Vital Statistics:

| Last | Change | |

| S&P Futures | 2266.0 | 2.0 |

| Eurostoxx Index | 365.3 | -0.4 |

| Oil (WTI) | 54.2 | 0.4 |

| US dollar index | 92.6 | 0.6 |

| 10 Year Govt Bond Yield | 2.40% | |

| Current Coupon Fannie Mae TBA | 103 | |

| Current Coupon Ginnie Mae TBA | 104 | |

| 30 Year Fixed Rate Mortgage | 4.11 |

Stocks are up slightly after the jobs report. Bonds and MBS are down.

Jobs report data dump:

- Nonfarm payrolls increased 156,000

- November payrolls revised up to 204,000

- Unemployment rate 4.7%

- Labor force participation rate 62.7%

- Average hourly earnings up 0.4% (up 2.9% annualized)

Overall, a good report. The payrolls number was a disappointment, however we did see an increase in the labor force participation rate and an increase in average hourly earnings. The employment to population ratio was steady at 59.7%. The job growth was primarily in health care and social assistance. Retail gained, as well as transportation. Finance grew as well.

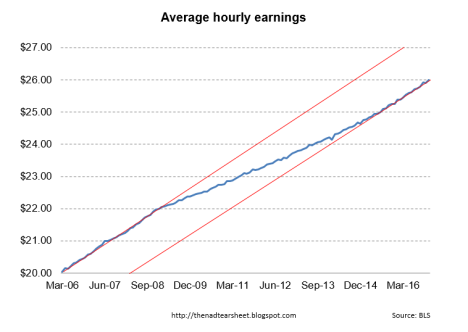

The focus for markets in on wage growth, as that is going to be the big determinant of Fed policy. I have plotted average hourly earnings over the past 10 years. You can see that the slope of the blue line (wage inflation) has almost come back to pre-crisis levels. In fact, wage inflation is the highest since 2009. The gap between the two red lines represents the damage done by the Great Recession. The bigger question is whether employees get their raises in the form of higher benefit costs or whether it shows up in their paychecks. That will depend (in part) on whether the young Millennials get jobs, as they will help the risk pool which should (all things being equal) help lower health insurance costs for everyone else. Universities are reporting lower enrollments, which is a tell that Millennials are finding jobs. Note that sentiment indicators show that Millennials are more bearish on the economy than most, though this could be explained by partisanship.

Bonds sold off slightly on the report, with the 10-year reaching 2.4% before dropping back down. We have had some hawkish Fed-speak with Loretta Mester suggesting more than 3 hikes might be necessary and Williams saying 3 hikes would be reasonable. Remember, just because the Fed Funds rate increases, it doesn’t automatically follow that long term rate (which determine mortgage rates) will also increase. The last few tightening cycles have seen a flattening of the yield curve.

Despite the gloom for department stores and the holiday shopping season, online retailers reported an 11% increase in sales over the holiday period. We’ll have to wait until we get retail sales to see how the season actually went.

What are the most crowded trades on Wall Street? Here is your guide.

The trade gap widened in December, while factory orders fell 2.4% in November.

Filed under: Economy, Morning Report | 56 Comments »