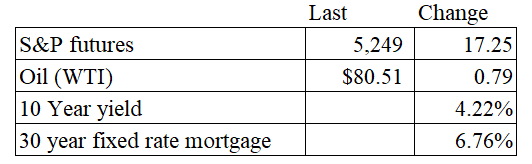

Vital Statistics:

Stocks are higher this morning on no real news. Bonds and MBS are down.

Retail sales rose 0.6% in February, which was a touch below expectations. On a year-over-year basis retail sales were up 1.5%. These numbers are not adjusted for inflation, so it is an indication that spending is on the weaker side. January’s numbers were revised downward, which is typical these days.

Inflation at the wholesale level increased 0.6% in February, which was an acceleration from January and December. About 70% of the increase was due to energy prices, particularly gasoline. Excluding food and energy, wholesale prices rose 0.3%.

Initial Jobless Claims fell to 209,000 last week.

Biden is proposing a $10,000 tax credit for first-time homebuyers and people who sell their starter home. The admin is also directing FHFA to waive title insurance fees and telling CFPB to go after fees at closing. Ultimately the problem is supply and interest rates, so the going after closing costs and goosing demand probably isn’t going to do much.

Since the inflation numbers aren’t going to allow the Fed to cut as much as necessary to lower mortgage rates, one way to attack the problem is to target MBS spreads. FHFA can tell Fannie Mae and Freddie Mac buy MBS again which was part of their job prior to the financial crisis.

Homebuilder Lennar reported first quarter earnings yesterday. Revenues rose 13%, which was driven by a 23% increase in units and a 8% decline in average selling prices. Gross margins expanded to 21.8% compared to 21.3% a year ago. The increase in gross margins were driven by decreased construction costs which was offset by a decline in average selling prices and higher land costs. Lennar is holding much less land in inventory than it has in the past.

Earnings were $719 million and the company spent $506 million buying back stock.

Filed under: Economy | 41 Comments »