Vital Statistics:

Stocks are higher this morning as we await Jerome Powell’s speech at Jackson Hole. Bonds and MBS are down.

Powell is set to speak at 10:00 am this morning. The FOMC minutes indicated that unless something dramatic happens, the Fed is set to cut interest rates at their September meeting. Powell will probably reiterate the Fed’s data-dependent mindset and confirm that a September rate cut is probably in the cards. Note that Kansas City Fed President Tom Harker said the Fed is ready to start cutting on CNBC yesterday. “I think it means this September we need to start a process of moving rates down,” Harker told CNBC’s Steve Liesman during a “Squawk on the Street” interview. Harker said the Fed should ease “methodically and signal well in advance….Right now, I’m not in the camp of 25 or 50. I need to see a couple more weeks of data,” he said.

Existing home sales rose 1.3% in July to a seasonally adjusted annual pace of 3.95 million, according to the National Association of Realtors. This snaps a 4 month losing streak which started in March. On a year-over-year basis, sales fell 2.5%. “Despite the modest gain, home sales are still sluggish,” said NAR Chief Economist Lawrence Yun. “But consumers are definitely seeing more choices, and affordability is improving due to lower interest rates.”

Total housing inventory rose 0.8% to 1.33 million units, which is up 19.8% compared to a year ago. The median home price rose to $422,600, up 4.2% compared to a year ago.

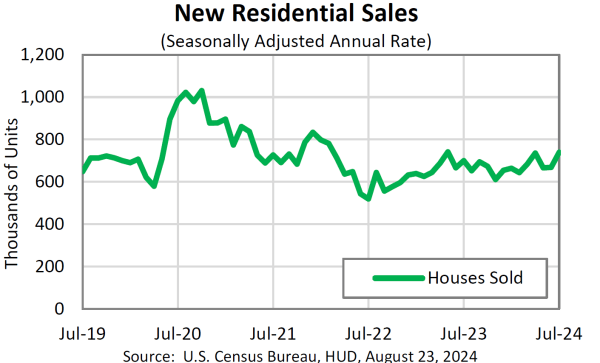

New Home sales rose by more than expected in July, increasing 10.6% to a seasonally adjusted annual rate of 739,000. This is still down about 5.8% compared to last year.

The Chicago Fed National Activity Index declined in July. Consumption and housing indicators improved, while production / income, employment, and sales indicators all fell.

The CFNAI is sort of a meta-index which gives a high-level view of the state of the economy. While the numbers don’t indicate recessionary territory, it does show a softening economy.

Filed under: Economy |

I laughed but women will hate it.

LikeLike

This is impressive.

LikeLike

That leftist shill makes Jonah Goldberg sound like Rush Limbaugh.

LikeLike

Elect this man!

LikeLike

These people are so totalitarian

LikeLike

my guess is this,

Is a attempted distraction from this,

LikeLike

Totally support fully funding NATO!

Also, might as well just add Russia as well. We’re mirroring their domestic politics.

LikeLike

They all want to be China with it’s social trust scores for the prols.

LikeLike

We have an international ideological war on our hands, similar to what we faced in the 20th century over Communism.

Will need the same sort of effort to defeat this.

LikeLike

It’s the same war.

LikeLike

Yep, took a 25 year slumber, but its back

LikeLike

Uniparty.

LikeLike

Excellent thread on why actually defending Taiwan would be folly.

LikeLike