Vital Statistics:

| Last | Change | |

| S&P Futures | 2265.3 | -1.3 |

| Eurostoxx Index | 362.4 | -0.7 |

| Oil (WTI) | 51.6 | 0.5 |

| US dollar index | 91.9 | 0.0 |

| 10 Year Govt Bond Yield | 2.45% | |

| Current Coupon Fannie Mae TBA | 103 | |

| Current Coupon Ginnie Mae TBA | 104 | |

| 30 Year Fixed Rate Mortgage | 4.13 |

Stocks are lower this morning after the ECB decision to stand pat. Bonds and MBS are lower after Janet Yellen’s bullish comments on the economy and some decent data this morning.

Janet Yellen spoke yesterday, saying the economy was close to the Fed’s target, which warrants gradual rate hikes. Here are her prepared remarks. “That said, as of last month, I and most of my colleagues–the other members of the Fed Board in Washington and the presidents of the 12 regional Federal Reserve Banks–were expecting to increase our federal funds rate target a few times a year until, by the end of 2019, it is close to our estimate of its longer-run neutral rate of 3 percent.” That should have been a relative uncontroversial statement, given that roughly corresponds with the December dot plot. However, bonds sold off anyway.

Housing starts rose to 1.23 million in December from 1.1 million in November. Building Permits were flat at 1.21 million. Starts beat expectations while permits missed. Multifam drove the increase in starts, while single fam fell slightly.

Initial Jobless Claims fell to 234k last week nearly matching a low set in November. You would have to go back to the early 1970s (during the Vietnam war draft) to see claims this low. That is even more impressive when you factor in population growth. Employers are hanging onto their employees.

The Philadelphia Fed survey jumped last month as conditions improved for manufacturing. New orders and employment drove the increase.

Treasury Secretary nominee Steve Mnuchin travels to Capitol Hill today for his confirmation hearing. The questions will largely center on his role in the IndyMac turnaround, as well as his recommendations for the GSEs. He will also be asked about his comments regarding possible tax reform and whether the rich will receive an “absolute tax cut.”

The nonbank share of FHA lending is worrying some in Washington. As banks have retreated from FHA lending, nonbank lenders like Quicken and Freedom have taken up the slack. GNMA is conducting a push to lure banks back into the business.

The Fed’s Beige Book survey was a non-event. Most districts described their employment markets as “tight” and expansion as “modest.”

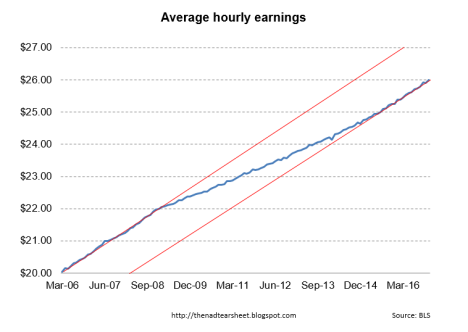

One bond investor thinks the bond bull market is still going to last a while longer. Why? The velocity of money has hit a floor since the Great Recession and hasn’t picked up. The velocity of money measures how many times a dollar has been “turned over” in different transactions. It peaked at 2.2x in 1997 and is currently sitting around 1.4x. This has been driven by the Great American Deleveraging which began with the bursting of the real estate bubble – income growth has been nonexistent, and the marginal dollar has been saved, not spent. The lower velocity is keeping a lid on inflation.

Bridgewater CEO Ray Dalio sees a mild bear market in bonds as economic growth picks up. He views the nascent populism being exhibited worldwide as a threat to multinational corporations and emerging economies. How politicians direct and engage that populism is going to be critical. Note that the Fed is addressing some of this by launching a new think tank: The Opportunity and Inclusive Growth Institute, which will be run by Minneapolis Fed head Neel Kashkari. Of course there isn’t much the Fed can do to address income inequality, however quantitative easing has largely benefited those that own assets, who are primarily rich.

Here is a good article on determining how much house you can afford.

Filed under: Economy, Morning Report | 20 Comments »