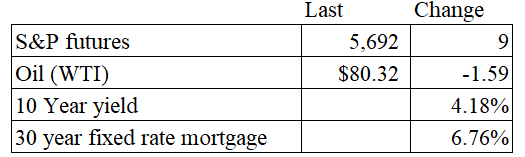

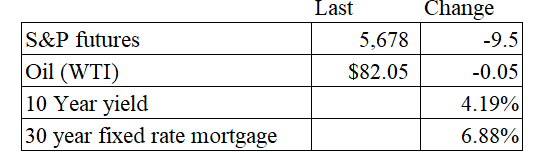

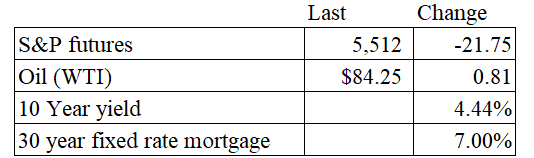

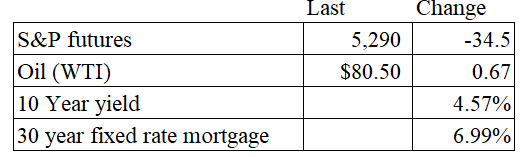

Vital Statistics:

Stocks are lower this morning after lackluster earnings from Tesla. Bonds and MBS are flat.

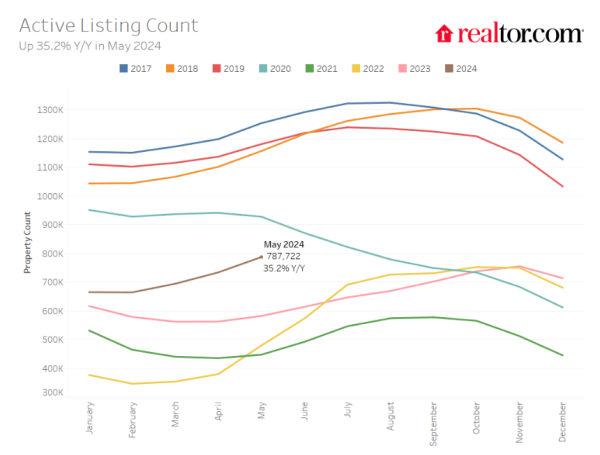

Existing home sales fell 5.4% last month to a seasonally-adjusted annual rate of 3.89 million. “We’re seeing a slow shift from a seller’s market to a buyer’s market,” said NAR Chief Economist Lawrence Yun. “Homes are sitting on the market a bit longer, and sellers are receiving fewer offers. More buyers are insisting on home inspections and appraisals, and inventory is definitively rising on a national basis. Even as the median home price reached a new record high, further large accelerations are unlikely,” Yun added. “Supply and demand dynamics are nearing a balanced market condition. The months supply of inventory reached its highest level in more than four years.”

The median home price rose to 426,900, which was a 4.1% increase from a year ago. The first time homebuyer share fell from 31% to 29%, while investor purchases fell from 18% to 16%. The 3.9 million pace of existing home sales is pretty consistent for a housing recession. To put that number into perspective, we did something like 5.3 million in 2019.

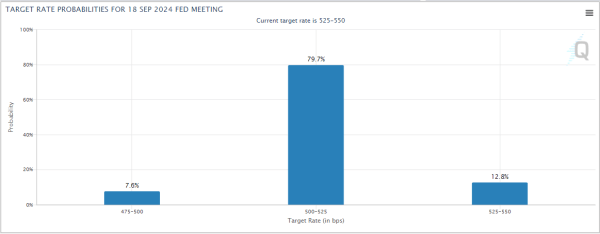

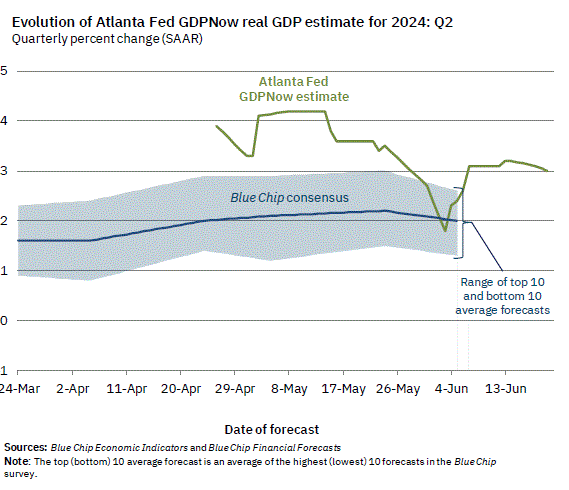

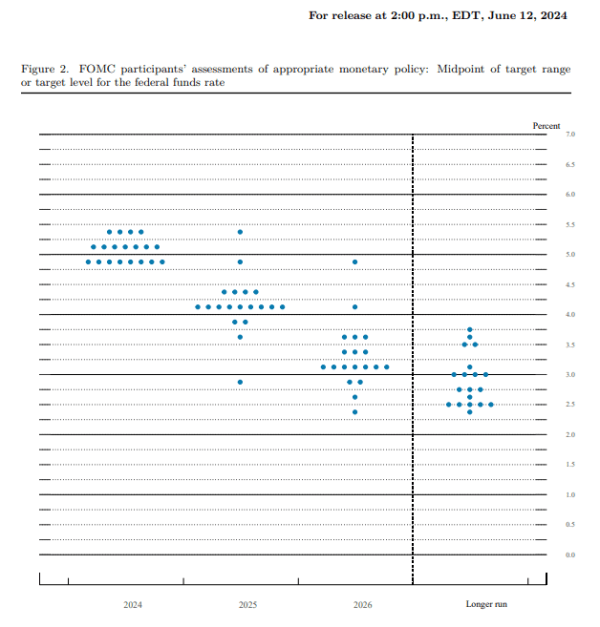

Fannie Mae’s latest housing forecast is out. They see the 30 year fixed rate mortgage ending the year at 6.7%, and gradually falling to 6.2% by the end of 2025. Home price appreciation is expected to remain in the 6% range before falling into the 3% range in 2025. They expect to see 25 basis points in rate cuts this year and another 75 bp in 2025. The core PCE inflation rate is expected to fall to 2.7% this year and 2.3% next year.

PennyMac reported earnings that disappointed the Street. The company acquired $22.5 billion in loans in Q2, which was up 6% on a year-over-year basis. On the earnings conference call, CEO David Spector was asked about when we will start seeing more refi activity:

“Look, I think it’s a gradual decline down. I think if you look at originations post COVID, we kind of jumped and kind of ran through loans with 5% handle. And I think it’s really in the 6% to 7% range where you see a lot — and even north of 7%, where you see a lot of opportunity. It’s going to be — the way I think about it is it’s going to be the slow grind down. I think when rates get to 6.5%, that’s where it really picks up steam.

And I think at 6%, you’re in what I would deem a really robust refi market because it’s not just the existing first that are in the money. You could have loans that are 4% and 5%, taking out debt consolidation, cash refinance to either pay off existing HELOCs or closed-end seconds or other forms of debt. And so it’s really a function of what’s behind the first lien that helps drive the refinanceability. But I continue to believe that it’s 10-year around 3.75%, mortgage is down 50 basis points, that it really is to me, that’s the signal of a true new market or new phase of the refinanceability.”

Mortgage applications fell 2.2% last week as purchases fell 4% and refis rose 0.3%. “Mortgage rates continued to ease, with the 30-year fixed rate dipping to 6.82 percent, the lowest level since February 2024,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “Refinance applications were up, driven by conventional and FHA application activity, as some borrowers took the opportunity to act. Furthermore, the conventional refi index was at its highest level since September 2022. Purchase applications decreased as ongoing affordability challenges persist with rates at their current levels and with home-price appreciation still strong in many markets.”

Filed under: Economy | 14 Comments »