Vital Statistics:

|

Last |

Change |

| S&P Futures |

2732.8 |

9.0 |

| Eurostoxx Index |

396.3 |

2.6 |

| Oil (WTI) |

61.3 |

-0.7 |

| US dollar index |

85.6 |

0.0 |

| 10 Year Govt Bond Yield |

2.44% |

|

| Current Coupon Fannie Mae TBA |

102.375 |

|

| Current Coupon Ginnie Mae TBA |

103.25 |

|

| 30 Year Fixed Rate Mortgage |

3.91 |

|

Stocks are up despite surprisingly weak nonfarm payroll number. Bonds and MBS are up.

Jobs report data dump:

- Nonfarm payrolls up 148,000 vs 191,000 expected

- Unemployment rate 4.1%, in line with expectations

- Labor force participation rate 62.7% in line with expectations

- Average hourly earnings up 0/3% MOM / 2.5% YOY in line with expectations

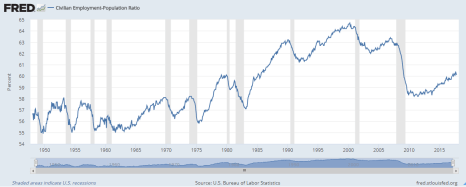

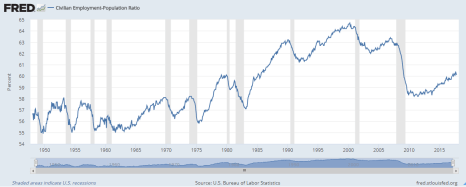

The NFP number was a surprise given that the ADP was over 100,000 higher. I suspect the NFP number will get revised upward in coming months given all of the other data we have been seeing. Wage growth remains slightly above inflation, and the labor force participation rate is still well below what would be considered a healthy job market. The employment-population ratio, which is one of the preferred metrics for the Fed was 60.1%, unchanged MOM, but up 0.3% YOY. While some of the drop in the EP ratio is demographics-driven, it shows we still have a long way to go to recover from the Great Recession and return to the last great labor market, which was the 90s.

Chart: Employment to population ratio:

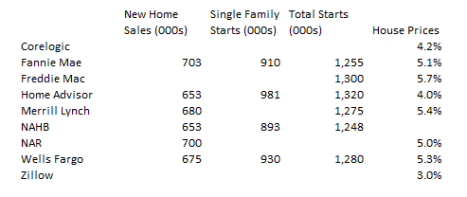

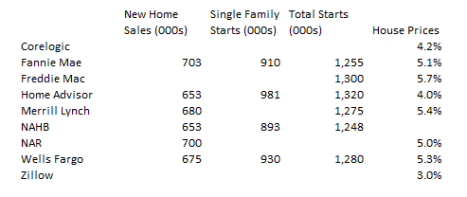

Bill McBride of Calculated Risk summarizes the housing market forecasts for 2018:

In other words, not much of a change from last year. FWIW, I think either the total housing starts or the house price inflation numbers are too low. There is so much pent-up demand for housing that starts around 1.3 million are not going to come close to satisfying it, which would imply much faster home price appreciation (especially if inflation and wages rise). On the other hand, given the increases in input prices (labor, framing lumber, etc), if prices are only rising in the mid single digits, margins for builders are going to fall, which means they will have to compensate by increasing volume. This would make the housing starts estimates too low. Remember, historically (even ignoring the bubble / bust years) housing starts have averaged 1.5 million per year, and have typically hit 2 million per year coming out of recessions.

NAR weighed in the jobs report: “The job market continues to improve, but at a decelerating pace. The year 2017 ended with 2.1 million net new job additions, a very solid rate. However, the gains had been 2.6 million, 2.9 million, and 2.5 million in the three preceding years. More jobs and more income for households definitely attest to the rising housing demand.

As to the supply of homes, construction workers are needed. In 2017, a net 190,000 new workers were employed in the construction industry, and that also marks a decelerating trend, as the prior three years averaged 284,000 annual additions. With the unemployment rate in the construction industry having fallen from over 20% in 2010 to 5.9% at the year-end of 2017, there could be a little growth to home construction despite the on-going housing shortage. There needs to be serious consideration in allowing temporary work visas until American trade schools can adequately crank out much needed, domestic skilled construction workers.”

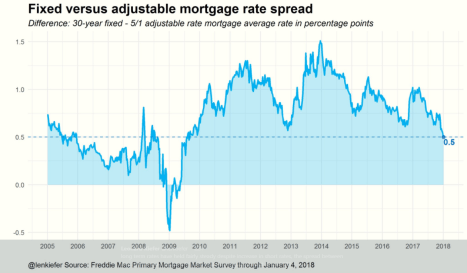

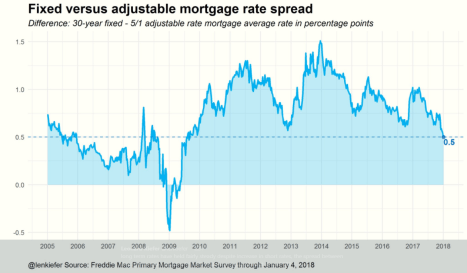

As home prices get more expensive, people tend to turn to adjustable rate mortgages in order to lower their monthly payment, at least initially. For the past few years, the spread (or the yield pickup) has been shrinking. The current difference between the two is the lowest since 2009:

In fact, the Wall Street Journal’s numbers show that the 30 year fixed rate mortgage is currently 3.92% and the 5/1 ARM is 4.07%. When ARMs are higher than a 30 year fixed rate mortgage, it makes no sense to go for an adjustable, unless you think long term rates are headed way lower. In this current economic environment, with an accelerating economy and a Fed raising rates, that is a long shot bet.

Filed under: Economy, Morning Report | 77 Comments »