Vital Statistics:

| Last | Change | |

| S&P futures | 3,998 | -33.75 |

| Oil (WTI) | 74.41 | -1.83 |

| 10 year government bond yield | 3.69% | |

| 30 year fixed rate mortgage | 6.56% |

Stocks are lower this morning on Chinese protests over COVID lockdowns. Bonds and MBS are up.

We have a big week of data coming up with house prices on Tuesday, GDP on Wednesday, Personal Incomes and Outlays on Thursday and the jobs report on Friday.

The FHFA House Price Index will be released on Tuesday. This will be the final number to establish the conforming loan limits for 2023. As of now, the consensus seems to be that the new limit will be 715k or so.

The PCE Price Index (the Fed’s preferred inflation index) will be released on Wednesday. We will also get one more CPI print before the Fed announces its decision for December.

Single family rents rose 10.2% YOY, according to CoreLogic. “Annual single-family rent growth decelerated for the fifth consecutive month in September but remained at more than twice the pre-pandemic growth rate,” said Molly Boesel, principal economist at CoreLogic. “High mortgage interest rates may be causing potential homebuyers to hit pause and remain renters, keeping pressure on rent prices. However, the monthly rent change was negative in September, resuming the typical seasonal pattern for the first time since 2019, which could signal the beginning of rent price growth normalization.”

Interestingly, the lag between home price appreciation and rents is about 21 months, which means that we are looking at home price appreciation from early 2021. In theory, we should see an acceleration of rental inflation as the home price growth of 2021 and 2022 is still not reflected in the numbers yet.

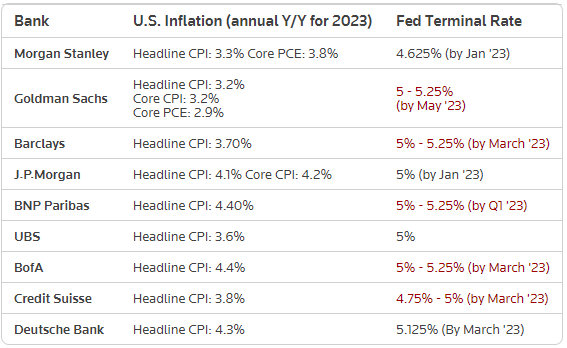

The big banks are largely forecasting a recession for next year and a Fed Funds rate of 5%+

Most strategists think the S&P 500 will end 2023 lower than where it is today.

Filed under: Economy |

Apparently Musk is the new Trump over at Dkos.

https://www.dailykos.com/

LikeLike

Thou Shalt Not Cross The Borg

LikeLike

Whoever is having the most impact in the society/culture that isn’t explicitly of the left is always going to be the new Trump. It was why Trump was Trump. Musk will be the new Trump for now, then probably Ron Desantis.

Sometimes Ben Shapiro is the worst human being in the world, used to be Rush Limbaugh could be the worst human being in the world, definitely was during Clinton. Whoever is the top “not a leftist” is always occupying the role of enemy #1, which was Trump and is now Musk.

LikeLike

Teach sheep to cook and we’ll have reached the Singularity.

LikeLike

Very amusing…with her usefulness to the Dems as the token Republican willing to carry their water about to come to a voter-demanded end, Liz Cheney finds Dem support waning.

https://thefederalist.com/2022/11/28/j6-democrats-sour-on-cheney-2024/

LikeLike

WTF is a school district doing with its own plane?!?

https://texasscorecard.com/local/north-texas-school-official-caught-using-district-plane-for-family-trip/

LikeLike

Their Student Aviation Program”? Tell me your property owners are overtaxed without telling me your property owners are overtaxed.

LikeLike

Probably the single best example of “Bad Thing Happens: Minorities Hardest Hit” that I’ve seen.

“The Black Investors Who Were Burned by Bitcoin

Neglected by the traditional financial system, they got into cryptocurrency with gusto—but late.

By Annie Lowrey”

https://www.theatlantic.com/ideas/archive/2022/11/black-investors-bitcoin-cryptocurrency-crash/671750/

The only guy that they chose to interview lost a grand total of $1000.

LikeLike

It is also worrisome because many Black investors poured money into bitcoin because they found it so hard to build generational wealth in the first place. Discriminated against by banks, overlooked by investment managers, redlined and saddled with educational debt, many turned to more esoteric opportunities.

Redlining hasn’t existed for 50 years. Lending discrimination in the banking system doesn’t exist anymore. Banks have quotas. An exchange traded fund or mutual fund doesn’t look or overlook anyone. And educational debt is a self-inflicted exercise.

I love how these bubblehead millennial women uncritically spout off these narratives and fancy themselves as smart.

They somehow think that anything bad that happens to someone today is due to systemic -isms. But I am supposedly responsible for the misdeeds of my ancestors, but today’s victim classes aren’t even responsible for their own actions.

LikeLike

Brent:

They somehow think that anything bad that happens to someone today is due to systemic -isms.

It is a fundamental premise of the critical theory that has been indoctrinated into so many of these millenials. The question they ask themselves is not whether some kind of discrimination has happened. The question they ask is how the discrimination that they presume up front does exist has been manifested.

I am supposedly responsible for the misdeeds of my ancestors, but today’s victim classes aren’t even responsible for their own actions.

It’s all about emoting, not reasoning.

LikeLike

https://evergreensmallbusiness.com/dozen-ways-to-deduct-real-estate-losses/

LikeLike