Vital Statistics:

| Last | Change | |

| S&P futures | 2858 | 70.1 |

| Oil (WTI) | 17.83 | -2.29 |

| 10 year government bond yield | 0.63% | |

| 30 year fixed rate mortgage | 3.38% |

Stocks are higher this morning after positive news out of Gilead regarding a treatment for COVID-19. Bonds and MBS are down small.

Investors are bullish after the government released its plan to re-start the economy. It will involve a staggered, 3 stage process which will be left up largely to state governors. Under the first phase, movie theaters, restaurants, sports venues, places of worship, gyms and other venues could re-open with some restrictions. Schools would remain closed, and workplaces could re-open although companies will be encouraged to telecommute. Under the second phase, non-essential travel could resume, bars and schools could re-open. Under the final phase, visits to hospitals and nursing homes could resume. The Trump Administration believes some states could be ready to open quickly, by May 1. Others will take some time. Separately, NY extended the lockdown to May 15.

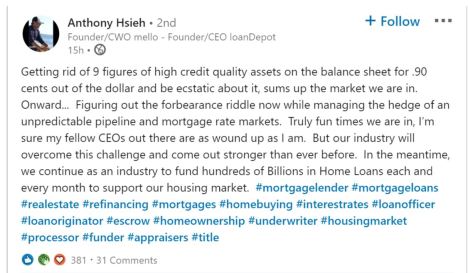

Politicians are beginning to become more vocal regarding the need to help servicers. Senators Maxine Waters and Sherrod Brown both called on the Fed and Treasury to provide liquidity to servicers struggling with advances. “Mortgage servicers are expected to face increased strain as millions of homeowners and renters lose jobs, are furloughed, or see reduced hours, all of which will keep them from making mortgage and rent payments, as a result of this public health crisis. We must not allow the pandemic to destabilize critical markets, including our housing market,” the lawmakers wrote in their letter.

China’s first quarter GDP dropped for the first time on record. China went into this crisis with a real estate bubble and a shaky banking system to begin with. Their economy will bear watching going forward, especially if the real estate bubble bursts and China begins exporting deflation. If it does, plan on 0% rates in the US for longer.

Chase has stopped accepting HELOC applications for the time being. This is just after instituting a 700 FICO floor and 20% down on loans. Chase wasn’t really in the FHA space after getting socked with a deluge of false claims act penalties in the aftermath of the 2008 crisis. I have to wonder if the COVID-19 Crisis restricts the FHA market even further overall going forward. This is the last thing the left wants to see, and is perhaps why we are seeing Democrats like Maxine Waters and Sherrod Brown suddenly care about servicers.

Last week, I participated on Louis Amaya’s Capital Markets Today podcast and discussed the issues affecting the origination market. You can get the replay here.

Filed under: Economy, Morning Report | 25 Comments »