Vital Statistics:

| Last | Change | |

| S&P futures | 3200 | -19.1 |

| Oil (WTI) | 40.74 | -0.41 |

| 10 year government bond yield | 0.61% | |

| 30 year fixed rate mortgage | 3.02% |

Stocks are lower this morning on no real news. Bonds and MBS are up.

Initial Jobless claims came in at 1.3 million. It is surprising to see so many claims given the state of re-opening, however it seems like many small businesses are still closing down as a result of the COVID shutdown. There is talk of additional stimulus out of Washington, along with the end of the additional $600 a week for the unemployed.

Retail Sales increased 7.5% in June, well above the 5.2% forecast. The control group, which excludes gas, autos, and building products rose 5.7%. This is overall good news for the economy as consumption is the biggest driver.

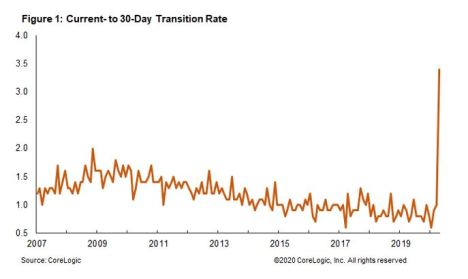

Overall delinquencies rose to 6.1% in April, according to CoreLogic. The hardest hit states were the NYC area: NY, NJ, CT, as well as the deep south states of LA and MS. You can see how fast the DQ rate spiked in the chart below:

Single family authorizations fell 10% in June, according to BuildFax, although activity might be stabilizing as builders learn to work within the restrictions of COVID. Certainly the demand is there, as first time homebuyers try and escape the cities. Note we will get housing starts and building permits tomorrow.

Filed under: Economy, Morning Report | 36 Comments »