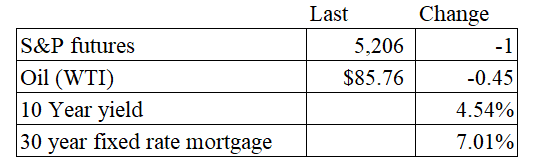

Vital Statistics:

Stocks are flattish after another inflation gauge came in hot. Bonds and MBS are down.

Inflation at the wholesale level rose 0.2% in March and 2.1% YOY, according to the Producer Price Index. If you strip out food and energy, the index rose 0.2% month-over-month and 2.4% year-over-year. While not a disaster like the CPI report yesterday, it isn’t helping the cause, and the 10 year is getting smoked again.

The FOMC minutes from the March meeting did indicate rate cuts were in the near future. While they did note that there might be some seasonality involved with the inflation numbers, the message was steady as she goes.

In discussing the policy outlook, participants judged that the policy rate was likely at its peak for this tightening cycle, and almost all participants judged that it would be appropriate to move policy to a less restrictive stance at some point this year if the economy evolved broadly as they expected. In support of this view, they noted that the disinflation process was continuing along a path that was generally expected to be somewhat uneven. They also pointed to the Committee’s policy actions together with the ongoing improvements in supply conditions as factors working to move supply and demand into better balance. Participants noted indicators pointing to strong economic momentum and disappointing readings on inflation in recent months and commented that they did not expect it would be appropriate to reduce the target range for the federal funds rate until they had gained greater confidence that inflation was moving sustainably toward 2 percent.

In addition to the hotter-than-expected CPI print, we also had a pretty lousy 10 year bond auction. The bid-to-cover ratio was an anemic 2.34x, and dealers were forced to buy 25% of the $39 billion issue, which pushed 10 year yields to 4.56%.

Needless to say, the mortgage banks got roughed up yesterday, with Rocket down 13%, UWM down 7%, and Loan Depot down 5%. Mr. Cooper held up reasonably well due to is heavy MSR exposure.

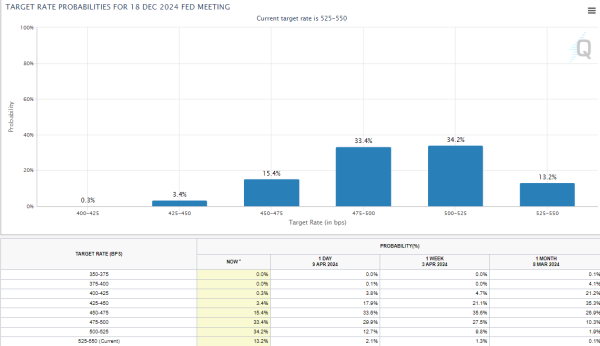

Between all three hawkish events, the Fed Funds futures moved decisively towards higher rates, with the June futures pricing in only a 17% chance of a rate cut, and the December futures pricing in only 1 cut this year. Check out the probabilities from a month ago – markets saw 100 basis points in cuts.

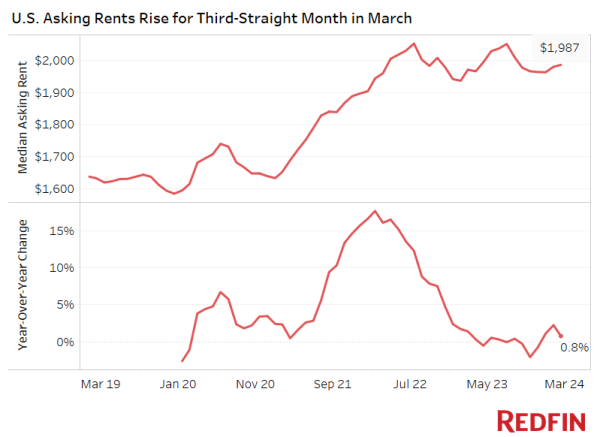

Asking rents rose 1% in March compared to a year ago, according to data from Redfin. They were little changed compared to February at $1,987. The Midwest and the Northeast saw the biggest increases.

Filed under: Economy |

Democrats are badly mistaken to believe that all latinos identify with illegal immigrants.

https://www.axios.com/2024/04/11/poll-latino-support-border-wall-deportations-jumps

LikeLike

This:

LikeLike

Much like Biden’s alleged competency, the evidence, sadly, has to be hidden.

https://x.com/theblaze/status/1778525666172178927?s=46&t=vSGsUlnc4rLxcUf7zfUiHg

LikeLike

Every accusation is a confession:

LikeLike

Aren’t we supposed to say “false equivalence” at this point?

LikeLike

See the comments. That’s 100% the talking point.

Original source:

https://www.axios.com/2024/04/12/dnc-covered-biden-legal-bills-special-counsel-probe

LikeLike

The cave is now complete:

LikeLike

This is my shocked face.

It’s funny.

LikeLike

Interesting backstory on Taibbi leaving Rolling Stone:

LikeLike

I love the “I am not in a bubble! And if I am it’s the Times fault!” vibe with this story. Apparantly the author only has two sources of information, the Left and the Far Left.

LikeLike

“If this polling is true, then Trump has run circles around the Times”

Not necessarily wrong.

This was interesting to watch:

LikeLike

<b>During the Trump years we had every vital major institution diminished – the courts, the Congress, our national security apparatus, our public health system, in ways that are still sowing chaos, even with Trump gone from office for more than three years.</b>

The lack of self-awareness is a sight to behold.

LikeLike

There needs to be more of this in California until the reich-wing facists in charge get it through their heads to change their policy!

Ditto for the known MAGA Country of Chicago.

https://x.com/paytonsun/status/1779888484955607363?s=46&t=vSGsUlnc4rLxcUf7zfUiHg

LikeLike

Remember the reaction when Christ Christie shut down the bridge?

LikeLike

It was only a lane for a traffic study that the left claimed was superfluous.

LikeLike

Good piece on the timeline of the decline of the New York Times.

https://chrishedges.substack.com/p/requiem-for-the-new-york-times?utm_source=profile&utm_medium=reader2

LikeLike

All the news that fits the narrative.

LikeLike