Markets are closed for the Good Friday Holiday.

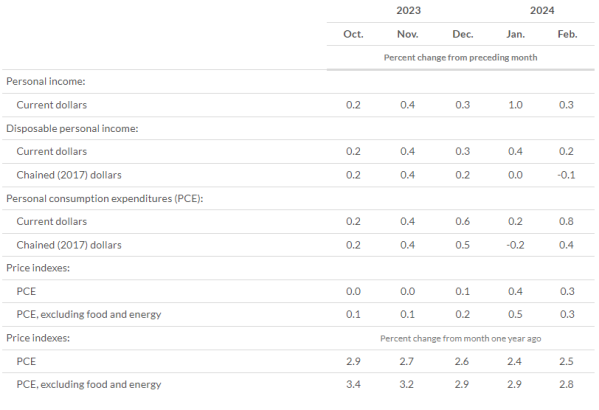

Personal Incomes rose 0.3% in February, while spending rose 0.8%. The all-important PCE Price Index rose 0.3% MOM, which was a deceleration from the 0.4% increase in January, but higher than the numbers were were seeing in the fourth quarter of 2023. Excluding food and energy, the index rose 0.3%. The annual rates continued their general downward trend, with the annual headline number falling to 2.5% and the core rate falling to 2.8%.

Pending Home Sales grew 1.6 month-over-month in February, according to NAR. Pending Home Sales fell 7% on a year-over-year basis however. NAR expects to see more inventory hit the market, however which should boost sales. “While modest sales growth might not stir excitement, it shows slow and steady progress from the lows of late last year,” said NAR Chief Economist Lawrence Yun. “Ongoing job gains are clearly increasing demand along with more inventory. The high-cost regions in the Northeast and West experienced pullbacks due to affordability challenges,” added Yun. “Home prices rising faster than income growth is not healthy and adds challenges for first-time buyers.”

Yun further noted, “There will be a steady rise in inventory from recent growth in home building. Additionally, many sellers, who delayed listing in the past two years, will begin to put their homes on the market to move to a different home that better fits their new life circumstances – such as changes in family composition, jobs, commuting patterns and retirees wanting to be closer to their grandkids.”

Consumer sentiment improved in March, according to the University of Michigan Consumer Sentiment Survey. “Consumer sentiment recorded an incremental increase of less than three index points from February, well within the margin of error and stable since January. Critically, consumers exhibited confidence that inflation will continue to soften. Assessments and expectations of personal finances improved modestly from last month, as the perceived negative effects of high prices and expenses on living standards eased. Strong stock market performance this month supported sentiment gains only for those with the largest holdings, with little impact on the index. Overall, sentiment is essentially unchanged throughout the first quarter of 2024, remaining just shy of the midpoint between the pre-pandemic level of sentiment and the historic trough from June 2022.”

Importantly, consumers’ forecasts for inflation continued to improve. Year-ahead expectations fell from 3.0% to 2.9%, while long-term expectations fell from 2.9% to 2.8%. The Fed pays attention to UMich and has mentioned it in its minutes.

Filed under: Economy |

The struggle is real.

Truth to power!

LikeLike

Here’s my conspiracy theory, Schumer agreed to a Senate impeachment of Mayorkas if Johnson brings the Ukraine funding bill to the floor.

LikeLike

Proof of above?

LikeLike

I’m not even sure if that counts as a conspiracy theory. More like the typical horse trading.

LikeLike

Fascinating discussion

This Is One of the Biggest Medical Malpractice Scandals in History | Michael Shellenberger | EP 435 (youtube.com)

LikeLike

Pure gaslighting.

LikeLike

Hawt blue on blue action.

LikeLike

Fucking Christians!

LikeLike

Was David French ever conservative, or was it all an act?

LikeLike

Worth noting

https://reason.com/2024/03/29/fbi-agent-says-he-hassles-people-every-day-all-day-long-over-facebook-posts/

LikeLike

WIP, yo.

LikeLike