Stocks are lower this morning after yesterday’s bloodbath. Bonds and MBS are up.

The jobs report came in weaker than expected. Payrolls increased by 209,000, and the two-month payroll revision was +15,000. The unemployment rate ticked up to 6.2% and the labor force participation rate rose to 62.9% from 62.8%. However hourly earnings were flat and average weekly hours were flat as well. The lack of wage pressure cheered the bond market, which is clawing back yesterday’s losses. FWIW, the employment cost index showed a .8% increase in wages yesterday (benefits are calculated separately), so the lack of wage growth as reported by BLS is surprising.

By the way, for the bond market to start worrying about wage inflation, you will need to see increases in average wages of about 4%, not the 2% inflation target. Why? Productivitiy, which is running about 2% (notwithstanding the lousy print in Q1). Wage inflation that is offset by productivity increases is not inflationary. So, when you think about the US needing 4% wage growth just to get to the Fed’s inflation target, you can see we have a long way to go.

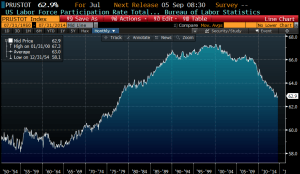

Still, we aren’t going to see a robust economy until the labor force participation rate gets back to normal levels. As you can see from the chart below, about half of the increase in the labor force participation rate that was attributable to women entering the workforce starting in the 1960s has been given back. That low number represents excess capacity that isn’t being captured with the headline unemployment number. Which is why wage growth is so hard to come by (the other reason being technology).

Personal Spending rose .4% in June, and Personal Income rose .4% as well. The core personal consumption expenditure index rose 1.5% year-over-year, still below the 2% target the Fed would like to see.

The ISM numbers came in stronger than expected, showing that manufacturing continues to do well, A 57.1 number would correspond to GDP growth of 4.6%. Of course manufacturing doesn’t dominate the economy (and employ people) like it used to, but it is still a good, strong number.

Finally, construction spending slipped 1.8% in June after increasing an upwardly-revised .8% in May. Resi construction fell .2% month-over-month but is up 7.1% year-over-year.

Filed under: Morning Report |

Heh.

LikeLike

It was discussed on the News Hour last night:

Go to the cops and use the justice system to prosecute crimes? Crazy talk.

LikeLike

I’ve never understood how a possible criminal act gets funneled in to the college disciplinary system.

that said, my wife reports that as a freshman at ND, she was advised by her RA to go to the local police and not the campus police if something happened.

LikeLike

The Democrats run into some people they can’t buy off:

Exactly.

LikeLike

Bagger’s are what Progressive’s think nihilists are.

LikeLike

We believe in nossing Lebowski

LikeLike

Brent, I just want to thank you yet again for MR. I believe that it is more illuminating in less time than anything comparable that I read, and often leaves me without a question just because it is so straightforward. Or perhaps because of my basic ignorance, but either way, thanx.

LikeLike

Any guesses on mortgage rate direction for the rest of the year? I’m looking at buying a new house.

LikeLike

Thanks, Mark…

jnc, my guess is higher, though I didn’t see this bond rally coming..

LikeLike

I just have to tell this story to someone.

I took my 14yr old daughter golfing for the first time this morning. I was surprised she wanted to go because she is generally much happier to read a book than to engage in any kind of sport. She’s a voracious reader, with a book in her hand all the time. I bought her a kindle 2 years ago so she could just order books without having to go to the bookstore all the time.

Anyway, we’re on the second hole and I suggested she should hit her 9-iron. She said that she didn’t have one. I said “Sure you do” and pulled the 9-iron out. She said “Isn’t that a 6-iron” so I pointed out the two dots below the number, indicating that it was the bottom and hence a 9.

“Oh,” she says, “I thought that was an umlaut.”

I told her I think that may be the first time ever the word “umlaut” has been used on a golf course.

LikeLike

Brent…where’s the 10yr trading? (I’m on my mandatory 2 weeks.)

LikeLike

Pretty cool. She speaks German?

How’s the one in college doing? Where did she end up?

LikeLike

Does an umlaut over a 6 cause it to be pronounced “s¨chs” instead of “sechs”?

Great answer from her and I hope she enjoyed the outing. I so hate putting [surely I have mentioned this here] that I can never find golf fun. Driving range is OK, though.

LikeLike

mark:

Great answer from her and I hope she enjoyed the outing.

I think she found it surprisingly enjoyable. Another quote, from hole 10: “I have to admit this is a lot better than watching it on TV.”

LikeLike

jnc:

She does not speak German. I assume she picked it up from her extensive reading. (Seriously, I downloaded the Kindle app for my iPad once and as a result I could see all the books she had downloaded and read. The number was astonishing to me.)

The oldest one had a great first year at Boston College. When I picked her up last October for her first trip home after going to school, she couldn’t wait to get back home to sleep in her room and see her friends and sisters. I told her it wouldn’t be long before she didn’t want to come home at all and I don’t think she believed me. Then when I picked her up in May after the school year, she cried her eyes out because she didn’t want to leave.

Currently in the process for number 2, who is a senior this year. Common app went live today, in fact, and she is busy working on it as I type. She can’t wait to get out of high school and into college (and away from home!). Senior year can’t go fast enough for her.

LikeLike

Scott: Sep 10 year treasury futures are trading at 125-08.

10 year cash yield 2.50%

LikeLike

Thanks…so a bit of a rally from 2 days ago, but not back to the recent highs yet.

LikeLike

Regarding the comment at the top, I’d expect nothing less from a Schmuckeye.

BB

LikeLike

Scott, the 10 year has been trading like a tech stock the last couple days. Big sell off yesterday, big rally today..

LikeLike

Brent…glad I am out.

LikeLike

mortgage banking means always being short convexity. No fun on days like these…

LikeLike

Brent:

mortgage banking means always being short convexity.

Forgot about that. High vol sucks.

LikeLike

When, WHEN will these fucking Bagger’s learn their goddamn place?

http://pjmedia.com/tatler/2014/07/31/exclusive-rep-sheila-jackson-lees-staff-threatens-taxpayer-for-asking-about-her-impeachment-claims/

LikeLike

Anyone ever been to Manassas and the Battle of Bull Run battlefield site? Is it worthwhile visiting?

LikeLike

Isn’t the real question will they allow a gay wedding at the site?

LikeLike

The arrogance of knowing the mainstream media won’t call her out on it, so they can ignore everyone else..

LikeLike

The arrogance of knowing that…even if the mainstream media calls her on it, her constituency will re-elect her.

LikeLike

My understanding is that once Snarlin’ Arlen kicked the bucket, the title of Nastiest Legislator fell to her.

Nova might be able to confirm or deny.

LikeLike

The fact that this is funny,

And that people still think single-payer would be better…

LikeLike

KW really chokes it here, IYKWIMAITYD!!!

http://m.nationalreview.com/article/384381/touching-tale-kevin-d-williamson

LikeLike

Sublime.

LikeLike

By any means necessary…

LikeLike