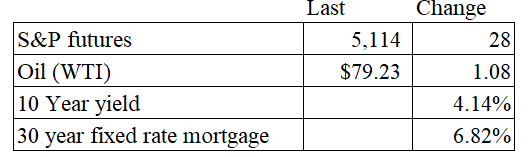

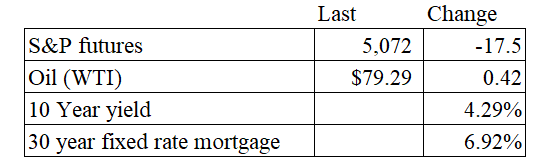

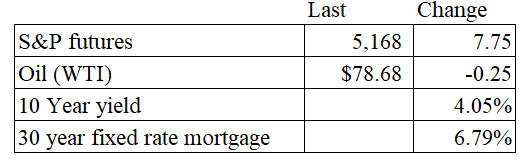

Vital Statistics:

Stocks are higher this morning after the jobs report. Bonds and MBS are up small.

The economy added 275,000 jobs in February, which was way more than expected. The unemployment rate ticked up from 3.7% to 3.9%, while average hourly earnings rose 0.1%. The headline numbers are indicative of a strong labor market.

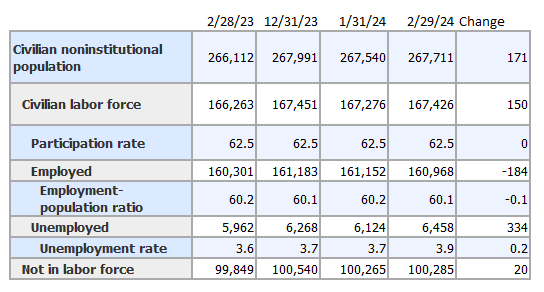

January’s payroll number was revised downward substantially, from a gain of 353,000 to a gain of 229,000. The February payroll number was another case of statistical adjustments accounting for the increase, as the number of people with jobs actually fell by 184,000. The number of unemployed people rose by 334k.

The Fed will be happy with the decline in wage growth, and the overall message that the labor market is coming more into balance.

Jerome Powell said yesterday that the Fed is close to cutting rates. “I think we are in the right place,” Powell said of the current stance of monetary policy in a hearing before the Senate Banking Committee. “We are waiting to become more confident that inflation is moving sustainably down to 2%. When we do get that confidence, and we’re not far from it, it will be appropriate to begin to dial back the level of restriction so that we don’t drive the economy into recession.”

When asked about concerns over workers losing their jobs, Powell said: “We’re well aware of that risk, of course, and very conscious of avoiding it,” Powell said. “If what we expect and what we’re seeing – continued strong growth, strong labor market and continuing progress in bringing inflation down – if that happens, if the economy evolves over that path, then we do think that the process of carefully removing the restrictive stance of policy can and will begin over the course of this year.”

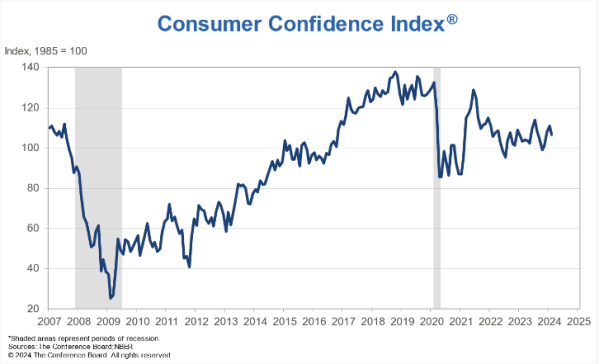

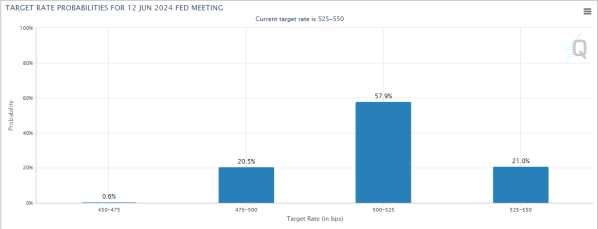

These comments helped push the 10 year bond yield to the lowest level in over a month. The Fed Funds futures for March didn’t change, but the June futures are showing a roughly 80% chance of a rate cut.

Filed under: Economy | 34 Comments »