing inflation down – if that happens, if the economy evolves over that path, then we do think that the process of carefully removing the restrictive stance of policy can and will begin over the course of this year.”

These comments helped push the 10 year bond yield to the lowest level in over a month. The Fed Funds futures for March didn’t change, but the June futures are showing a roughly 80% chance of a rate cut.

Filed under: Economy |

Worth noting – Rent control law in 2019 leading to bank issues in 2024.

LikeLike

This is why the markets aren’t worried about something systemic.

LikeLike

Watched the RFK Jr. SOTU response. He makes the MAGA case better than Trump does.

LikeLike

I don’t understand what the U.K. Government has against Tommy Christopher.

LikeLike

You mean Tommy Robinson.

LikeLike

Yes, that’s his name. Thanks!

LikeLike

NY has to put the National Guard in the subway and this is the priority of the NY AG:

https://www.vox.com/future-perfect/2024/3/8/24093774/big-meat-jbs-lawsuit-greenwashing-climate-new-york

LikeLike

They voted for this.

LikeLike

Thought her threatening people not being nice enough to trannies was the priority?

The fuck, Leticia?

LikeLike

She has given the next Republican administration a nice roadmap on how to target your political enemies with the authority of the AG’s office.

https://www.nytimes.com/2024/03/10/nyregion/letitia-james-trump-nra.html

LikeLike

We’ve gone from, “There is no Deep State, Wingnut!” To, “Here’s why it’s great there’s a Deep State, Wingnut!”

LikeLike

I would automatically assume that they are withholding info at a minimum, even if he’s actually elected again.

LikeLike

Agreed. Plus, I suspect most of it is stovepiped for all Administrations.

LikeLike

How weak is Biden if he has to grovel at this level in an attempt to shore up his base.

https://redstate.com/nick-arama/2024/03/09/biden-msnbc-interview-its-just-a-disaster-as-he-digs-deeper-hole-on-illegals-laken-riley-and-israel-n2171165

The last Democrat incumbent that was this week in their election year was Carter, and Carter had an actual primary opponent. I think LBJ was in a better position than Biden right now.

LikeLike

We’re in Guns and Butter II…

LikeLike

there is no irony left.

LikeLike

This is hilarious:

“The ACLU Is Trying to Destroy the Biden NLRB

from Matt Bruenig’s new publication NLRB Edge

Freddie deBoer

Mar 11, 2024″

https://freddiedeboer.substack.com/p/the-aclu-is-trying-to-destroy-the

LikeLike

FYI Brent:

https://www.washingtonpost.com/business/2024/03/10/smaller-new-houses-afforable/

LikeLike

Always watching:

https://www.nytimes.com/2024/03/11/technology/carmakers-driver-tracking-insurance.html

LikeLike

Final Turley comment made me laugh.

LikeLike

Best Reader Added Context ever.

LikeLike

Totally different than Trump.

LikeLike

Lol

LOL squared!

https://x.com/seanmdav/status/1767555008952971277?s=46&t=vSGsUlnc4rLxcUf7zfUiHg

LikeLike

This one is good:

https://babylonbee.com/news/jan-6-protesters-request-to-be-called-undocumented-tourists

LikeLike

So do people here think this Tik Tok ban is nothing more than a pretext to ban X and Rumble?

LikeLike

I have no idea. I suppose that it could be but I also suspect that X already is throttling some things and people for political reasons. I don’t really think that Rumble is all that big a concern for the Deep State, it’s reach just isn’t that big.

LikeLike

The China link is what gets it majority support from both Republicans and Democrats.

LikeLike

I think it is a Trojan Horse for censorship.

LikeLike

It’s not a Trojan Horse. It’s the explicit goal. But “China!” is the only thing that can get a majority of elected Republicans and Democrats to agree on who should be censored.

LikeLike

This is good

John Kerry Praises Haitian Cannibals’ Efforts To Reduce Humanity’s Carbon Footprint | Babylon Bee

LikeLike

Taibbi goes into the deep history of the Trans craziness

https://www.racket.news/p/the-dumbest-cover-story-ever

He finally gets it too:

“However, the live-and-let-live liberalism that apparently makes me a TARL persuaded me to keep my mouth shut previously, which I now realize was a mistake.”

LikeLike

And another narrative falls apart

https://www.washingtonpost.com/nation/2024/03/13/nex-benedict-oklahoma-death-autopsy/

LikeLike

The left is trying to re-define “genocide”

LikeLike

This should do it.

LikeLike