Vital Statistics:

| Last | Change | |

| S&P futures | 3260 | -56.6 |

| Oil (WTI) | 40.43 | -0.46 |

| 10 year government bond yield | 0.65% | |

| 30 year fixed rate mortgage | 2.94% |

Stocks are lower this morning as the banks are getting hammered over a money laundering report. Bonds and MBS are up.

Bank stocks are getting slammed this morning after a report alleges that over $2 trillion in transactions were flagged as possible money laundering.

We don’t have much in the way of market-moving data this week, although we will get some housing numbers with existing home sales, new home sales, and the FHFA Home Price Index. Jerome Powell will be speaking Tuesday, Wednesday and Thursday this week.

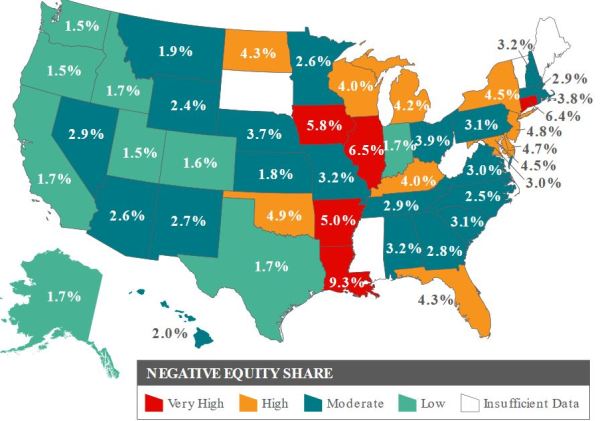

The average homeowner gained $9,800 in home equity in the second quarter according to CoreLogic. There are still about 1.7 million homes with negative equity. Negative Equity still remains a problem in a few states, but the home price appreciation of the past decade has largely solved the issue.

The housing market remains red hot according to Redfin. The median home price rose 13% YOY to $319k. Active listings fell 28% to an all-time low, while sales prices were 99.3% of listing prices, which is an 11 year high.

“Seasonality is going to become more noticeable now that schools have started and Labor Day is over,” said Redfin lead economist Taylor Marr. “There is still a lot of room for more homes for sale to hit the market to make up for lost ground during the pandemic. This increase in supply is likely to drive more strong year-over-year growth in home sales. Leading indicators of home sales like mortgage applications and pending sales are still showing tremendous strength as we head into fall.”

Filed under: Economy, Morning Report | 21 Comments »