Vital Statistics:

| Last | Change | |

| S&P Futures | 2257.0 | 4.5 |

| Eurostoxx Index | 365.7 | 0.0 |

| Oil (WTI) | 52.5 | 0.1 |

| US dollar index | 93.2 | -0.3 |

| 10 Year Govt Bond Yield | 2.47% | |

| Current Coupon Fannie Mae TBA | 103 | |

| Current Coupon Ginnie Mae TBA | 104 | |

| 30 Year Fixed Rate Mortgage | 4.17 |

Stocks are higher this morning on some good economic news out of Europe. Bonds and MBS are up small.

The FOMC minutes are scheduled to be released at 2:00 pm EST today. The focus will be on the dot plot, which showed the Committee members predicting 3 Fed Funds rate hikes this year. At her press conference, Janet Yellen downplayed the change, so investors will be looking closely at the discussion to get some more color on what the Fed is thinking. There is a chance that rates could get volatile around 2:00 pm, so just be aware if you are looking to lock around then.

HSBC took up their estimate for world growth on better US and Chinese growth prospects.

Mortgage Applications fell 12% last week as purchases fell 2% and refis fell 22%. It was a holiday week, so the numbers aren’t as bad as they look.

The Gallup Job Creation Index was unchanged last week and is at post-crisis highs.

China recently imposed new capital controls in order to prevent outflows of their currency, which restricts Chinese companies from buying foreign real estate. You are starting to see the effect of that in the high end real estate markets. Apartment prices fell 6.3% in Manhattan and you are seeing the same thing in Central London (which has been in bubble territory for years). Though we have yet to see it, you should expect to see some of the froth come off other high flying real estate markets, particularly on the West Coast.

CoreLogic looks at the change in Administrations (and ideologies) regarding housing going forward. Think tanks like the Urban Institute will take a backseat to think tanks like Cato. Expect to see a de-emphasis on fair housing issues like zoning and more of a focus on free-market solutions. Steve Mnuchin has been out calling for a re-privatization of Fannie Mae.

“Buy the election, sell the inauguration” is Morgan Stanley’s advice to equity owners. Their call is that uncertainty about Trump’s policies and the Fed will overshadow the optimism over regulatory relief and lower taxes going forward.

Wall Street lawyer Jay Clayton is the leading candidate to run the SEC. Along with Treasury Secretary Steve Mnuchin, they will hopefully get the private label securitization market back on track.

A fascinating read on the CFPB and how it operates.

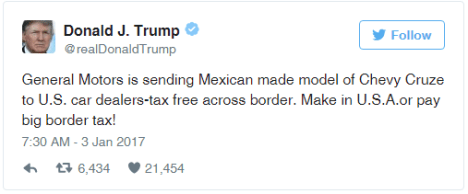

It is interesting to see Corporate America begin to tout bringing jobs back to the US post-election. You have seen Ford, GM, Sprint, etc all out with headlines about planned job creation and shifting production back to the US. This could be the beginning of a trend. IMO, Corporate America has read the tea leaves from the election and realizes that they too are in the spotlight and want to get ahead of it. Ironically, Obama would have been crucified if he took on companies directly via Twitter the way Trump has. I guess only Nixon could go to China.

Filed under: Economy, Morning Report | 25 Comments »