Vital Statistics:

| Last | Change | |

| S&P futures | 2660.75 | 19 |

| Eurostoxx index | 347.9 | 2.9 |

| Oil (WTI) | 52.57 | 0.91 |

| 10 year government bond yield | 2.89% | |

| 30 year fixed rate mortgage | 4.72% |

Stocks are higher this morning on no real news. Bonds and MBS are flat.

Donald Trump got into it with Democrats on live TV yesterday over funding for the wall. He said he would be “proud” to do a partial government shutdown in order to obtain funds for border security. “Partial government shutdown” all but screams that this shutdown will be symbolic only – usually the only thing they shut down are the monuments around DC – but that doesn’t always happen. As a general rule, the mortgage market should not be affected, but things like tax transcripts etc could be delayed. This sounds like it is all for show as both parties play to their respective bases.

Inflation at the wholesale level came in a hair above expectations, with the headline producer price index rising 0.1% MOM / 2.5% YOY. Ex-food and energy, the number was 0.3% / 2.7%. The Fed doesn’t necessarily put a lot of stock in the PPI, but it does show that inflation is beginning to creep above the Fed’s target of 2%. Building labor costs (which not only show up in direct wages, but also inputs like transportation) are being offset somewhat by declining commodity prices and strength in the US dollar.

Home prices rose 5.4% YOY in October, according to CoreLogic. “Rising prices and interest rates have reduced home buyer activity and led to a gradual slowing in appreciation. October’s mortgage rates were the highest in seven and a half years, eroding buyer affordability. Despite higher interest rates, many renters view a home purchase as a way to build wealth through home-equity growth, especially in areas where rents are rising quickly. These include the Phoenix, Las Vegas and Orlando metro areas, where the CoreLogic Single-Family Rent Index rose 6 percent or more during the last 12 months.”

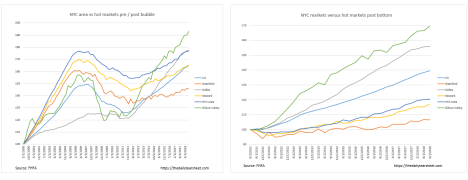

CoreLogic estimates that 35% of all MSAs are overvalued, including the NY-NJ-LI area. This is interesting given that this area has barely rebounded off the 2012 lows, and has massively underperformed the rest of the US. This is evidence of the lack of wage growth in this area, primarily driven by secular changes in the financial services industry. Some of this was undoubtedly being driven by 0% interest rates, but a lot of it is technology replacing people.

Filed under: Economy, Morning Report | 48 Comments »