Vital Statistics:

| Last | Change | |

| S&P futures | 4,050 | 0.50 |

| Oil (WTI) | 78.48 | -1.20 |

| 10 year government bond yield | 3.91% | |

| 30 year fixed rate mortgage | 6.77% |

Stocks are flat this morning on no real news. Bonds and MBS are up. It looks like the bond rally is due to fears of weakness in Europe and Treasuries are just correlating with overseas markets.

The week ahead should be relatively eventful with Jerome Powell heading to the Hill for his Humphrey-Hawkins testimony. We will also get the jobs report on Friday. It will be interesting to see whether Powell starts to get some static from lawmakers on overshooting. My guess is that Congress will probably leave him alone as long as the labor market is strong.

I compared the economy of today versus the late 1960s, and I think the similarities are pretty striking. The big question is whether you can have a recession when the labor market is super-strong. The answer may surprise you. It also gives us a template for this year and next.

This article is on my substack: The Weekly Tearsheet. It is meant as a companion to this blog where I do deeper dives into some of the weekly data or other things going on in the markets. I hope you like it and consider subscribing.

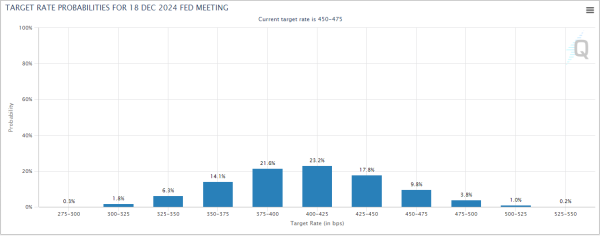

The March Fed Funds futures are now handicapping a 30% chance of a 50 basis point hike. The CME has introduced the 2024 futures as well, which see a December 2024 Fed Funds rate of 4.00% – 4.25% as the most likely outcome next year.

The homebuilders are under pressure this morning as J.P. Morgan downgraded KB Home and D.R. Horton based on valuation. It wasn’t all glum however as Meritage was upgraded to Overweight from neutral.

The homebuilders are the classic early-stage cyclical. The timing isn’t right yet – we have to wait for rate cuts – but we are getting close.

I am accepting ads for this blog if you would like to make an announcement, highlight something your company is offering or want more visibility. I also offer white-label services which give you the ability to use this content for your own daily emails. Please feel free to reach out to nyitray@hotmail.com if you would like to discuss this further.

Filed under: Economy | 61 Comments »