Vital Statistics:

|

Last |

Change |

Percent |

| S&P Futures |

2090.5 |

0.3 |

0.01% |

| Eurostoxx Index |

2888.6 |

23.9 |

0.83% |

| Oil (WTI) |

48.03 |

-0.3 |

-0.62% |

| LIBOR |

0.646 |

0.015 |

2.38% |

| US Dollar Index (DXY) |

95.66 |

-0.488 |

-0.51% |

| 10 Year Govt Bond Yield |

1.44% |

-0.03% |

|

| Current Coupon Ginnie Mae TBA |

106.2 |

|

|

| Current Coupon Fannie Mae TBA |

105.6 |

|

|

| BankRate 30 Year Fixed Rate Mortgage |

3.53 |

|

|

Markets are flattish as we head into a 3 day weekend. Bonds and MBS are up.

Bonds will close early today and most of the Street will be on the LIE by noon.

Manufacturing picked up in June, according to the ISM Manufacturing Survey. New orders were up while prices paid fell.

Construction spending fell 0.8% in May versus an expected increase of 0.6%. April was revised downward from -1.8% to -2%. Homebuilding was flat versus April and is up 5.3% on a year-over-year basis.

Vehicle sales are coming in this morning, and they look light generally.

Overnight, the 10 year yield touched 1.38%, which is a record low on the 10 year. It looks like we are getting ready for another refi boom. Vanguard, Blackrock, and Guggenheim are all making the call that Brexit means slower growth and lower rates for the next couple of years. How pension funds and insurance companies, which need to earn 7% or more to keep up with liability growth will do that is beyond me.

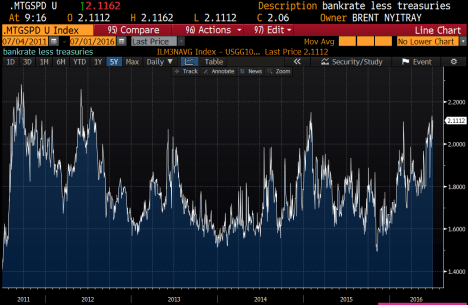

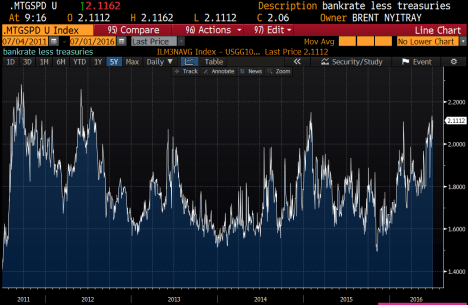

Note that the Bankrate 30 year fixed rate mortgage rate is still about 20 basis points higher than the record low set in late 2012. Mortgage backed securities have lagged the move up in Treasuries. Below is a chart of the Bankrate 30 year fixed rate mortgage rate versus the 10 year yield. The top line is mortgage rates, the lower line is the 10 year yield. If you look at the 2012 period, you can see that the 10 year yield bottomed out in July, and started rising into the end of the year. Mortgage rates kept falling throughout the year, bottoming out in December. So, mortgage rates didn’t bottom out until 5 months after Treasuries did.

If you plot the difference between the two rates (basically a proxy for MBS spreads), you can see that the current difference is approaching a high again. If this is a truly mean-reverting series, you should expect that gap to close over time, and that will either happen through higher Treasury yields or lower mortgage rates. Given the momentum in the Treasury markets at the moment, it is probably mortgage rates that will have to give. Which means we could have a good refi season into the end of the year.

The worlds’ central bankers are being forced to take the global economy into account more and more. Brexit gives Janet Yellen the excuse to hold off on hiking rates until we see inflation in the US. The ECB and the Bank of England are looking at easing. Could the next move by the Fed be some sort of stimulative measure, like bringing back QE or cutting the Fed Funds rate back down to .25%? It is definitely a non-zero probability.

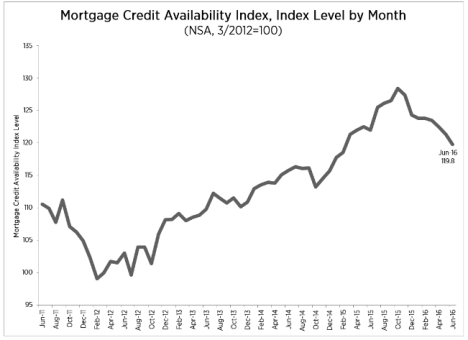

The discussion draft of the bill to reform the CFPB is out. The main changes would be to bring the agency under Congressional control (it nominally reports to the Fed, but in reality it reports to no one) and to replace a single director with a bipartisan board of 5. It will also make some changed aimed at curbing the most abusive practices of the agency. While the Elizabeth Warren wing of the Democratic party will fight this tooth and nail, the affordable housing lobby is getting sick and tired of tight credit. Note that the President doesn’t think there is an issue, and even if there was, it isn’t his fault. Quote from the article:

Bloomberg Magazine: “Some of the rules put in place have meant it’s harder to get a loan. Something like 58 percent of approved mortgages are going to the wealthiest applicants, and homeownership among African Americans is down. Where’s the balance there?

Obama: “Well, the interesting thing—and we’ve looked at this very carefully—is that there’s no doubt that there’s been some pullback and increased conservatism on the part of lenders. But oftentimes, it’s not justified by the regulations”

Filed under: Economy, Federal Reserve, Morning Report | 55 Comments »