Stocks are lower after talks between Greece and its creditors broke down over the weekend. Bonds and MBS are up.

This is supposedly “deal week” for Greece. They owe the IMF $1.7 billion. If they don’t pay (and they have already missed one payment), then it makes it hard for the ECB to continue providing emergency liquidity. The current program with the ECB expires at the end of the month. Rhetoric is getting more and more heated between Germany and Greece at this point. At issue are the pensions. Greece is steadfastly resisting restructuring the country’s pension system. And the Germans are getting sick of it: ‘We will not let the German workers and their families pay for the overblown election promises of a partially communist government,’’ Vice-Chancellor Sigmar Gabriel wrote in a Bild opinion column on Monday. If they can’t get a deal, then the ECB will probably stop supporting the Greek banks and the county will have to impose capital controls to keep hard assets from fleeing the country. It sounds like the Europe will consider allowing Tsipras some sort of face-saving change to the deal, but nothing really meaningful. The bond markets are getting nervous, as the Greek 10 year bond yield is up almost one full percentage point this morning at 12.723%. For us in the the US markets, any sort of Greek exit will probably cause a flight to quality, which means it would be bullish for US bonds.

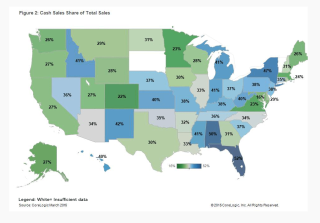

Chart: Greek 10 year bond yield:

In other “bullish for US bonds” news, the manufacturing sector had a rough go of it in May. Industrial Production fell 0.2%, manufacturing production fell 0.2% and capacity utilization fell to 78.1%. Separately the New York State Empire Manufacturing Index fell to -1.98. While manufacturing is no longer the economic driver it used to be, these are still lousy numbers, and reinforces the idea that the Fed will stand pat this week.

The NAHB Homebuilder index rebounded to 59 in June, topping its post-crisis highs. Builder confidence is more or less back at “normalcy.” While homebuilder sentiment is back to normalcy, housing starts most certainly are not. The Street is forecasting housing starts to come in at 1.09 million tomorrow, which is still 27% below the normal, pre-bubble level of 1.5 million starts a year. Starts are only now approaching the recessionary lows of the past. So while builders may have positive sentiment, they aren’t putting their money where their mouth is, at least not yet.

Chart: housing starts, long term:

The FOMC meets on Tuesday and Wednesday this week. This will be the first FOMC meeting where a rate hike is in play. Given some of the weak economic data and persistent low inflation, it is unlikely the Fed will hike rates this week, however the language of the statement will certainly be important. Expect to see some volatility this week in bonds, between the FOMC and the Greek situation. LOs, be sure to tell your borrowers about the risks of floating.

If the Fed does in fact hike rates, it doesn’t necessarily follow that the 10 year bond yield (and by extension mortgage rates) will spike. When you look at the tightenings in the past, the yield curve flattened, which means the short end of the curve (overnight rates etc) moved higher, but the longer end of the curve largely ignored the increase. The 2004 tightening cycle is probably the most relevant, as we were still in the aftermath of the collapse of the stock market bubble. The Fed increased the Fed Funds target rate from 1% to 5.25% over the course of 2 years. The US 10 year basically went nowhere.

Chart: aftermath of 2004 rate hikes:

For a contrarian view on the Fed and long-term interest rates, listen to Bill Gross, who thinks the world’s central banks want higher long-term rates because they are worried about insurance companies and pension funds. These entities are not able to earn the returns they need in this low interest rate environment (the actuarial tables couldn’t care less that rates are zero), and they have been forced to take a lot of credit risk. The most painless way to avoid a crisis is to let long-term rates slowly creep up. It just goes to show how small the eye is in the needle the world’s central banks need to thread.

Elizabeth Warren and the left are not fans of share buybacks And there are legitimate questions about companies levering up to fund buybacks. And yes, buybacks are more tax efficient than dividend hikes because investors can defer taxes on capital gains by not selling. . However they are trying to conflate stock buybacks with “market manipulation,” which is fraud and illegal. I think the gameplan is twofold here: The first is to weaken the presumption that management’s first priority is to maximize shareholder value. The second is to shame companies into raising wages for workers.

Filed under: Morning Report | 14 Comments »