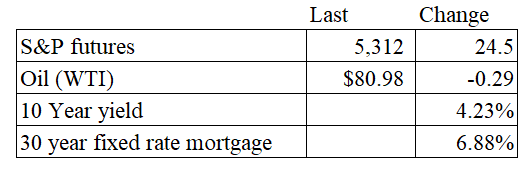

Vital Statistics:

Stocks are higher this morning after the Fed’s statement kicked off another rally. Bonds and MBS are up.

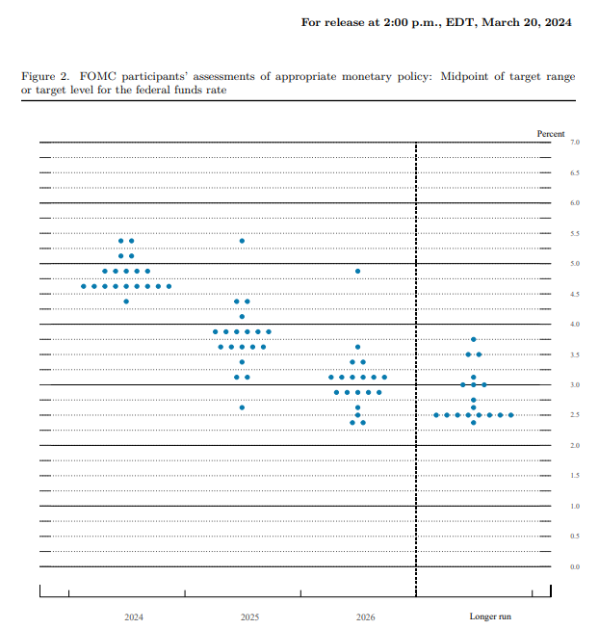

The Fed maintained the Fed Funds rate at current levels as expected and signaled that it would begin cutting this year. The dot plot was pretty similar to December, which signaled three rate cuts this year. The fear going into the meeting was that the majority of voters might move from 3 cuts to 2, but that didn’t happen. That said, there were more votes for 2 cuts than there were in December.

In the economic projections, the Fed raised their estimate for this year’s GDP growth from 1.4% to 2%, pushed down their estimate for unemployment from 4.1% to 4% and increased their estimate for core inflation growth from 2.4% to 2.6%.

During the press conference, Jerome Powell said that the recent disappointing inflation numbers might be due to seasonality, and he also said that the Fed might begin to taper its balance sheet runoff. I think the comments on tapering QT were a surprise to the market. Theoretically this should be a positive for MBS spreads, although the Fed’s MBS portfolio is way out of the money, and the only runoff will be from people who are moving.

When asked about shelter inflation, he mentioned that rents seem to be cooling off and he was convinced that overall inflation would move lower.

Overall, the stock market liked the decision and the bond market seemed to take comfort in the fact that quantitative tightening might decrease going forward. The yield curve became slightly less inverted, with the 2s-10s spread going from -36 basis points to -32 basis points. Given the strength of the overall economy, it is surprising to see an inverted yield curve.

The Fed Funds futures didn’t make any dramatic changes, although the June chances of a rate cut increased from about 60% to 75%, while the December futures remained at three cuts. The December futures are handicapping a bigger chance of 100 basis points than 50 this year.

Overall, the Fed statement and press conference was mildly bullish, and the big takeaways are that (a) the Fed seems unconcerned about the recent hot inflation prints and (b) the Fed wants to slow its balance sheet reduction which should be supportive to the 10 year bond and MBS spreads.

Redfin was out with their take on the meeting and its impact on mortgage rates: “Mortgage rates are still expected to fall gradually this year as the Fed solidifies its plans to cut rates this year. When enough economic data accumulates to set the stage for that, rates will start to drop. However, we don’t expect rates to drop precipitously. We should end the year in the low 6% range. That means the housing market won’t shift dramatically this year, but we do expect more supply and transactions this year amidst weakening price growth.”

Deutsche Bank strategist Jim Reid had this to say: “Last night saw a remarkably relaxed Fed as Powell indicated that January’s higher inflation could have been seasonal, and February’s print had already seen improvements,” said Deutsche Bank’s Jim Reid, adding that Powell’s dovish-leaning press conference drove equities higher and yields lower. “Our economists continue to expect the first rate cut to come in June with 100 bps of cuts in total this year, but with risks skewed to a more hawkish outcome,” Reid added.

Filed under: Economy | 41 Comments »