Vital Statistics:

Stocks are higher this morning on no real news. Bonds and MBS are flat.

Consumer sentiment slipped in May, according to the University of Michigan Consumer Sentiment Survey. This is down 9.1% from April. Consumer expectations fell 11% despite a strong labor market. Inflationary expectations for the near term fell, while longer-term expectations rose to 3.2%, the highest level in 12 years.

We know the Fed pays close attention to the UM inflationary expectations, so this is bad news for those hoping for rate cuts this year.

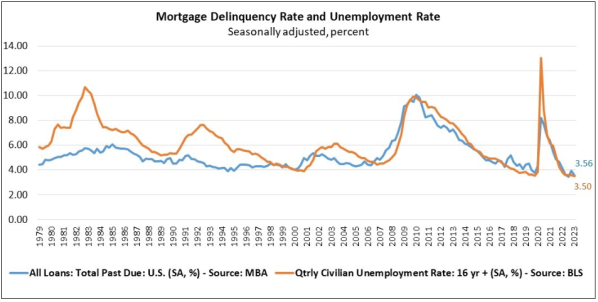

Mortgage delinquency rates fell 3.56% in the first quarter, according to the MBA. This is down 40 basis points from the fourth quarter and 55 basis points from a year ago.

“The mortgage delinquency rate fell to its lowest level for any first quarter since MBA’s survey began in 1979 and was the second lowest quarterly rate overall, just 11 basis points above the survey low in the third quarter of 2022,” said Marina Walsh, CMB, MBA’s Vice President of Industry Analysis. “Mortgage delinquencies and the unemployment rate continue to track each other closely, with the unemployment rate in April falling back to the 54-year low of 3.4 percent set in January. Consistent with the resilient job market, the performance of existing mortgages is exceeding expectations. Across all states, there was an improvement in the first quarter compared to one year ago. Year-over-year delinquencies for all product types – FHA, VA, and conventional – were also down.”

Unemployment and delinquencies correlate pretty tightly:

Fed Governor Michelle Bowman spoke in Germany this morning. Here are her prepared remarks. Her comments were pretty hawkish on monetary policy, and nothing remote suggests rate cuts are coming in the near future, though the Fed Funds futures see cuts as imminent.

In my view, our policy stance is now restrictive, but whether it is sufficiently restrictive to bring inflation down remains uncertain. Some signs of slowing in aggregate demand, lower numbers of job openings and more modest gross domestic product (GDP) growth indicate that we have moved into restrictive territory. But inflation remains much too high, and measures of core inflation have remained persistently elevated, with declining unemployment and ongoing wage growth. And, as senior loan officers signaled beginning last summer, credit has continued to tighten.2 I expect this trend will continue given increased bank funding costs and reduced levels of liquidity.

Should inflation remain high and the labor market remain tight, additional monetary policy tightening will likely be appropriate to attain a sufficiently restrictive stance of monetary policy to lower inflation over time. I also expect that our policy rate will need to remain sufficiently restrictive for some time to bring inflation down and create conditions that will support a sustainably strong labor market.

Filed under: Economy | 25 Comments »