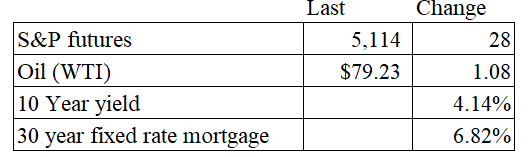

Vital Statistics:

Stocks are higher after Super Tuesday gave unsurprising results. Bonds and MBS are up small.

Jerome Powell heads to the Hill today for his semiannual Humphrey-Hawkins testimony. Here are his prepared remarks. Punch line: Rate cuts are coming, but not imminent:

We believe that our policy rate is likely at its peak for this tightening cycle. If the economy evolves broadly as expected, it will likely be appropriate to begin dialing back policy restraint at some point this year. But the economic outlook is uncertain, and ongoing progress toward our 2 percent inflation objective is not assured. Reducing policy restraint too soon or too much could result in a reversal of progress we have seen in inflation and ultimately require even tighter policy to get inflation back to 2 percent. At the same time, reducing policy restraint too late or too little could unduly weaken economic activity and employment. In considering any adjustments to the target range for the policy rate, we will carefully assess the incoming data, the evolving outlook, and the balance of risks. The Committee does not expect that it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent.

The questions from Congress will be interesting. I am sure that many in Congress are getting itchy for rate cuts, especially since consumers are rather down on the economy overall, which tends to lead to a bad election season for incumbents.

The private sector added 140k jobs in February, according to the ADP Employment Report. Wage gains for job changers accelerated from 7.2% to 7.6%. Overall wage inflation was 5.1%. “Job gains remain solid. Pay gains are trending lower but are still above inflation,” said Nela Richardson, chief economist, ADP. “In short, the labor market is dynamic, but doesn’t tip the scales in terms of a Fed rate decision this year.

Leisure / hospitality added 41,000 jobs in February, followed by construction. The Street was looking for 150,000 jobs, so this was a bit lower than expected. The Street is looking for 190,000 jobs in Friday’s jobs report.

Mortgage applications rose 9.7% last week as purchases rose 12% and refis rose 8%. “The latest data on inflation was not markedly better nor worse than expected, which was enough to bring mortgage rates down a bit, with the 30-year fixed mortgage rate declining slightly last week to 7.02 percent,” said Mike Fratantoni, MBA’s SVP and Chief Economist. “Mortgage applications were up considerably relative to the prior week, which included the President’s Day holiday. Of note, purchase volume – particularly for FHA loans – was up strongly, again showing how sensitive the first-time homebuyer segment is to relatively small changes in the direction of rates. Other sources of housing data are showing increases in new listings, which is a real positive for the spring buying season given the lack of for-sale inventory.”

Home prices rose 5.8% in January, according to CoreLogic. “U.S. annual home price growth strengthened to 5.8% in January 2024,” said Dr. Selma Hepp, chief economist for CoreLogic. “And while the acceleration continues to reflect the residual impact of strong appreciation in early 2023, the annual rate of growth is expected to taper off in coming months.”

“Home prices further increased in late 2023 despite high mortgage rates, which surged to the highest level since the beginning of the millennium,” Hepp continued. “But metro areas that have struggled with the impact of higher rates continue to see downward movement on home prices. Generally, pressures from higher mortgage rates tend to occur in markets where the higher cost of homeownership pushes against the affordability ceiling.”

Filed under: Economy | 34 Comments »