Vital Statistics:

| Last | Change | |

| S&P Futures | 2372.5 | -2.8 |

| Eurostoxx Index | 377.7 | -0.6 |

| Oil (WTI) | 48.0 | -0.7 |

| US dollar index | 90.6 | |

| 10 Year Govt Bond Yield | 2.50% | |

| Current Coupon Fannie Mae TBA | 101.53 | |

| Current Coupon Ginnie Mae TBA | 102.87 | |

| 30 Year Fixed Rate Mortgage | 4.24 |

Stocks are lower on no real news. Bonds and MBS are flat.

Should be a relatively quiet week coming up with not a lot of market-moving data.

Economic growth increased in February, according to the Chicago Fed National Activity Index. The 3 month moving average is the highest since December 2014. Employment-related indicators accounted for most of the growth in the index.

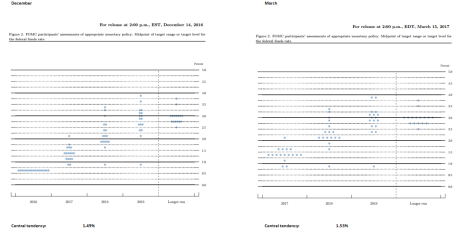

Chicago Fed’s Evans expects GDP to grow 2.3% this year, and says that 3 rate hikes is reasonable. 2 hikes are appropriate even if inflation progress remains uncertain.

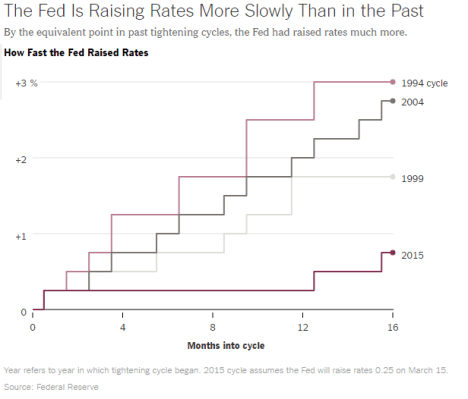

Minneapolis Fed Governor Neel Kashkari was the lone dissenter from last week’s Fed decision, preferring to maintain rates at current levels. His rationale: inflation remains below the Fed’s target rate and there is still too much slack in the labor market. “I dissented because the key data I look at to assess how close we are to meeting our dual mandate goals haven’t changed much at all since our prior meeting, We are still coming up short on our inflation target, and the job market continues to strengthen, suggesting that slack remains.” He also supports unwinding the Fed’s balance sheet once conditions warrant tightening monetary policy, however he believes the Fed should announce their plan well in advance of taking any action in order to let the markets adjust.

The internet has disintermediated the middleman in just about every profession – from retail to stockbroking. One area that hasn’t been affected: realtors. It turns out people still value the human touch. “Who is going to write a contract? Fill out a disclosure statement? Anticipate what’s coming on the market?” asked association president Bill Brown. “There’s a human element to buying and selling a home that can’t be replaced.” It is amazing that the traditional 5% – 6% commission has been impervious to technology, but it has.

The Department of Justice is taking PHH’s side in the lawsuit over the structure of the CFPB. This is an amicus brief, and the judges may pay close attention, however the DC District Court of appeals is a liberal stronghold and will probably side with the CFBP. However the CFPB would need DOJ on its side if it goes to SCOTUS.

As we begin the spring selling season, inventories are at record lows and we are seeing bidding wars even in places like the Midwest. In fact, buyers are bidding on contracts. It is truly a strange state of affairs when there is record low inventory, bidding wars, and housing starts remain well below historical averages.

Here is what the proposed cuts to HUD means for US cities. The biggest cut will be the Community Development Block Grant program, which provides Federal funding for parks and bike paths etc. Unsurprisingly, the biggest beneficiaries are the counties surrounding Washington DC. This program also provides some of the funding for Meals On Wheels, which provides food to senior citizens. Needless to say, the media has focused all of its attention on that piece, which is a tiny fraction of the CDBG program.

That said, we do have a housing shortage, especially at the lower price points. The Campaign for Housing and Community Development Funding makes its case for continuing public investment in low income housing.

Supreme Court nominee Neil Gorsuch will start his Senate hearings this week. It will be interesting to see if the left filibusters him, and whether Mitch McConnell goes nuclear (eliminates the filibuster for SCOTUS nominees) in retaliation.

Filed under: Economy, Morning Report | 15 Comments »