Vital Statistics:

| LastChangeS&P futures4,025 -2.25Oil (WTI)76.521.3410 year government bond yield 3.52%30 year fixed rate mortgage 6.45% |

Stocks are flat as we await the Fed decision at 2:00 PM. Bonds and MBS are flat.

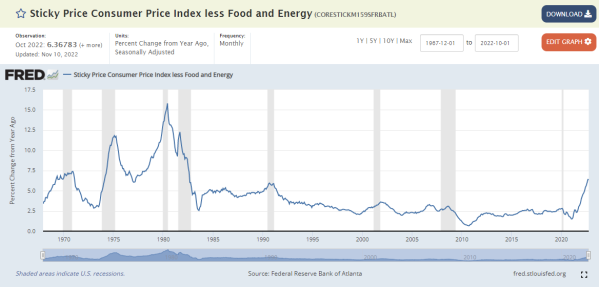

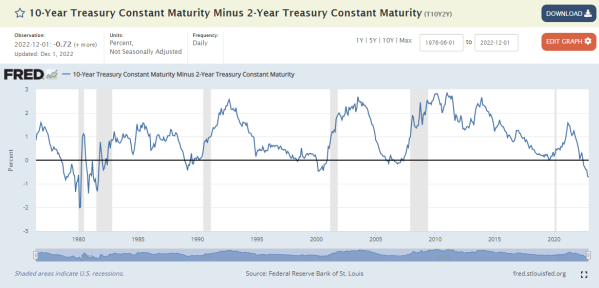

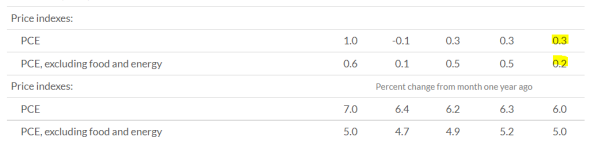

Today’s Fed decision is one of the biggest ones in the past few years. The inflation numbers are falling, and the yield curve is inverted. The actual decision (50 basis points versus 75) is really not going to be the important part. The dot plot will be the focus, as the Fed Funds are predicting a more dovish path than the Fed was forecasting at the September meeting. Below is the September dot plot, and I put some lines next to the year-end 2023 forecast to give you what the Fed funds futures are currently predicting. The wider the line, the higher the probability, if that makes sense.

IMO, if the Fed’s dot plot confirms the Fed Funds futures, then it will be a signal to the markets that the Fed is more or less done with this tightening cycle (the steepest since the early 80s), and that will be a weight off the shoulders of the stock market and the bond market.

The economic projections will matter less, although the forecast for inflation will carry some weight. We are seeing increased financial stress in the markets, so at some point that will begin to drive the Fed’s thinking, especially if inflation continues to moderate. If the financial stress begins to accelerate, the Fed will probably cut rates since illiquidity is a front-burner issue.

Mortgage applications rose 3.2% last week as purchases increased 4% and refis increased 3%. “Mortgage rates increased slightly after a month of declines, as financial markets reacted to mixed signals regarding inflation and the Federal Reserve’s next policy moves,” said Joel Kan, MBA Vice President and Deputy Chief Economist. “The 30-year fixed rate inched to 6.42 percent, which is still close to the lowest rate in a month. Overall applications increased, driven by increases in purchase and refinance activity. However, with rates more than three percentage points higher than a year ago, both purchase and refinance applications are still well behind last year’s pace.”

Wells Fargo investment raised its weighting on PennyMac to overweight based on falling rates. “We are not expecting a return to the 2020/2021 boom period, but we believe the worst is behind the industry,” he said. “The risk is that we are early and that the interest rate drop reverses or remains stubbornly high.”

Chase has apparently raised its net worth requirement for correspondents from $2.5 million to $10 million.

Filed under: Economy | 9 Comments »