Filed under: Uncategorized | 75 Comments »

Bits & Pieces (Friday Night Buckingham Edition)

Lee Stranahan on Pigford

If you’ve followed Pigford at all, you might want to read this article by Lee Stranahan reiterating his belief that the Pgiford settlement was mostly a fraud and black farmers with legitimate claims pretty much got screwed by folks exploiting the controversy for their own gain.

Of course, Lee Stranahan works with Andrew Breitbart, so if you may draw whatever conclusions, based on context, that you please.

Filed under: Uncategorized | 32 Comments »

Job Creation Ideas

I’m late on a bunch of stuff, but wanted to post this for the good of the order.

“‘Jobs’ are deals between workers and employers, and so ‘creating’ them out of unwilling parties is impossible. The state, though, can outlaw deals, and has,” Deirdre McCloskey is a professor of economics, history, English, and communication at the University of Illinois at Chicago

This, and other job improvement suggestions, available here for your review and discussion.

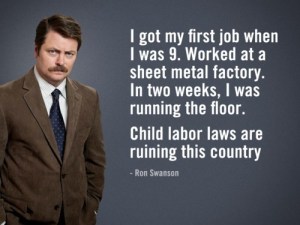

And for a little Friday fun, everyone’s favorite sit-com libertarian Ron Swanson:

Filed under: Uncategorized | 54 Comments »

Morning Report

Vital Statistics:

| Last | Change | Percent | |

| S&P Futures | 1210.4 | 12.5 | 1.04% |

| Eurostoxx Index | 2352.5 | 20.01 | 0.86% |

| Oil (WTI) | 85.83 | 1.6 | 1.90% |

| US Dollar Index (DXY) | 76.869 | -0.18901 | -0.25% |

| 10 Year Govt Bond Yield | 2.24% | 0.05% |

Economic data this morning: Import Price Index up 13.4% YOY. Advance retail sales up 1.1% for the month of September. August sales were revised higher from flat to +.3%. September’s numbers have generally been much stronger than August. The WSJ has a story this morning discussing economic volatility, and shows that economic volatility has indeed been higher than historical averages. Certainly the stock market has been more volatile, with the VIX index over 30 (even after a gigantic rally). Link: Economy in Full Swing (Watch Your Head) – WSJ

Google reported last night better than expected numbers. The stock is up over 8% premarket. So far, Alcoa and JP Morgan have sold off after their numbers (in spite of “beating” the “analyst estimate”). The initial take from JPM and AA is that Europe is going to be a problem. Last quarter, CEOs were generally constructive on 2H; it will be interesting to hear their views going forward this time around.

Today’s Washington Post discusses the prospect of a double dip recession, (link) and makes the point that the typical drivers of a recession – construction and auto inventories – are already flat on their back, so there isn’t any excess to work off. That is a fair-enough observation, although I would point out that this isn’t the typical inventory-driven recession. This is a recession in the aftermath of an asset bubble, and those recoveries are slower, more fickle, and a lot of the levers that government has to fix things (monetary and fiscal policy) don’t work very well. To give you an idea of how depressed housing is (and why this recession is different), look at the chart below regarding housing starts.

Housing and construction typically leads the economy out of a recession. This time, it is not because there is a massive inventory of unsold homes. In addition, household formation has been depressed as a) immigration has been slowing, and b) unemployed college graduates move back in with their parents. A bottom in housing is a necessary, but not sufficient, condition for an economic rebound.

The WSJ has a depressing piece on how median incomes have fallen during the 2000s. Again, this is typical post-bubble behavior. The equity bubble burst in 2000, and the only thing that provided the economy any real energy was the housing bubble. Although people have the perception that the housing bubble inflated in 05-06, if you look at housing’s historical relationship with incomes, the bubble actually started in 2000, when the equity bubble burst. Guys like Krugman have been advocating inflation as a way out of this mess; so far, the Fed has only succeeded in commodity price inflation. If the “wage” side of the wage / price spiral don’t cooperate, the Fed only succeeds in crimping disposable incomes further, which is a recipe for the dreaded misery index.

Filed under: Uncategorized | 11 Comments »