Vital Statistics:

| Last | Change | |

| S&P futures | 3707 | 5.6 |

| Oil (WTI) | 46.01 | -0.34 |

| 10 year government bond yield | 0.94% | |

| 30 year fixed rate mortgage | 2.80% |

Stocks are higher this morning on hopes for a stimulus bill. Bonds and MBS are down.

Mortgage Applications fell 1.2% last week as purchases decreased 5% and refis increased 2%. The numbers include an adjustment for the Thanksgiving Day holiday. “Refinance activity increased last week in response to mortgage rates for 30-year, 15-year and FHA loans hitting their lowest levels in MBA’s survey,” said Joel Kan, MBA Associate Vice President of Economic and Industry Forecasting. “The increase in refinance applications was driven by FHA and VA refinances, while conventional activity fell slightly. The ongoing refinance wave has continued through the fall, with activity last week up 89 percent from a year ago.”

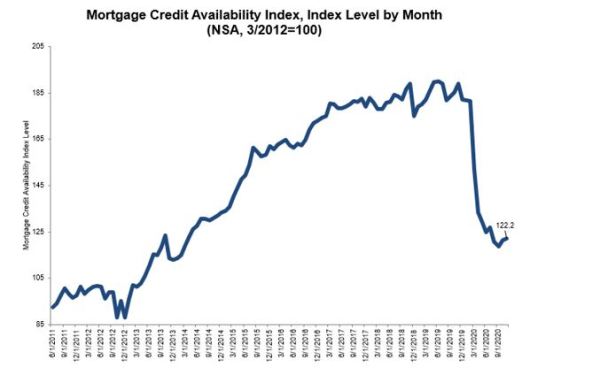

Mortgage credit increased in November, according to the MBA. “Mortgage credit availability increased slightly in November to its highest level since July, as the job market improved, and the housing sector continued to show strong borrower demand,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “There was an increase in credit availability for jumbo loans, as well as loan products with low credit scores, higher LTVs, and adjustable-rate features. Home purchase and refinance activity have remained strong in recent months, and the increased credit supply should help qualified borrowers still looking to capitalize on record-low mortgage rates. However, credit availability is still more than 30 percent below pre-pandemic levels and close to the restricted standards seen in 2014. This has especially impacted government borrowers and first-time buyers.”

Note that mortgage credit is basically back to 2014 levels. It has still tightened dramatically post-COVID. Still we are nowhere near where we were during the mid 00s.

Toll Brothers recently reported earnings with contract signings up 63% on a YOY basis. Douglas Yearly, CEO said that the current market is the strongest he has seen in his 30 years at Toll Brothers.

“We attribute the strength in demand to a number of factors, including historically low interest rates, an undersupply of new and resale homes, and a renewed appreciation for the home as a sanctuary. The work-from-home phenomenon is also enabling more buyers to live where they want rather than where their jobs previously required. And since most of our customers have a

home to sell, the tight resale market gives them confidence they can sell their home quickly at an appreciated value that can then be re-invested in their new home.”

About 75% of renters made a full or partial rent payment in the first week of December, according to the National Multifamily Housing Council. In the first week of November, that number was closer to 80%, so this drop is a concern. “While the initial rent collection figures for the first week of December are concerning, only a full month’s results will paint a complete picture. However, it should not come as a surprise that a rising number of households are struggling to make ends meet. As the nation enters a winter with increasing COVID-19 case levels and even greater economic distress – as indicated by last week’s disquieting employment report – it is only a matter of time before both renters and housing providers reach the end of their resources,” said Doug Bibby, NMHC President.

Filed under: Economy, Morning Report | 15 Comments »