First, a disconsolate victory lap for the predictions I got right. I believed Trump would take Florida, and he did. I believed he could win the election, although as election night neared I decided he would not. So, I ultimately was swayed by the polls and my general sense of his awfulness as a candidate. So I was mostly wrong, but at least I foresaw the possibility that he would win.

I warned a few very cocky liberals and Democrats at the Plum Line to be careful what they wish for. During the Republican primary, they were talking about crossing party lines, even temporarily registering as Republicans to vote for Trump. They were excited about the possibility of Trump being the nominee, because he was clearly the most easily defeat-able Republican.

No small number of liberals helped Trump to win the Republican nomination. Those few cases where I interacted with them, I warned them to be careful what they wished for. So, did I call that, or what? I called it when there were still 14 Republican presidential hopefuls.

It was the same thing I said during 2008, when excited Republicans were calling into Rush Limbaugh to report how they had crossed party lines and voted for Barack Obama. Tee-hee-hee! There’s just no way Barack Obama could possibly win. Limbaugh doesn’t tend to bring up his campaign to make Barack Obama the Democratic nominee in 2008, but he did it.

Be careful what you wish for. I would always recommend folks vote for what they want, not to game the system. But people will always want to be too clever by half. Human nature.

So, that’s lesson 1 (other than always listening to me, because 60% of the time I’m right all the time): be careful what you wish for. You might get it. And then keep getting it, even though you want it to stop now.

I think lesson number 2 is the demographics isn’t destiny, at least not yet.

It might be, 8 years from now or 16 years from now or 24 years from now, but not yet. The corollary lesson is: impatience is not a virtue. Demographics looks to be the critical factor in American elections in the future, but it isn’t yet, and saying “But I want it now” like Veruca Salt doesn’t make it happen.

In fact, it might end up with your candidate being determined a bad egg and getting memory-holed by a reclusive serial child-abuser disguising himself as a chocolatier.

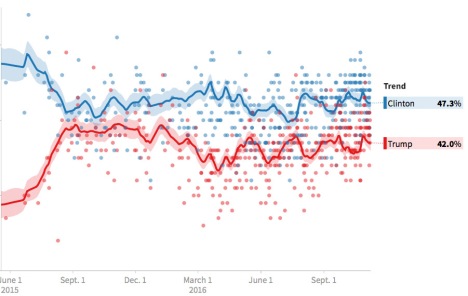

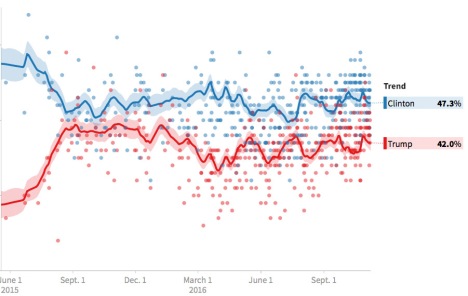

Lesson 3 is that polls are not worthless, just almost worthless.

In the lead up to the election, while Trump was complaining that the vote would be rigged, there was some interesting discussing on the Plum Line about how elections weren’t rigged, but Republicans only won when they rigged elections.

The primary example given was 2004, where exit polls predicted a clear Kerry victory, but somehow George W. Bush stole the election. Although an incumbent president who replaced a president of the opposite party almost always wins re-election. But never mind, it was stolen, because the exit polls said Kerry won. Kerry did, briefly, mull a challenge to the results based on those exit polls.

But the problem wasn’t that Bush stole the election, the problem was that the exit polling was bad. This time, almost all the polling was off. The polls captured growing momentum as election night neared, but in no way captured the scale of Trump’s electoral victory.

Another way to restate this lesson: don’t trust the polls.

Lesson 4 is a lesson for both parties and political sides, but I think it’s particularly applicable to the Democrats and liberals in this cycle: name calling is fine, if it’s your opponent or common enemies of the people. It’s bad when it’s potential voters.

Making everyone who disagrees with you into a hopeless racist sexist bigot homophobe beyond redemption is a losing strategy. And will continue to do so, until demographics finally do become destiny. Until then, insisting there is no reason not to call a spade a spade, and you will, in principle, stand tall and strong and call everyone who doesn’t agree with you a Nazi, is not a winning strategy.

There is a deeper dive into the risks of playing identity politics that could and should be had, but that’s a future lesson.

Insulting the voters also applies to the Republicans, of course, but I think it’s pretty clear who had the lower opinion of rural folks, flyover country, and middle-town America in this election. Not to mention what Democrats apparently think of folks south of the Mason-Dixon line.

Lesson 5 is mostly for the Democrats: when playing identity politics, stick with race, not gender. An important part of identity politics ultimately has to be that the candidate reflects the identity of the class of people you want to vote for you. Ergo, Obama was a successful candidate in terms of identity politics. He got African-Americans to turn out and vote Democrat in unprecedented numbers and, importantly, vote for him specifically.

Hillary was unable to do that with women, and I’m not sure any woman could. Could Sarah Palin? Carly Fiorina? I don’t think so. Not every potential grouping of humanity is susceptible to identity politics-style appeals. Whichever woman finally does become president, in other words, it’s not going to be because she is a woman and “it’s time”.

Lesson 5? Money doesn’t buy electoral victories.

This will be lost on most of the left, I expect, but it’s simply true. Demonstrated repeatedly. Donald Trump didn’t spend as much as Clinton. His supporters didn’t spend as much on him as Romney’s did on their candidate. The PACs weren’t as flush with cash. Jeb! Bush had far more money, and spent far more money, in the primaries than Trump, and went nowhere. Meddlesome billionaires poured cash into the election, and not just in ads, but into support networks and astroturfing and on and on. The result? Rich jerk who occasionally said positive things about the working class, and actually would do a little fighting for them, sort of, won the election. Oligarchs who plowed money into the election like their lives depended on it lost.

As corollary, I would say another lesson, to be learned or ignored, is this: in a democracy, the elites and oligarchs ignore the proletariat and the common man at their peril.

Lesson 6? Presidential debates just aren’t that important.

Might be becoming less important as time goes on. Neither performed that well but Trump was generally seen as the loser. My own observations were that he did not come off as presidential, and sometimes not even as competent. He missed obvious opportunities, was not articulate, and mostly HRC more than held her own against him. Ultimately, none of that seemed to matter that much.

Predictions now?

- Hillary will not go to jail, despite Trump’s implying that she’d be in jail under a Trump presidency.

- There will be more turn over in the Trump cabinet than is typical. This may not be a bad thing.

- Deportation will become self-deportation, perhaps a beefing up of e-Verify.

- There will be no wall.

- He will urge the house to repeal ObamaCare. It will become something similar with a different name. I don’t believe pre-existing condition coverage will be going anywhere. Now that the Republicans control everything, Obamacare will cease to be a huge issue.

- Many on the left will rend their garments and tear out their hair, predicting that abortion will be outlawed, all Mexicans forcibly deported, Muslims shot on site at airports, etc. None of this will happen, but nobody will be called out on their crazy predictions.

- Democrats will continue to make a serious push for an end to the electoral college, especially if they get the house or the senate in midterms, but will make no headway.

- The filibuster, if used much, will get the nuclear option. For reals, this time.

- And, my far out prediction? Trump puts some fairly well-known Democrats in his cabinet, and maybe plays identity politics (minorities edition) with some of his choices.

- And, along with that, keep in mind that Trump is less partisan than he is Trumptastic. He will continue to make enemies amongst Republicans and Democrats. It won’t matter, he’ll still win re-election in another close race in 2020.

Filed under: Elections | 81 Comments »