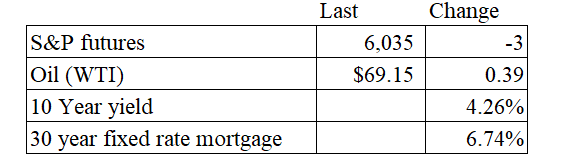

Vital Statistics:

Stocks are flattish this morning on no real news. Bonds and MBS are up.

Third quarter GDP rose 2.8% in the second revision to the estimate. This was in line with Street expectations.

New Home Sales disappointed again, coming in at 610,000, which was well below the Street expectation of 725k. This was down 17.3% compared to September and down 9% compared to a year ago.

The median home price was $437,300, and the average price was $585,800. There was 9.5 months’ worth of supply.

The FOMC minutes were released yesterday. On the subject of inflation, the members sounded pretty confident:

With regard to the outlook for inflation, participants indicated that they remained confident that inflation was moving sustainably toward 2 percent, although a couple noted the possibility that the process could take longer than previously expected. A few participants remarked that insofar as recent robust increases in real GDP reflected favorable supply developments, the strength of economic activity was unlikely to be a source of upward inflation pressures. Participants cited various factors likely to put continuing downward pressure on inflation, including waning business pricing

power, the Committee’s still-restrictive monetary policy stance, and well-anchored longer-term inflation expectations. Several participants noted that nominal wage growth had continued to move down and that the wage premium available to job switchers had diminished. In addition, some participants observed that, with supply and demand in the labor market being roughly in balance and in light of recent productivity gains, wage increases were unlikely to be a source of inflationary pressure in the near future.

Further into the minutes, they discussed that the economy has been stronger than expected, and that downside risks to the economy had become less prominent. The Fed Funds futures see a 66% chance of a 25 basis point cut at the next meeting in mid-December.

Mortgage applications rose 6.3% last week, as purchases rose 12% and refis fell 3%. “Purchase activity drove overall applications higher last week, as conventional purchase applications picked up pace and mortgage rates declined for the first time in over two months, with the 30-year fixed rate dropping slightly to 6.86 percent,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. With the growth in for-sale inventory and signs that the economy remains strong, buyers have remained in the market even though rates have increased recently. The increase in conventional purchase applications helped push the average purchase loan size to $439,200, its highest level in almost a month. The decline in refinance activity was driven by pullbacks in FHA and VA refinances. Applications were significantly higher than a year ago by most measures, but this was compared to the week of Thanksgiving 2023, which was a week earlier than this year’s holiday.”

The new FHFA limits are out, rising 5.2% to $806,500. The high balance limit (for expensive MSAs) is 150% of that or $1,209,750.

Consumer confidence improved in November, according to the Conference Board. “Consumer confidence continued to improve in November and reached the top of the range that has prevailed over the past two years,” said Dana M. Peterson, Chief Economist at The Conference Board. “November’s increase was mainly driven by more positive consumer assessments of the present situation, particularly regarding the labor market. Compared to October, consumers were also substantially more optimistic about future job availability, which reached its highest level in almost three years. Meanwhile, consumers’ expectations about future business conditions were unchanged and they were slightly less positive about future income.”

I am accepting ads for this blog if you would like to make an announcement, highlight something your company is offering or want more visibility. I am running a special for new clients as well. I offer white-label services which give you the ability to use this content for your own daily emails. The blog has thousands of subscribers / followers and an open rate around 50%. Please feel free to reach out to brent@thedailytearsheet.com if you would like to discuss this further

Filed under: Economy |

“The new FHFA limits are out, rising 5.2% to $806,500. The high balance limit (for expensive MSAs) is 150% of that or $1,209,750.”

Speaking of the FHFA, what’s your over/under on Freddie Mac, etc being returned to private ownership during the second Trump administration?

LikeLike

It is going to be hard to raise the amount of capital required

LikeLike

During the last Trump administration FHFA Chairman Mark Calabria imposed a limit on the number of investment properties that fan and Fred would guarantee. It caused pandemonium in the mortgage market for about six weeks, but a robust private market developed pretty quickly…

FHFA eventually relented, but they’ll probably try again, and will put a longer fuse on it.

IMO, these programs should be starter home programs

LikeLike

You see this?

https://www.washingtonpost.com/business/2024/11/30/trump-homebuilders-housing-market/

LikeLike

My God, you mean we have to go back to the dreaded deadly building codes of, er, 2020? I literally just felt my foundation crack.

LikeLike

I really don’t believe Trump is going to institute any unbalanced tariff that will negatively impact builders or building suppliers.

LikeLike

Maureen Dowd’s brother should be the columnist at the New York Times instead of her. His once a year column is the only time an actual voice from the other half of the country appears on that page:

https://www.nytimes.com/2024/11/28/opinion/donald-trump-presidency.html

LikeLike

DailyKos has MAGA nailed.

The KosKidz are in my head!

LikeLike

Is DailyKos even relevant any more?

LikeLike

It’s the Progressive wing of the party – the activist base.

LikeLike

McWing is the only person I hear anything about DailyKos from. They are truly in their own little bubble.

Anyone else here on Bluesky? Most of the lefties there aren’t that bright. And when it comes to politics it’s all delusional bullshit, fearmongering, and vitriolic sputum. And occasional mentions of how uncivil the right is, those mouth breathing MAGAt asshats.

I mean, the right-o-sphere on X is not exactly populated with the best and brightest but good lord, Bluesky. Want to be fair but holy shit, I feel the vast majority of modern leftism sincerely felt is the productive of severe childhood trauma or something. There is a serious sense that even the clearly smarter ones are stunted or emotionally damaged.

But I may be reading into things.

Anyway, I’m enjoying Bluesky. 😀

LikeLike

You need to get over to Bluesky and bask in the brilliance, stat!

LikeLike

Can’t tell you how many times I’ve talked with other Republicans about the Democrats weather machine.

LikeLike

Biden pardons Hunter. Who’d have guessed it!!!

Remember the good old days when that conman Trump was the most corrupt and dishonerable person to ever occupy the Oval Office? Times were so simple back then, eh?

LikeLike

I would have had more respect for him if he skipped the BS about “political pressure” (it was his Justice Department that approved the special counsel appointment) and just said that Hunter is his son and he’s doing it for him and he doesn’t owe anyone else anything at this point.

LikeLike

jnc:

I would have had more respect for him if…

I completely agree.

LikeLike

He had to pardon his brother and all of Hunter’s kids and ex’s, as they were all involved as well. In his words, his DOJ is out to get him and his family.

Poor bastard.

He needs Kash Patel to clean it up. I expect his endorsement.

LikeLike

He also shouldn’t have committed to not pardoning Hunter. Is it possible to give a blanket commutation even to crimes not yet tried and convicted? I’m guessing no, but he didn’t promise not to commute sentences.

Although the energy this had inspired is interesting; this doesn’t surprise or excite me and I probably should care but I don’t really; if people object they should agitate for reforming the pardon power.

This is hardly the worst use of the pardon power. IMO. And of all the things Biden has done it seems far less destructive than encouraging Ukraine to send missiles into Russia, trying to hobble Israel in its war against Iranian proxies, funding middle eastern terrorism to the tune of billions, abandoning Afghanistan and still spending $44 billion there somehow, creating hyperinflation, throwing our borders wide open, attention to force a quarter of the population to take an experimental an untested experimental gene therapy, locking down the entire economy based on no real data and actually in opposition to what data we did have, attempting to create an actual censorship regime within the government … and so on. This makes more sense to me and seems far less damaging that most everything else his administration has done or is now doing.

LikeLike

They should absolutely do this:

https://www.washingtonexaminer.com/news/justice/3246790/pardon-fifth-amendment-trouble-hunter-biden/

LikeLike

Yes, they should.

LikeLike

It won’t matter. I’m betting the first test case for a president pardoning himself won’t be Trump, it will be Biden on the way out the door.

LikeLike

He didn’t lie because he realized his Justice Department was weaponized.

But only is this one instance.

LikeLike

The icing on the cake:

https://www.nytimes.com/2024/12/02/opinion/biden-hunter-pardon-trump.html

LikeLike

I know I just said I don’t much care about the pardon but of the abuses of power Biden has or almost certainly has engaged in—though this is related—this seems fairly minor. Weaponizing the DoJ and potentially coordinating with state DAs to go after Trump seems way worse.

LikeLike

KW:

I know I just said I don’t much care about the pardon but of the abuses of power Biden has or almost certainly has engaged in—though this is related—this seems fairly minor.

You may be interested in my more fully fleshed out thoughts:

https://reasoninexile.substack.com/p/bidens-pardon-was-a-missed-opportunity

LikeLike

That was really good. Since I am mildly active on Bluesky, I shared it with my 11 followers. 😅

I have also subscribed to your Substack. Somehow I did not realize you had one, or had forgotten.

LikeLike

Thanks!

LikeLike

I also ended up linking to your lame duck article. You are 100% right. Lame duck period should be like 2 weeks, max. IMO.

LikeLike

This was pitch perfect:

https://babylonbee.com/news/hunter-asks-if-he-can-get-his-baggie-of-cocaine-back-from-the-white-house-now

LikeLike

Good analysis on how there’s already a National Emergency declared about the border and National Guard have already been deployed.

https://www.lawfaremedia.org/article/how-can-trump-deploy-the-military-at-the-southern-border

LikeLike

A useful reminder of recent history vis-a-vis Patel:

https://www.racket.news/p/the-bell-finally-tolls-for-the-fbi

LikeLike