Vital Statistics:

| Last | Change | |

| S&P futures | 2900 | 23.1 |

| Oil (WTI) | 24.27 | 0.29 |

| 10 year government bond yield | 0.66% | |

| 30 year fixed rate mortgage | 3.36% |

Stocks are higher this morning after the jobs report. Bonds and MBS are up.

Jobs report data dump:

- Nonfarm payrolls down 20.5 million

- Unemployment rate 14.7%

- Labor force participation rate 60.2%

- Average hourly earnings up 4.7% MOM / 7.4% YOY

The report was not as bad as feared. One stat jumped out at me, which is how the COVID Crisis has disproportionately affected lower wage earners. Average hourly earnings increased almost 5%, simply due to hourly workers getting laid off, which means the higher wage people who are able to work from home pull the average up. Average hourly earnings increased to $30.01 an hour in April from $28.67 an hour in March.

That stat may also explain why the stock market doesn’t seem to care all that much about COVID any more. The people who are most affected are the least likely to hold stocks and vice versa. I am hoping however that the stock market, being a forward-looking indicator, is looking over the valley and signalling that this whole thing is on the downside. If so, then we could see a V-shaped recovery as well. FWIW, I don’t think American have the appetite to shelter in place past Memorial Day, regardless of what the health professionals say.

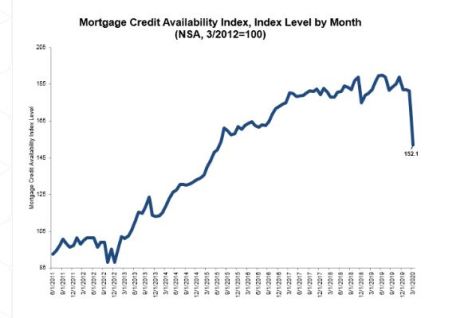

Fannie Mae’s Home Purchase Sentiment Index plunged in April, which isn’t surprising given the jobs report. “The HPSI experienced another unprecedented decline in April, falling to its lowest level since November 2011,” said Doug Duncan, Senior Vice President and Chief Economist. “The 17.8-point decrease reflected consumers’ deepening concerns about both their incomes and the housing market. Attitudes about whether it’s a good time to sell a home fell most sharply, dropping an additional 23 points this month. Individuals’ heightened uncertainty about job security, as registered in the survey over the last two months, is likely weighing on prospective homebuyers, who may be more wary of the substantial, long-term financial commitment of a mortgage. On average, consumers expect home prices to fall 2 percent over the next 12 months, the lowest expected growth rate in survey history. While consumers did grow more pessimistic in April about whether it’s a good time to buy a home, low mortgage rates remain a driver of purchase optimism. We expect that the much steeper decline in selling sentiment relative to buying sentiment will soften downward pressure on home prices.”

Speaking of homebuying, Redfin is resuming iBuying, and Zillow Offers isn’t far behind.

Filed under: Economy, Morning Report | 20 Comments »